Protect your finances and take control of credit card disputes

Chargebackhit is here to make it simple

Contact our team

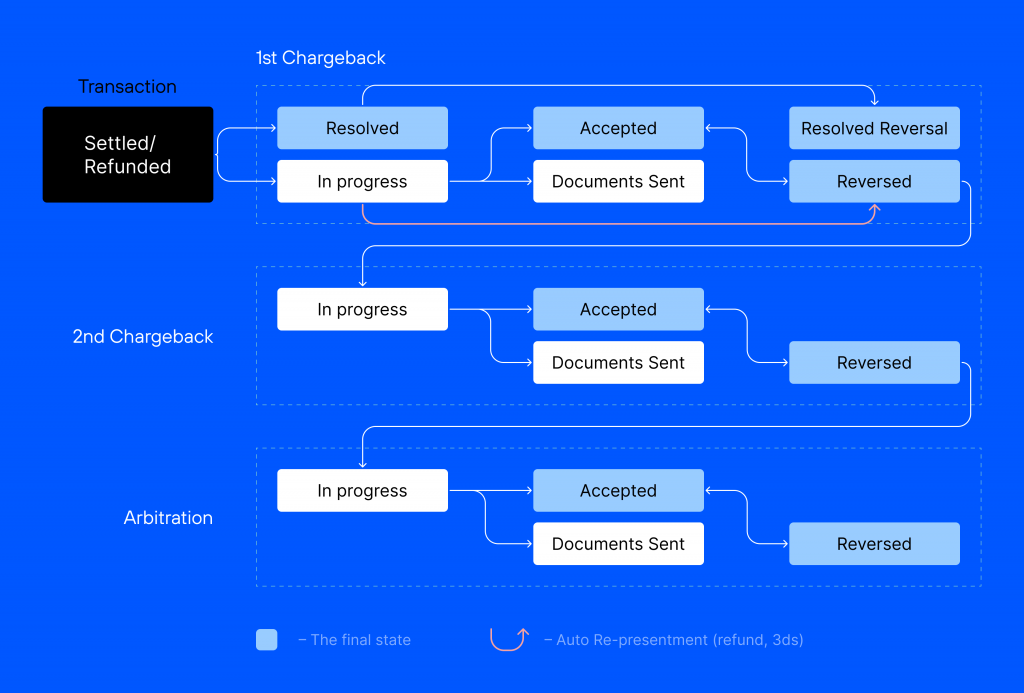

After a customer raises a dispute, it goes through several steps. It’s essential to understand the dispute process before trying to resolve it.

Table of Contents

Notification of Fraud (NOF) is a report that a bank or financial institution issues to alert a card network (such as Visa or Mastercard) about fraudulent activity detected on a credit or debit card account.

The report is typically used to request that the card network cancel or suspend the compromised card to prevent further fraudulent transactions from being approved.

Visa TC40 reports available with Chargebackhit are used to track fraudulent activity on Visa credit, debit, and prepaid card accounts.

Mastercard SAFE reports are used to track fraudulent activity on Mastercard credit, debit, and prepaid card accounts.

Both reports contain information about the specific card account that has been compromised, as well as details about the fraudulent transactions that have been detected.

NOF is not a dispute, and no money is withdrawn from the merchant’s account. However, this transaction can become a chargeback if 3Ds is not used.

The merchants can get NOF reports to perform the following actions:

A Request for Information (RFI) is a request sent by a credit card issuer to an acquirer for additional information about a transaction. The issuer may send an RFI if they need additional information to decide on a chargeback or dispute. There are a few different situations in which an issuer might send an RFI to an acquirer:

If a customer disputes a charge on their account and requests a chargeback, the issuer may send an RFI to the acquirer to request additional information about the transaction.

This could include information about the purchased product or service, customer interactions with the merchant, and any relevant receipts or invoices.

In some cases, the issuer may have concerns about a transaction and send an RFI to the acquirer to request additional information. This could be because the transaction appears unusual or because the issuer has identified other potential red flags.

In some cases, the issuer may send an RFI to the acquirer if they need additional information to decide on a dispute or other issue. This could include information about the merchant’s policies or procedures or the customer’s account.

At this stage, no money is withdrawn from the merchant’s account. However, acquirers must respond promptly to RFIs to help the issuer resolve disputes and make informed transaction decisions.

Due to the optional nature of signatures for all transactions, Visa has announced the phasing out of retrieval requests, effective October 2020. Instead, Visa’s Order Insight platform offers the same functionality, rendering retrieval requests obsolete.

On the other hand, Mastercard has discontinued retrieval requests, except for Maestro-branded card transactions in Europe. Similarly, Mastercard has a platform that provides equivalent functionality.

However, card networks such as Discover and American Express still mandate the use of retrieval requests, though this could change in the future.

Although Visa and Mastercard no longer include the RFI stage in the chargeback process, you may still receive RFIs from issuers who have chosen to use this process, but you are not required to respond or provide any information.

A Notification of Chargeback (NOC) is a notification issued by a card issuer to an acquirer when a cardholder disputes a transaction and requests a chargeback.

A Notification of Chargeback may be issued after a Request for Information has been submitted, or it may occur immediately after payment has been marked as Settled or Refunded without needing an RFI.

The NOC will include information about the disputed transaction and the reason for the chargeback. The acquirer can then review the NOC and decide whether to accept or challenge the chargeback.

If the acquirer decides to challenge the chargeback, they will need to provide evidence to the card issuer to support their case. If the acquirer is unsuccessful in challenging the chargeback, they will be required to refund the cardholder for the disputed transaction.

After NOC is submitted, the dispute process consists of the following steps:

The disputed amount is removed from the merchant’s account. This is the final stage if the merchant agrees with the dispute or does not provide supporting documents to defend its case.

In addition, the merchant may be assessed a chargeback fee by the acquiring bank or payment processor for the administrative cost of processing the chargeback.

It is important to provide any supporting information that can help your case at the start of the chargeback process, as there will not be any additional opportunities to do so later on.

Make sure to address the specific chargeback reason code and submit any relevant documentation to support your case.

The acquirer receives the supporting documents and sends them to the card network. It is no longer possible to change these documents.

The disputed amount is returned to the merchant’s account. At this stage, the issuer reviews the defense. This is the final stage if they accept the defense or do not respond within the required timeframe.

If the issuer denies the defense, they may initiate pre-arbitration, which the acquirer will review and provide additional information and/or documentation.

If the issuer denies the defense or the acquirer accepts their pre-arbitration case, a second chargeback occurs, and it’s impossible to provide any additional supporting documents. This is the final stage.

Chargebackhit Prevent is a state-of-the-art product created to properly prevent and handle chargebacks – decreasing them more than 2x and saving millions for our clients. Contact our team to learn more.

Chargeback arbitration is a process used to resolve disputes between merchants and cardholders when a chargeback has been initiated.

The arbitration process is typically used when the merchant and cardholder cannot agree about the disputed transaction. It allows an independent third party (card network) to review the case and make a final decision.

In the case of Visa and Mastercard, chargeback arbitration is typically initiated after the merchant has provided a defense against the chargeback and the card issuer has denied the defense.

The card network manages the arbitration process, which involves submitting additional evidence and documents by the merchant and the card issuer.

An arbitrator will review all the evidence and decide on the chargeback. The arbitrator’s decision is final and binding, and the chargeback is either granted or denied based on their decision.

The arbitration process is typically only used as a last resort, and it can be time-consuming and costly for both the merchant and the card issuer. It is generally better for both parties to resolve the dispute informally before resorting to arbitration.

Chargebackhit is here to make it simple

Contact our teamThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.