Chargebacks are damaging your business

We know how to minimize risks and maximize profits

Let us help

What is a chargeback? It is a payment dispute that a customer initiates directly with their bank after making a purchase with their bank card. The customer asks their bank to return the payment that was made for a product or service. If the bank rules in the customer’s favor, your business loses those funds.

That’s the short answer to “What is a chargeback?” The long answer contains a lot of details, as laid out below.

Table of Contents

The first thing to understand is the differences between a chargeback and a refund. While, technically, a chargeback involves a refund, they’re not the same. Here are some key differences between a chargeback vs a refund:

The chargeback process consists of several steps, starting from purchase and ending in the form of a decision and transfer of funds.

So, we know what chargebacks are, but how did they come around? Originally, this form of disputing transactions was implemented to protect consumers when using credit cards to make purchases. Since using credit cards during the 1970s was new, people were hesitant to make purchases with them as they could easily be stolen and used for unauthorized transactions. To tackle this problem, this system was introduced as part of the Fair Credit Billing Act of 1974 to make credit card use more widely accepted in the US.

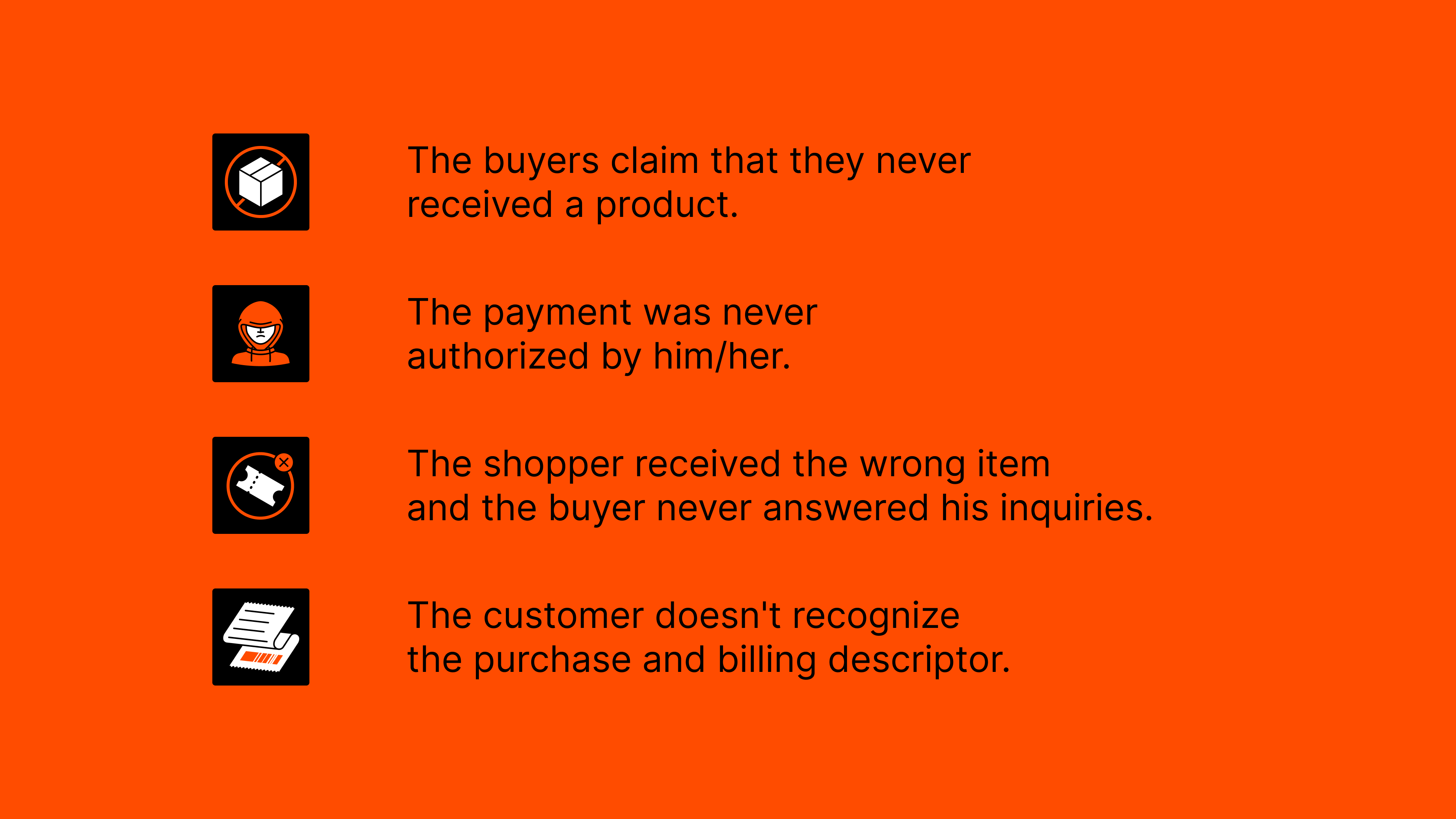

As online shopping grew more popular, the instances of chargeback fraud also grew. Also known as friendly fraud, these fraudulent claims have left merchants unprotected. Because of online banking, it has become very easy for people to initiate a dispute with their phones by contacting their bank directly. The ease of this process means that there are increasing rates of chargeback fraud.

Some of the reasons for people to commit friendly fraud include:

Chargeback fraud is a real problem for merchants because the costs they have to pay can add up really quickly.

Juniper Research released a study back in 2018 that stated that merchants would lose almost $20 billion only in 2021 as a result of fraudulent activities. Another company, Aite Group, estimated that these disputes would see a massive rise from $23 billion to $35 billion from 2018 to 2021. This should be enough to show the huge scale of this problem and why it is so important for merchants to be aware of what to do about it.

Chargeback reason codes are what tell a merchant why a customer is disputing a charge. This can provide important information to fight the dispute. However, it is important to note that this reason code is based on the reason given by the customer to their bank. In the case of friendly fraud, that reason could be completely invalid and unrelated to the actual situation.

Fighting a payment dispute usually comes down to how prepared you are. You might have all the proof and evidence, but you should be aware of the actual reason the transaction is being disputed to tackle the issue properly. And when you know what each of them entails, you can more easily deal with the situation.

Even though it is impossible to prevent them from happening at all, there are various steps that can be taken to prevent chargebacks from occurring. Here are some quick steps you can take:

Following some simple tips and healthy business practices can go a long way in helping you prevent chargebacks if you want to retain your revenue and reputation.

If and when you face a dispute, you need to be aware of the right steps to follow. The first thing is to find out whether the claim is legitimate. If it is, you can accept the charge and simply return the money back to the customer.

For illegitimate claims, however, here’s what you can do:

One thing to always keep in mind is that you need to dispute illegitimate chargebacks. A lot of merchants don’t do this as the charges seem small, but they can add up to a very significant number over time.

Many business owners decide not to fight such claims because they feel like the money they have to pay isn’t all that much. But that is very wrong, especially in the long run. Depending on the acquiring bank, the actual chargeback fees often lie between $20 and $100, which does seem like a low enough range for large businesses.

However, there are plenty of other fees that have to be paid as well. These charges like processing fee, fulfillment cost, operations cost, marketing cost, etc. can make the total chargeback fees up to 2.5 times the value of the actual transaction. That is why every merchant needs to be aware of just how much money they will have to pay in such cases because all these numbers can add up to a very significant chunk of cash that’s spent each year.

Merchants usually have somewhere between 7 and 30 days, depending on the card network, to give their response when faced with a dispute. It is crucial that you respond to the claim within the specified time period. If you fail to do so, the issuing bank will automatically decide in favor of the cardholder. A good way to get notified as soon as someone contacts their bank for a dispute is to set up automated Verifi or Ethoca alerts. These will give you the chance to resolve the issue directly with the customer.

To make sure you don’t lose ROI on such disputes, you can take the following steps:

The easiest way to manage chargebacks is to use a service like Chargebackhit. We can ensure you can prevent chargebacks and fight claims to resolve them as quickly as possible. Using products like Order Insight and Consumer Clarity, the company transmits all the relevant data to the issuing bank if a customer complains of a dubious transaction on their card. This process can lead to the customer recognizing the transaction, which means you can avoid an unnecessary chargeback.

If you want to get some custom help from professionals to manage chargebacks, get in touch regarding our solution. You’ll be able to increase your ROI and save money significantly.

We know how to minimize risks and maximize profits

Let us helpThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.