Protect Your Business Reputation

Our chargeback management solutions will support you every step of the chargeback process

Reach Out

Anyone who has ever had to deal with a chargeback knows how difficult and time-consuming the process can be. It consists of numerous steps and involves a lot of different elements that ultimately lead to the decision by the issuing bank.

If it’s not handled correctly, it can lead to a significant loss in money and time. On top of that, it can adversely affect the reputation of your business. That is why every merchant should understand the chargeback process and be ready to deal with it if and when they must go through it.

Table of Contents

To help merchants be ready for any payment disputes they may face, breaking down the chargeback dispute process into multiple steps is very important. This guide will help you understand the procedure thoroughly. It will cover what the chargeback dispute process entails, what steps it consists of, what you need to do at each step, and how you can make your position clear in the eyes of the issuing bank to win the case. After going through this guide, you will be much more confident about keeping your business safe if it ever goes through a chargeback dispute process.

When discussing the VISA or Mastercard chargeback process, it’s essential to know what this term refers to. A chargeback is issued when customers tell their bank they want to dispute a transaction on their bank card. At this point, two things can happen. Either the cardholder has a legitimate reason to make such a complaint or is committing fraud to get a free product or service. Whatever the case may be, the relevant bank issues a chargeback to the merchant, which means that the merchant has to issue a refund to the customer and pay several other fees.

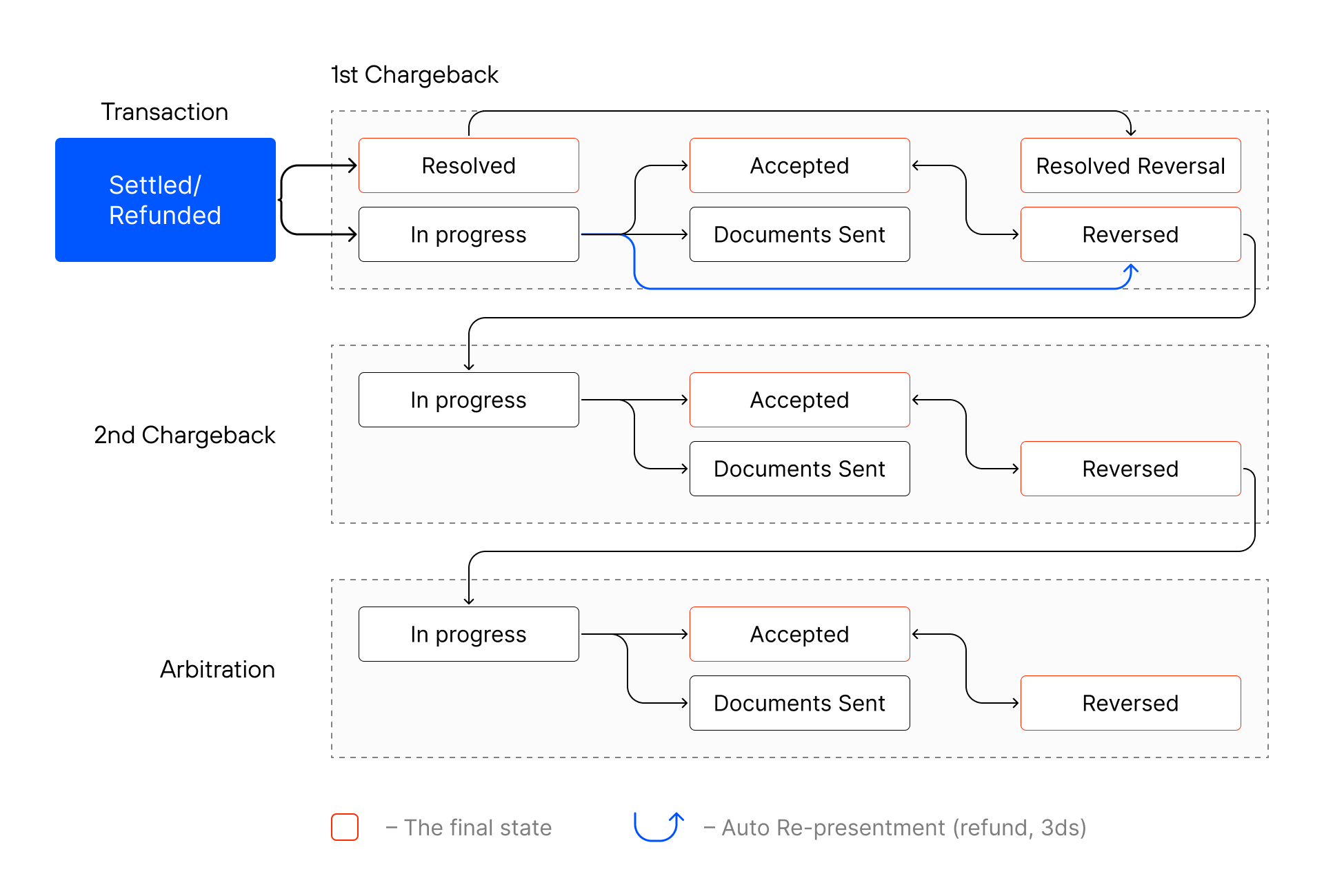

The whole VISA or Mastercard chargeback process looks like this:

Whether we talk about the VISA chargeback process or that of another bank, these steps are very similar.

Getting a good grasp of a chargeback can sometimes be difficult for people. Here are some essential points that can help you understand what a chargeback is:

When a chargeback is initiated, the merchant has to pay the disputed money back to the cardholder. But they are free to submit documents as evidence for the bank to review if they want to fight the charge. However, the decision is mainly made by the bank.

Other than losing money, the business loses its reputation over time due to the high chargeback ratio. Besides, the cardholder may falsify the reason for the dispute. This type of fraudulent activity leads to increasingly more illegal chargebacks placed on a business. As a result, companies can lose their merchant licenses.

Now that we’ve gone over the basics of the chargeback process, let’s take a deeper dive into the process by breaking it down into smaller steps. These steps stay mostly the same whether we consider the VISA chargeback process or that of another company.

The first step of the chargeback process happens when cardholders contact their bank and challenge a transaction. Each transaction customers perform in your store can be challenged, meaning that they could file for multiple chargebacks if they want.

The problem is that the merchant isn’t aware that the process has been initiated until the bank contacts them about it. On top of that, there is very little time to respond to this notification. If you do not manage to get back to the bank in time, the decision might go in favor of the cardholder by default.

The bank issues a conditional refund to the customer. The money is recouped from your acquirer, who then debits the same amount plus fees from your merchant account. This can be very problematic if you’re not aware of the chargeback by this time. Seeing money disappearing from your account is not only worrying, but it can also pose cash flow issues. Your business operations can potentially be affected by this move.

The bank assigns a reason code to the chargeback at this stage. It’s a numeric code based on the reason for chargeback initiation. The reason code aims to help merchants understand why the dispute has been made so that they can respond accordingly.

However, the problem here is that reason codes are assigned based on what the cardholder has told the bank. This makes the process very easy to manipulate. People committing friendly fraud can easily abuse the chargeback process by giving an illegitimate reason for their dispute. This makes it very difficult for merchants to respond correctly or prevent such claims from being made in the first place.

At this stage of the chargeback process, you have the chance to either accept it or fight it. Your acquirer will provide you with a Chargeback Debit Advice Letter, which can help you decide whether you’d like to engage in representment or not. Before deciding to fight the claim, ensure you have all the documents you’ll need as evidence to win the case.

If you’ve decided to fight the claim, you must respond to the issuing bank within the given time. Your response should include a rebuttal letter, the Chargeback Debit Advice Letter, and a reversal request. You should also include as much evidence as you can to have a chance of winning.

One vital thing to note is that time is scarce. That is why you must keep all the relevant information organized. This includes transaction records, shipping information, customer details, etc. The more organized your paperwork is, the more quickly you’ll be able to compile the required documents and send them to the issuing bank.

You will send all of these details to your acquiring bank first. The acquirer will then review the representment package for completeness and send it to the issuing bank. It’s imperative to know the requirements of the issuing bank in your case because they can differ from bank to bank. Make sure you compile your package the right way to make the process faster.

Based on all the data they receive from the customer and you, the issuing bank starts to review everything before making a decision. There are three ways this usually goes:

Getting a second chargeback is worse for merchants because they have to spend even more money and dedicate more resources to fight it. This can badly affect your company’s ROI, so just fight a chargeback if you believe you have a high chance of winning the case.

About 2% of cases make it to arbitration, and for a good reason. This step means you go directly to the card network to issue a decision after the issuing bank has given its verdict. The reason it’s not always a good idea to go into arbitration is that the card network’s decision is final and usually results in hefty fees to the party who loses the case. As a merchant, even if you have all the evidence and documents ready to fight, there’s still a chance that you might lose and end up paying hundreds of dollars.

The chargeback process is not an easy one to go through. It’s spread across multiple steps that each require input from multiple entities. The main parties involved in the chargeback process are the cardholder, the merchant, the issuing bank, the acquiring bank, and even the relevant card network.

At each step of the chargeback process, information and input are required from most of those involved. On top of that, the issuing bank sets stringent deadlines that have to be met. This is especially difficult for merchants to handle, as they get only a few days to gather all relevant data and submit it to the bank if they want to win the case.

That’s why the chargeback process can take a long while to complete. To make matters worse, every new entity introduced into the process can make it last even longer by adding layers of paperwork. Other complications to consider are:

Even when you completely understand the chargeback process, it’s not an easy one to go through by yourself. That is why it helps a lot to hire a chargeback expert. Such experts can help you prevent transaction disputes altogether or resolve them in the best way possible. They can also dedicate more time and resources to the case than you. On top of that, they’re aware of changing regulations and requirements, which enables them to handle your cases more effectively without spending additional time and/or money on them.

Chargebackhit is a chargeback management service that can help merchants prevent and resolve chargebacks. We’re a company that works with both Verifi and Ethoca networks to ensure that merchants are notified of a customer’s dispute before it turns into a chargeback. Tools like Consumer Clarity and Order Insight help prevent chargebacks by transmitting purchase data in real-time. Other tools like Verifi RDR help Chargebackhit resolve disputes without the merchant’s involvement.

If a merchant loses revenue due to an illegitimate claim, we also provide a Recover service to reclaim the lost income. So, in case a dispute is officially issued to you, Chargebackhit can help you fight the claim and increase your win rate. If you want to save yourself the hassle of being dragged through this challenging process, contact our team of experts and see how we can add value to your business.

Our chargeback management solutions will support you every step of the chargeback process

Reach OutThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.