Credit card dispute is not a verdict

Learn how you can prevent, resolve, or recover from chargeback with the right tools

Let's chat

Few things are worse for a merchant than receiving the notification of a transaction dispute. For them, this means that they are going to lose a sale as well as a customer. On top of that, they might also get dragged into a chargeback process. So knowing about credit card dispute resolution is very important for them. It helps merchants and cardholders understand the process and go through it more smoothly.

In this guide, we will go over everything related to credit card disputes so that everyone involved knows what credit card dispute resolution looks like and what they can do if ever faced with such a situation.

Table of Contents

A credit card dispute can be understood as a payment reversal. Unlike regular refunds the merchant offers directly to a customer, a dispute involves the customer’s issuing bank. The customer contacts their bank and tells them that a particular transaction is not authorized or that they want a refund. The bank takes their claims, reviews them, and decides if a credit card dispute is the right course of action. That, in essence, is what this term means. There are many reasons for such a claim and various steps in the process.

The easiest way to understand this type of dispute is to consider it an insurance policy against fraud designed for cardholders. Also known as chargebacks, they ensure that customers do not get charged for a payment they haven’t authorized. This is particularly helpful if a card has been stolen or someone has taken down card details and is trying to make a purchase.

One important thing to know about a credit card dispute is that a chargeback is not the same as a refund, even though it involves a refund. In the case of a refund, the customer contacts the seller directly, and they agree that a refund should be made. As a result, the merchant does not lose any reputation in this process and does not incur additional charges.

On the other hand, credit card disputes are initiated by the cardholder’s bank. The cardholder contacts the bank directly, and the bank handles the whole process. The merchant loses the transaction money and often pays hefty chargeback fees. After losing credit card disputes, the business loses its reputation and stands to lose its license.

While a refund can take as little as a day to process, credit card disputes are another story. There are many steps involved in this process, so let’s review them.

The credit card dispute process can be pretty long, depending on how many people are involved and what kind of evidence is submitted to the issuing bank. Most credit card disputes follow these steps:

The credit card dispute process starts when a customer challenges one or more transactions by getting in touch with the issuing bank. In the case of multiple challenged transactions, more than one chargeback may be issued to the merchant.

The issuing bank then offers a conditional refund to the customer. A reason code that signifies the reason for the claim is then sent to the acquiring bank.

The acquiring bank debits the transaction amount from the merchant’s account, which the issuing bank then recoups. Other than the original transaction fees, the merchant also pays additional fees.

When the merchant receives information about the chargeback, they can decide to accept it, which ends the credit card dispute process. On the other hand, if they feel the claim is illegitimate or a case of friendly fraud, they can notify the issuing bank that they want to fight the claim.

The merchant builds a response for the bank, including relevant evidence and documents like a letter of rebuttal. This package is then sent to the bank.

The bank reviews all of the information sent by the seller. If it rules in favor of the merchant, the original transaction is charged to the cardholder again. If it rules against the merchant, the seller loses the money debited from their account. Sometimes, a second chargeback may be filed immediately for a different reason code, starting the process from scratch.

If one of the parties disagrees with the resolution offered by the bank, they can ask the card network to step in and take over the case. However, the decision issued by the card network in the case is final and cannot be changed.

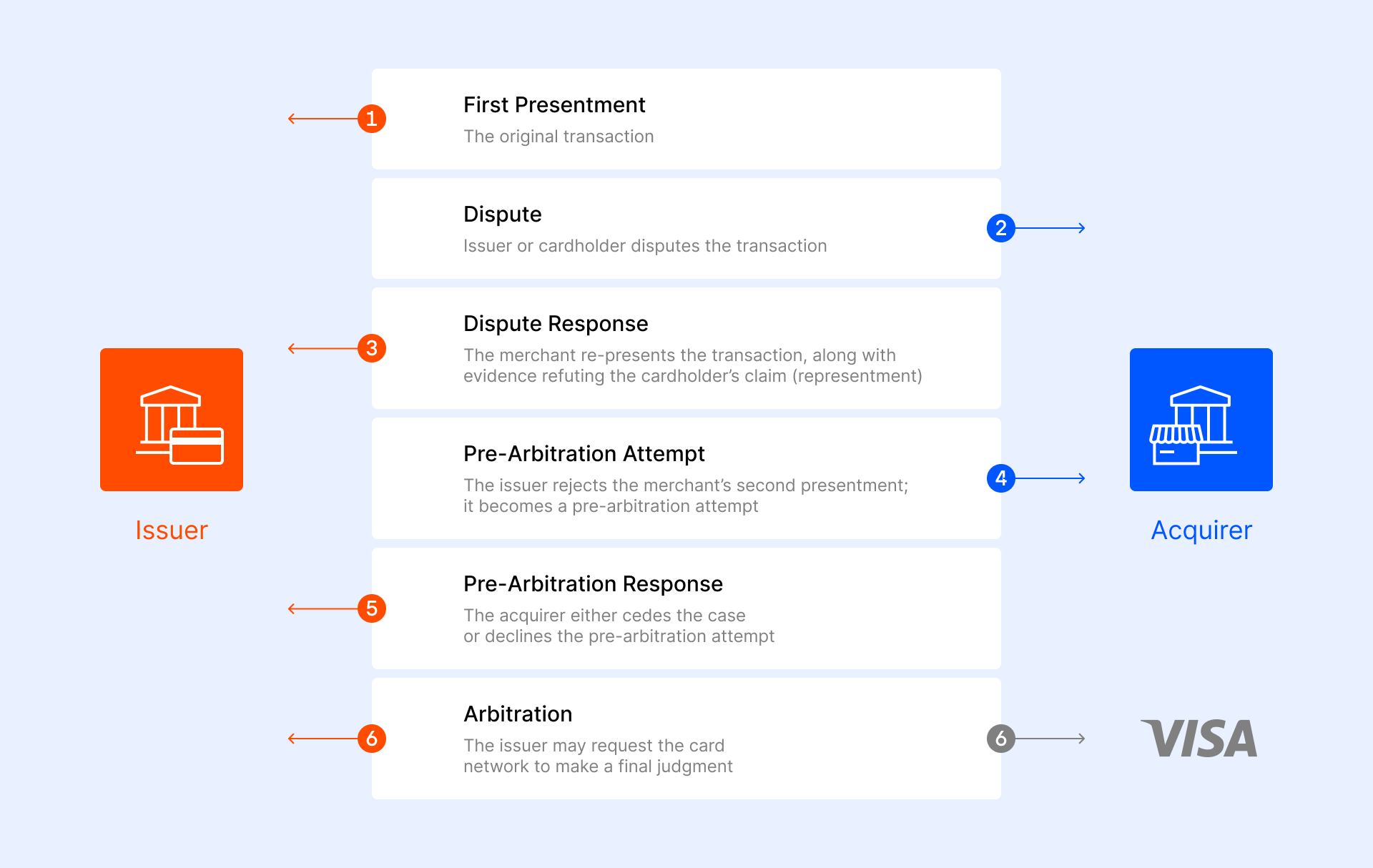

The VISA credit card dispute process has undergone plenty of changes after the VISA Claims Resolution was introduced in 2018. They updated their reason codes and introduced two separate workflows – Allocation and Collaboration – based on different categories of credit card disputes.

The VISA credit card dispute process follows the general process of credit card disputes mentioned above. The card network steps in when arbitration is required. Here’s a summary of what the process looks like:

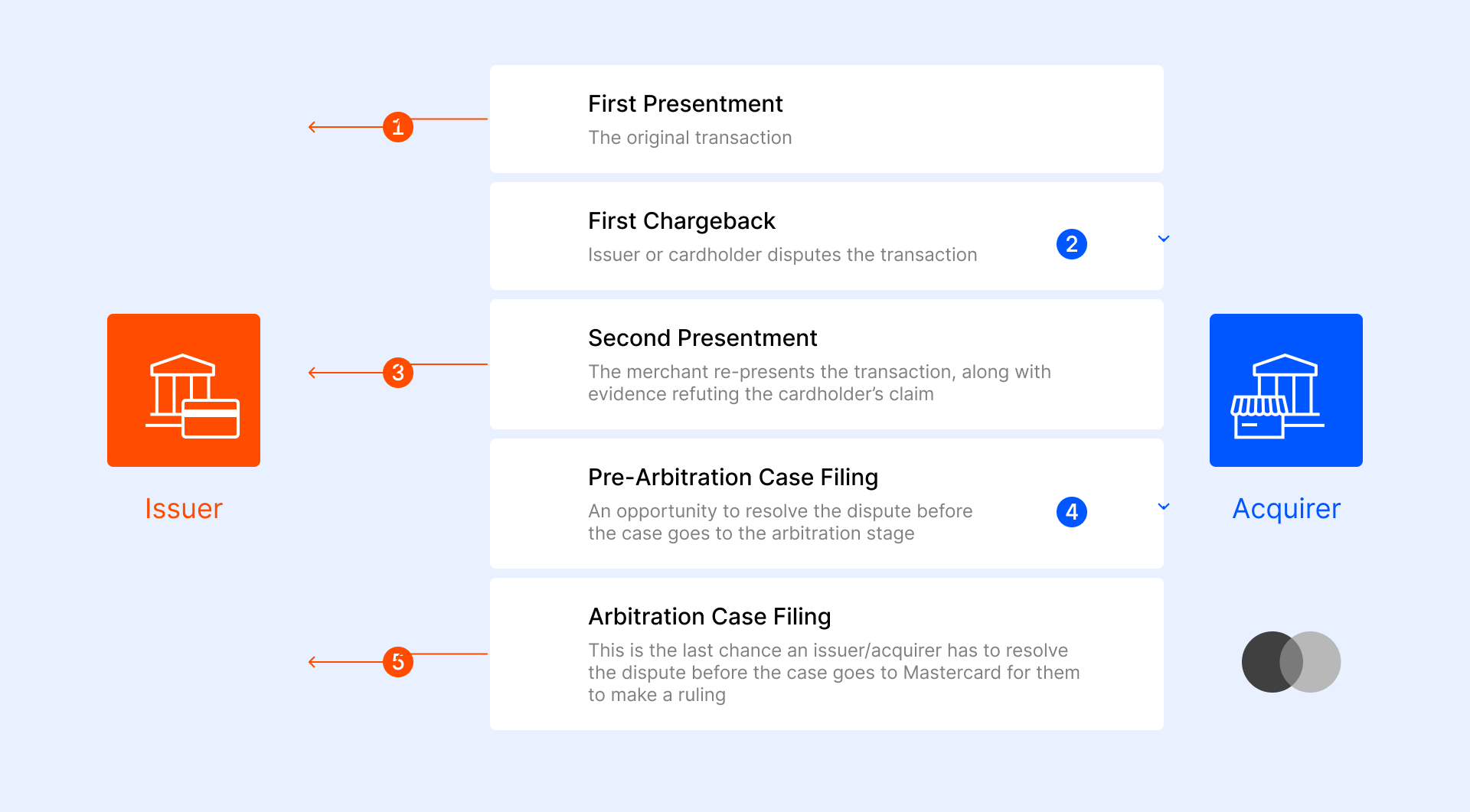

The Mastercard credit card dispute process also underwent some changes recently when the Mastercard Dispute Resolution initiative was rolled out. The Mastercard credit card dispute process is almost identical to that of VISA. Here is a quick breakdown of Mastercard credit card disputes:

A lot of customers don’t know the rule relating to when they are eligible for claiming a chargeback. It is imperative to know this so that you can file for credit card disputes correctly and not unknowingly engage in friendly fraud. There are two main cases in which you can challenge a transaction:

A merchant error is one of the most common reasons people initiate a credit card dispute. For example, if you placed an order with a seller and the product did not arrive as advertised, that is deemed a merchant error. You should first contact the merchant directly and try to resolve the issue with them. If they are unresponsive or refuse to fix the problem, you can ask your bank to issue a chargeback.

If you see a transaction on your statement that you don’t recognize and that hasn’t been made by a family member, you can ask your bank to look into it. The bank will examine the charge and determine if it is fraudulent. In this case, issuing a chargeback to the seller is also legal because the merchant should have strong enough payment protocols to avoid such orders.

Many credit card disputes are made illegally. These are known as cases of friendly fraud, and you should always avoid doing that. That is why it is crucial to know the instances in which you are not legally eligible to claim a chargeback. Here are some common reasons that lead to customers committing friendly fraud:

Always remember to dispute a charge only when you are eligible to do so and you have already tried resolving the issue with the merchant first. Starting disputes should always be the last resort, as it is a very long process that can ruin someone’s business reputation and cost them a lot of money.

In the case of legitimate claims, the cardholders don’t have to pay anything. However, if their information is false or their claim is illegal, they will lose the money they wanted to receive as a refund. On top of that, they can also lose some of their bank account privileges. That is why it is paramount that you only ask for a chargeback when it is a legal right and not carelessly.

Banks may also hit you with penalties in the case of friendly fraud done on purpose. You can also get blacklisted by the seller. If you keep doing the same, your bank may freeze your account.

Yes, if the customer makes an illegitimate claim, and the seller has all the necessary evidence to prove their side to the issuing bank, they can win credit card disputes. When a merchant enters representment, it is up to them to present their case to the bank. For this, they must be sure that the cardholder’s claim is not a result of a fraudulent transaction or merchant error. If your response to the bank contains relevant transaction details and can prove that you have done nothing wrong, you can win the case.

Yes! There are many things merchants can do to ensure that they receive the least number of credit card disputes. Here are some general things they can do:

These are just some basic things a seller can do to avoid chargebacks. By making it easy for customers to get in contact when there’s an issue, such cases can be avoided, and issues can be resolved directly and quickly.

If you’re a merchant and wish to maintain your ROI and reputation, then Chargebackhit can help you do all that and more. We are a chargeback prevention and resolution company that utilizes tools like Verifi and Ethoca Alerts to ensure that merchants are aware of any disputes coming their way before it’s too late. In addition, we make prevention of such issues possible by implementing tools like Consumer Clarity and Order Insight that automatically transmit data to the relevant authorities in real-time when needed.

For resolution purposes, Chargebackhit offers an automatic resolution that doesn’t require merchant interaction. For example, in the case of Verifi RDR disputes, the process goes through a decision engine for automatic resolution. In contrast, the process goes through a seller-directed resolution for other disputes.

With expertise in friendly fraud prevention and resolution, Chargebackhit can help decrease the number of chargebacks you face and increase your win rate in cases that end up being filed. Contact our company’s experts today to find out how and why having us by your side is the right thing for your business.

Learn how you can prevent, resolve, or recover from chargeback with the right tools

Let's chatThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.