Rapid dispute resolution in your favor

Reduce chargeback ratio and dispute times, cut costs, increase sales

Learn how

If you are dealing with a legitimate claim for a refund, Rapid Dispute Resolution prevention engines can be helpful to your business, especially if your company is almost breaching the Visa chargeback threshold.

With a Visa Rapid Dispute Resolution, merchants will have a powerful solution to reduce chargebacks that are valid claims. We will further discuss the specifications of an RDR tool and the benefits for a company acquiring it.

Table of Contents

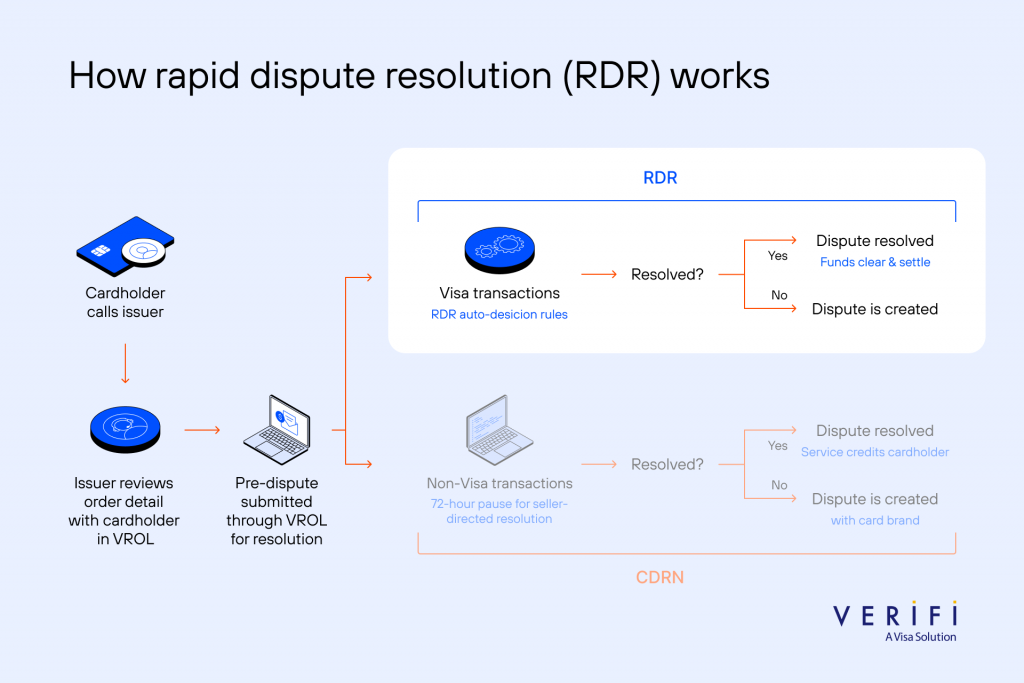

Rapid Dispute Resolution (RDR) is a new chargeback prevention tool for merchants offered by Verifi (a Visa solution) that acts on a pre-dispute stage. The difference between RDR and CDRN is that a Visa Rapid Dispute Resolution automates the decision-making process with no action from the seller aside from defining the initial rules.

According to internal data, Visa expects an increase of 66% in digital payments, especially with a card-not-present transaction. An RDR decision engine is here to make dispute resolution more automated.

In fact, RDR is present in a pre-dispute stage because it is not officially a chargeback. With Rapid Dispute Resolution, sellers can decide if they want to credit the client to avoid a chargeback. It is a way to manage Visa disputes by showing customers that merchants wish to solve them quickly.

Therefore, apart from reducing the number of conflicts, an RDR resolved transaction will also not have a negative impact on the sellers’ chargeback ratio and consequently reduce the number of disputes.

A seller can take advantage of Visa Rapid Dispute Resolution to defend their business from chargebacks. But first, it is essential to identify if you are facing criminal fraud or a merchant error. If this is the case, you should use RDR because it would be hard to reverse this situation in the seller’s favor. It is wiser to refund and avoid a chargeback.

Although, if you believe you are the target of friendly fraud, you can fight it through representment. Remember that your chargeback rate can be low if you refund every dispute, but you might find yourself with too many friendly fraudsters on your back, which can have financial repercussions.

A seller can reduce chargebacks because they can act before they are filed. With parameters previously defined, the decision engine will be able to determine if there should be a refund to the customer. The Rapid Dispute Resolution Visa can then do the refund automatically. No chargeback will be filed if the merchant accepts liability.

But how can sellers customize these parameters to their company’s needs? The first step is to analyze previous chargebacks and identify any patterns. And then focus on the parameters, such as transaction amount, chargeback reason code, and client’s bank identification number. For example, an organization can even establish that disputes under $40 will always be refunded because it will not justify the time and cost of representment.

It is also important to remember that sellers should regularly review the rules to confirm they generate the desired outcomes. Sellers should consider the reason for the disputes, the number of times a merchant accepts liability, the number of disputes ending up in chargebacks, and how many were followed by representment and had a positive outcome, among other things.

You can work on Rapid Dispute Resolution efficiency by analyzing data to ensure that it is not refunding friendly fraudsters. Keep track of the refund rate, and if there are too many refunds and the risk of a chargeback is low, it is time to revise your rules. It will help with not exceeding the Visa chargeback limits. Be aware that Visa has a ratio of 0.9% chargeback and a monthly threshold of 100 chargebacks.

Rapid Dispute Resolution (RDR) will verify the rules previously defined and validate, according to them, if the claim is applicable for refund. Then, the credit will automatically go to the issuer’s account.

After a cardholder issues a transaction dispute, it will go through a Resolve solution. The seller with Rapid Dispute Resolution Visa at his disposal can automatically accept sending back the credit to a cardholder.

The merchant must fix rules and parameters for this to work efficiently. In fact, start by defining the disputes to resolve with Rapid Dispute Resolution and then tailoring the parameters to be followed while evaluating the transaction data. Here you can find some examples of parameters that you can define according to your business requirements:

Another significant advantage of Visa transactions is that a Visa guarantee protects the sellers. It assures that the dispute is eliminated and no chargeback is initiated. Moreover, there will be no manual action from the merchant to send the funds to the client and are, therefore, quicker to solve. It means a zero impact on the chargeback ratio and improved customer service.

When the amount claimed is debited, this information will be shared by Visa with the acquirer bank and then to the merchant.

Visa’s Risk Dispute Resolution program helps merchants reduce chargeback costs by automating processes, customizing fraud rules, preventing chargebacks, reducing false positives, and ultimately increasing sales and conversion rates while minimizing friction.

RDR was designed to help all stakeholders involved in the transaction dispute, including issuers. Here are some of the key ways issuers benefit from Visa RDR:

Visa RDR offers several key benefits for merchants, aiming to streamline the dispute resolution process and improve their overall experience. Here are the key benefits of Visa RDR for merchants:

Visa RDR improves the cardholder payment experience and satisfaction because they receive a refund decision virtually instantly. Here are some key benefits of Visa RDR for cardholders:

Visa RDR benefits cardholders by providing them with real-time notifications, instant provisional credit, expedited dispute resolution, transparency, fraud protection, and convenient self-service tools. These features aim to enhance the overall cardholder experience, increase confidence in using Visa payment cards, and ensure a seamless and secure payment experience.

While Visa RDR (Real-time Dispute Resolution) offers advantages for merchants, there are some potential drawbacks to consider:

Merchants should assess their specific business needs, the volume of disputes, and customer dynamics to determine how Visa RDR aligns with their operations. Understanding the potential drawbacks and developing strategies to mitigate them will help merchants make informed decisions about utilizing Visa RDR for dispute resolution.

A business with Rapid Dispute Resolution (RDR) can ultimately prevent numerous chargebacks by automating processes. The merchant only needs to define parameters to determine if they want to credit the client and avoid a chargeback.

Let us make things simpler for you with Chargebackhit Resolve. Our prevention tool with Rapid Dispute Resolution will activate automatic resolutions for routine disputes and help you manage chargebacks quicker. Focus on running your business and stop losing time and money over chargebacks that can be prevented with an automated response from our platform.

We have a set of other services that will cover many chargeback issues from prevention to recovery. Continue working on your revenue growth while we help you keep your chargeback ratio low.

Reduce chargeback ratio and dispute times, cut costs, increase sales

Learn howThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.