Let professionals take care of your chargeback representment

Our financial consultants have got you covered from A to Z

We're here to help

Chargeback representment can be your way out of a dispute with a client who demands a refund from their bank. If you recognize that the customer is falsely accusing your company, you should do something about it. This is known as friendly fraud, and it’s one of the most common chargeback issues you will want to avoid.

This section will explore all the steps for a well-built chargeback representment and its particular relevance for a merchant to contest a fraud attempt. We will also talk about what consists of a well-designed representment package that can lead you to win a chargeback.

Table of Contents

This process helps to prove the non-legitimacy of a client’s claim for a transaction to be overturned. The company must hand over evidence to the issuing bank to verify the invalid payment card chargeback.

When a client files for chargeback, you have two options: accept it or fight it. If you’re not bothered with losing sales revenue and other expenses like fees, it is easier to take it. On the other hand, if you want to reverse the chargeback, you can always choose the representment process. In this case, you need to have the evidence to prove that this is an illegitimate chargeback.

Chargeback representment is related to the possibility of refuting an unlawful transaction claim. In other words, a representment is a merchant’s action to reverse a chargeback by submitting evidence. It aims to give the issuing bank solid information about the transaction’s lawfulness. No chargeback representment definition can forget to mention a rebuttal letter that summarises all the facts and documents that support them.

As stated by FIS Global, around 70% of credit card frauds are friendly frauds. And chargeback representment is the only way to try to retrieve the money from friendly fraud. After receiving the claim from the bank, the first step of the merchant is to identify the reason code to understand the scope of the transaction dispute and then aggregate all the needed documentation to file a chargeback representment.

An organization is entitled to defend a valid transaction if this is called into question. The process has its requirements, and you should acknowledge them.

Don’t postpone. You don’t want to lose the case due to a missed deadline. If you don’t send the representment process within the allotted time, the bank will assume that you accepted the chargeback. Typically, merchants have around 20 to 45 days to respond. Various aspects can have an impact on the time limit. For example, the reason for the dispute. Moreover, each card network and bank has its regulations.

Here we are talking about sales receipts, proof of delivery, a return policy copy, and proof of communication between the merchant and the client. Sellers need compelling evidence of the customer journey to support their case.

In addition to the documents mentioned above, the merchant must hand over an outline of the case. It is essential to be straight to the point and present the facts that validate the transaction.

The acquiring bank will receive it and send the evidence back to the issuing bank. The communication is only between the two banks. After finishing these steps, the bank will revise the evidence. At this point, the merchant needs to wait for the issuing bank’s decision.

Merchants must pay special attention to credit card dispute deadlines for the representment. When they are missed, sellers can forget about having your money back from a chargeback claim.

Please note that the time limits for cardholders and merchants differ. Cardholders have between 90 and 120 days from the moment of the transaction or delivery. Whereas merchants usually have between 20 and 45 days after receiving the notice. Timelines are also not standardized between card networks.

For instance, with Visa, you have up to 30 days and 45 days with Mastercard. Moreover, the chargeback representment timeline varies according to numerous aspects such as location, bank, and type of product/service.

Timelines are here to optimize this process, but collecting the proper evidence on such short notice can take some time. Using an automated solution to do it quicker and more precisely is better. Chargebackhit provides such and can help you submit the relevant data to deliver a successful representment package with all the compelling evidence to win the case.

It is a crucial part of your response package. You can prepare your chargeback representment letter like a well-written traditional letter. Start by greeting, then introduce the body of the letter and, finally, a closing sentence.

It is also relevant to highlight the essential information in the chargeback representment letter sample. Be concise and professional, and keep it easy to read. Remember to explain why you want to overturn a complaint.

Below you can find a sample letter that you can use to start writing your representment of the chargeback letter. Adapt it with dispute-specific information with clear evidence that supports your case.

Dear Sir or Madam [Bank Official Name],

My [business name] sells [product/services description] online. This rebuttal letter is in the scope of the chargeback [number] with the reason code [code and code name].

[Customer’s name] made a purchase of [product/services description] for [amount in the currency] with the [payment card number] on [date of purchase]. On [day of shipment], the product was shipped, and on the [day of delivery], the client received it and signed the delivery receipt.

Despite our effort to offer a high-quality service, the client decided to file a dispute for a chargeback. It represents a legitimate purchase that I would like to corroborate with evidence.

Attached to this letter, you may find evidence that indicates [cardholder’s name] authorization of payment:

- A copy of the receipt with the cardholder’s signature

- Client’s agreement to our Terms and Conditions

- IP records of the specific moment the product/service was acquired

- A delivery confirmation receipt

- Other relevant documents

If you have any questions regarding this issue, don’t hesitate to get in touch with our team.

Best Regards,

[Name/Department]

[Company]

[Email address/phone number]

As a merchant, you should focus on presenting this matter well. Avoid spelling and grammar mistakes and irrelevant information that won’t add up.

If the chargeback happened due to actual fraud or a company mistake, don’t waste your time with a representment of chargeback. The law protects the client’s interest, so there is no point in fighting a legitimate claim. Accept it and make the refund to the client.

However, representment is a viable alternative when you want to overturn a chargeback that does not have a valid claim. According to LexisNexis Risk Solutions, successful fraud attacks have increased by 52% since 2020. There is a clear need to reduce fraud, but if sellers ignore the notification, they will lose the chance of representment.

Moreover, banks wish to make the process faster and avoid funds being in provisional status for too long. It means that sellers might have to pay a fee to some card networks, such as Visa if they ignore chargeback notifications.

Like the reason code, the type of merchant also has its specifications. Representment will be different for each of them, as their offer is different. Here are the three most common merchant types:

It is essential to know this, namely when looking for the evidence for representment. The type of purchase is not the same for each of these merchants, so you need to have adequate documentation related to your business to try to overturn a chargeback.

First, know the reason code before gathering all the documents, as their relevance will differ from case to case. This is how you can perceive the type of chargeback you’re facing. Although, be vigilant for the fact that bank criteria can vary so that you get the right evidence for representment.

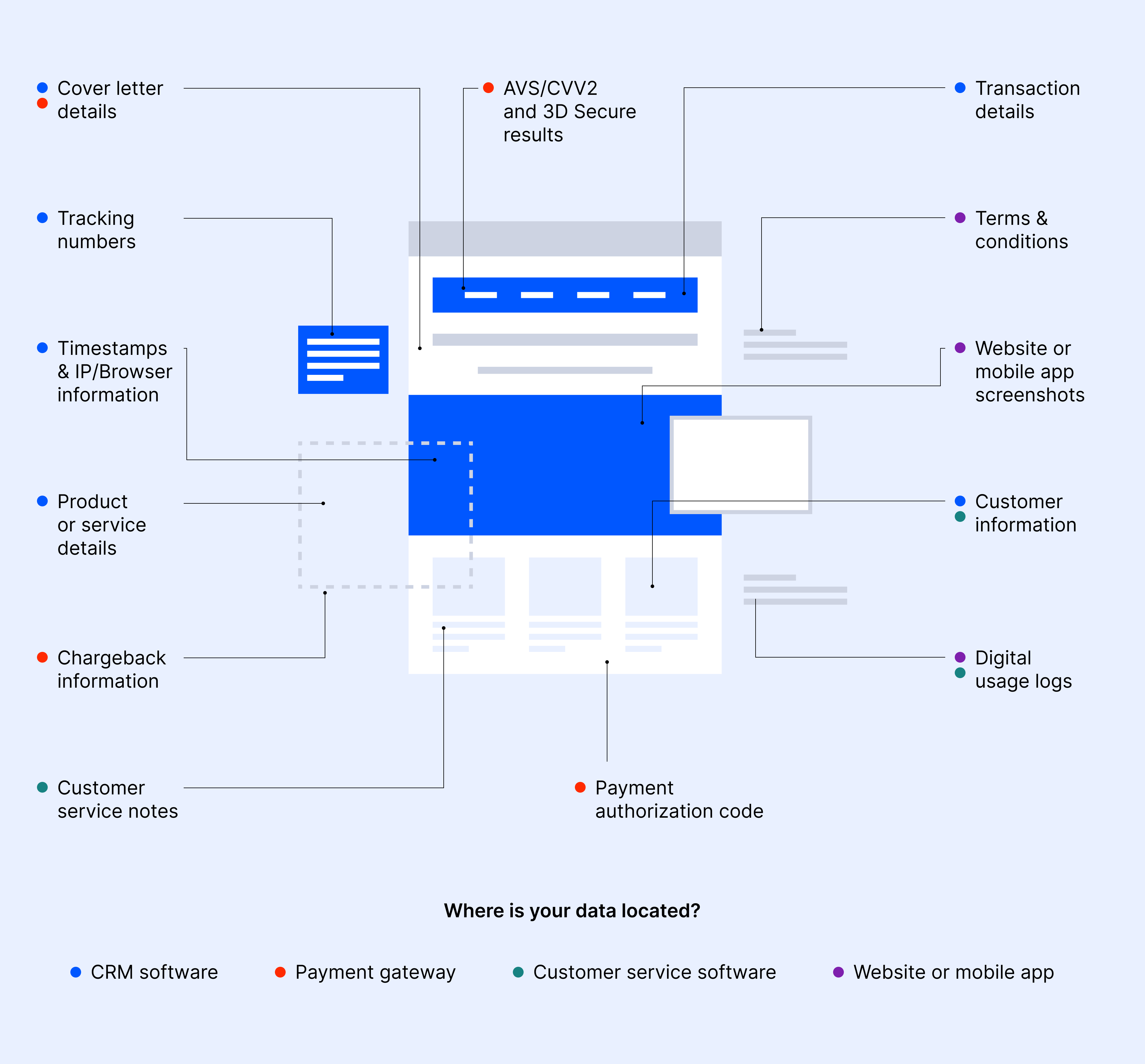

When trying to reverse a chargeback dispute, there are several documents that a merchant can use as compelling evidence that supports a valid transaction. Nonetheless, they can vary depending on the type of merchant previously mentioned. Here are some examples that can be of great help to your business:

If you want to prepare for any possible chargeback, you can start by having a collecting system to archive evidence during the buying process. This way, you will have access to specific information whenever you need it without spending a lot of time looking for it.

The issuing bank will review the evidence and make a decision. Either the chargeback is reversed, or the merchant claim is rejected and the cardholder is refunded. If the seller wins, the issuing bank will decline the chargeback to the cardholder. It will send the funds to the acquiring bank to return them to the merchant’s account. However, it is not an easy job to win. In case the merchant representment claim is rejected, the client can keep the credit.

There is also the last outcome: the pre-arbitration stage. The issuer or the customer can dispute it a second time with additional evidence. Like the first time, the seller must decide whether to accept the chargeback or not. But new evidence will be needed, so the merchant has to be sure this is worth pursuing.

If any resolution is settled, then it will go to arbitration, which is more common in transactions with high amounts at stake. In this situation, the card network will have to review the case and decide.

When a chargeback is wrongly accusing a company, the only way to recover the funds is with representment. That said, if sellers want to recover the money lost with a chargeback, they should fight it.

However, this is not the only reason. When merchants deliberately ignore friendly fraud, they open the door to more cases because the consumer will feel that there are no consequences for their actions.

It is also relevant to maintain a good reputation with the bank. If sellers do not fight the chargeback, the banks will assume that the cardholder has a legitimate claim.

A chargeback specialist is a professional who helps a company evaluate, assess, and manage chargeback to help prevent it. They are the ones getting in touch with banks, payment processors, card networks, and perhaps customers.

Some of their tasks include:

The chargeback analyst will decide if the company should fight a chargeback, namely when provoked by fraud, or if it is better to accept liability. To determine whether the claim is valid or to analyze the vulnerabilities, it is essential to examine the transaction data provided by platforms such as the Chargebackhit.

Each card network (Visa, MasterCard, etc.) has its own rules, and the chargeback specialist must ensure that the organization is always in compliance with regulations and its changes.

The specialists have to identify trends and patterns that could represent a higher risk of chargebacks and how to address the issues. Their primary focus should be prevention by being very vigilant with the chargeback ratio. The specialist will also help identify internal vulnerabilities regarding, for example, operations, customer service policies, and anti-fraud tools that should be mitigated.

If a seller wants to fight it, the chargeback specialist should collect all the documents that can prove the chargeback illegitimacy after checking the reason code. Afterward, the analyst is responsible for the submission of the representment package.

It is difficult to win a chargeback on your own. To successfully win a chargeback fight, sellers need to provide compelling evidence. Use innovative technology to your advantage and let Chargebackhit make this process less time and cost-consuming by helping with the collection of the data needed for representment.

Our Recover solution will take care of your dispute response and will also submit it for you. With our automated solution, you will be able to handle numerous chargebacks at a time promptly.

Our complete offer includes chargeback prevention, detection, and representment to take care of your chargeback disputes. While you work on your business growth, we work on your chargeback ratio decrease.

Our financial consultants have got you covered from A to Z

We're here to helpThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.