Save Revenue through Increased Customer Loyalty and Zero Billing Confusion

Prevent disputes by sharing enhanced transaction information with issuers and customers in real-time

Learn how

Ethoca is a globally renowned software company based in Toronto, specializing in providing cutting-edge technology to prevent chargebacks and combat fraud. Since its establishment in 2005, the company has been revolutionizing the way businesses interact with issuers, consumers, and merchants in the virtual fintech world. In April 2019, Mastercard acquired Ethoca.

In 2018, the company launched Ethoca Eliminator, a product that reduced chargeback disputes by 70%. The company’s team of experts has also developed a suite of products that offer transactional clarity to clients, reducing the likelihood of chargeback disputes.

For years, there was no fast, reliable, and secure way to share intelligence about fraud and chargebacks outside the chargeback process. Ethoca changed this with its innovative fraud fighting and chargeback management system. Ethoca’s Consumer Clarity provides a way to prevent friendly fraud chargebacks, which mostly occur when a customer does not recognize a charge from a merchant on their bank statement.

Chargebacks exist to protect consumers from fraud, and legitimate chargebacks, such as those resulting from actual fraud or merchants failing to meet their sales agreements, must be accepted. On the other hand, friendly fraud chargebacks result from false or incorrect dispute claims and can be fought and won by merchants, but proactive prevention is still the most cost-effective solution.

Friendly fraud occurs when a customer files a chargeback for a legitimate transaction and receives a refund from their bank. This type of fraud presents a significant challenge for payment card issuers and merchants. It can account for up to 80% of all credit card fraud, costing the industry around $132 billion per year, according to Rahul Deshpande, CTO of Ethoca.

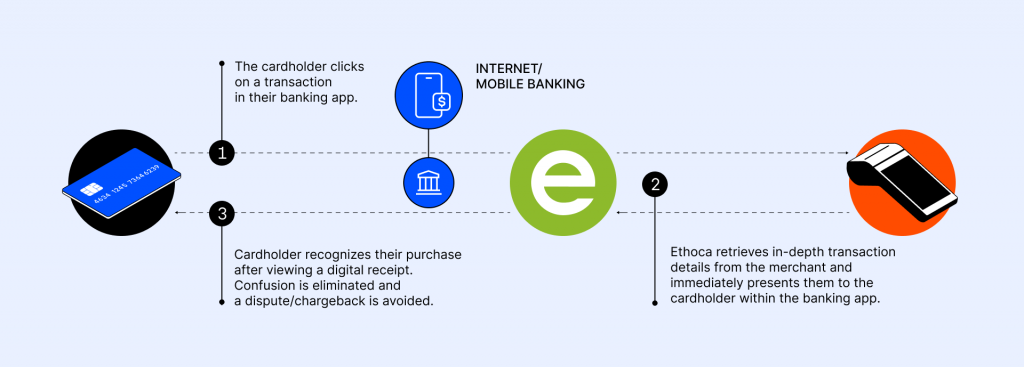

Consumer Clarity is a system that enables issuing banks to access detailed transaction information when a cardholder disputes a charge on their account. The data is automatically sent from the merchant’s CRM to the bank, clarifying the nature of the transaction for the customer.

By connecting merchants and issuers, Consumer Clarity enables rich purchase information sharing, including clear merchant names, contact information, logos, and itemized receipts, to be shared via issuers’ digital banking apps and back-office teams.

Table of Contents

Customers may question a charge on their card, file a dispute, or request a chargeback, and banks usually only give merchants a limited time to respond and resolve the problem. Ethoca Consumer Clarity solves this problem by creating a connection between customers, issuing banks, and merchant accounts by providing banks with real-time access to merchants’ orders and account history. Let’s take a look at the process involved:

This secure communication channel between the merchant and the issuer eliminates the need for a chargeback to be raised and prevents disputes from escalating. Consumer Clarity provides transaction data and other information, such as:

Once you’ve responded to a Consumer Clarity inquiry, follow these steps to prevent future issues from arising:

The service covers more than 145 million merchant locations in over 200 countries and offers real-time transaction lookup, self-service options for reviewing transactions, and integration with CRM or order management systems.

In the past, a customer complaint would usually turn into a chargeback, and the merchant would have to defend the transaction and pay fees regardless of the outcome. But with Consumer Clarity in place, the process begins with a transaction inquiry, allowing the necessary transaction information to be quickly transferred back to the bank, resolving disputes, and avoiding chargebacks.

Using a global network, Ethoca helps merchants combat fraud, reduce chargebacks, retain revenue, and improve the customer experience, all while reducing costs and improving efficiency. Here are some of the benefits that Ethoca offers merchants:

It’s essential to keep track of data generated by Consumer Clarity responses, which will help you analyze your chargeback situation and make informed decisions about how to reduce your chargeback rate. Merchants can use tools offered by companies like Ethoca and Verifi, which partner directly with card networks, to prevent chargebacks and preserve good relationships with their customers.

Verifi Order Insight is a solution offered by Visa to help merchants prevent chargebacks and reduce fraud. Like Consumer Clarity, Order Insight provides real-time alerts to merchants on transactions that may be at risk of chargeback. However, there are a few key differences between the two products that set them apart.

One of the main differences between Consumer Clarity and Order Insight is the level of detail provided in the alerts. The former provides merchants with comprehensive information about the transaction, including the customer’s name and address, allowing them to proactively resolve any disputes before the chargeback is initiated; the latter provides limited information on the transaction.

Another difference between Ethoca Consumer Clarity and Verifi Order Insight is the type of alerts provided. Consumer Clarity provides alerts on a wide range of transactions that may be at risk of chargeback, including those related to fraud, friendly fraud, and technical issues. In comparison, Verifi Order Insight only provides alerts on potentially fraudulent transactions.

One significant advantage of Ethoca Consumer Clarity is its integration with Mastercard’s chargeback management system. This integration allows merchants to easily access Consumer Clarity and view the alerts directly within the Mastercard portal. In comparison, Verifi Order Insight is a standalone product that requires merchants to log in to a separate portal to view the alerts.

In conclusion, both Ethoca Consumer Clarity and Verifi Order Insight are effective solutions for merchants looking to prevent chargebacks and reduce fraud. However, Consumer Clarity offers a more comprehensive solution, with more detailed information about the transaction that may be at risk of chargeback and a wider range of alerts. That’s why Chargebackhit combines both of these products’ benefits in a single solution called Prevent.

Chargebacks have been a constant challenge for merchants, as they can result in lost revenue and damage to their reputation. To help mitigate this risk, payment service providers like Mastercard offer various alerts to their clients or merchants to prevent chargebacks from being issued by their customers. One such solution is provided through the integration of Mastercard with Ethoca Consumer Clarity.

Ethoca Consumer Clarity is a product designed to build trust between customers and merchants by increasing transparency and transaction clarity. It acts as an intermediary that connects information from both parties and makes the best possible solution to support consumers and enhance their buying experience.

In conclusion, Ethoca Consumer Clarity is a powerful tool that helps merchants and issuers to prevent chargebacks and improve the customer experience. Merchants and issuers can reduce confusion and build better customer relationships by providing real-time access to detailed transaction information. Whether you are a merchant, issuer, or customer, Ethoca Consumer Clarity is an innovative solution that can benefit everyone involved in a transaction.

Prevent disputes by sharing enhanced transaction information with issuers and customers in real-time

Learn howThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.