Protect your Bottom Line and Your Reputation from Chargeback Fraud

We're here to help you safeguard your profits and keep your customers satisfied.

Reach out

Nearly 90% of chargebacks you receive are cases of friendly fraud that originate with genuine cardholders. These claims can happen because of misunderstandings or come from customers who erroneously believe a chargeback is a legitimate (or faster) way to resolve the complaint.

An increasing number of cases involve customers lying to get merchandise for free. To be effective, merchants need a dynamic, multi-level chargeback fraud management strategy that addresses pre- and post-transaction fraud.

Table of Contents

Chargeback fraud occurs when a consumer requests the issuing bank to initiate a chargeback on an online purchase they made personally, claiming that a transaction was unauthorized or that they did not receive the goods or services they paid for.

This can happen even if the transaction was legitimate, and it can be costly for merchants, as they may be required to refund the transaction and incur additional fees.

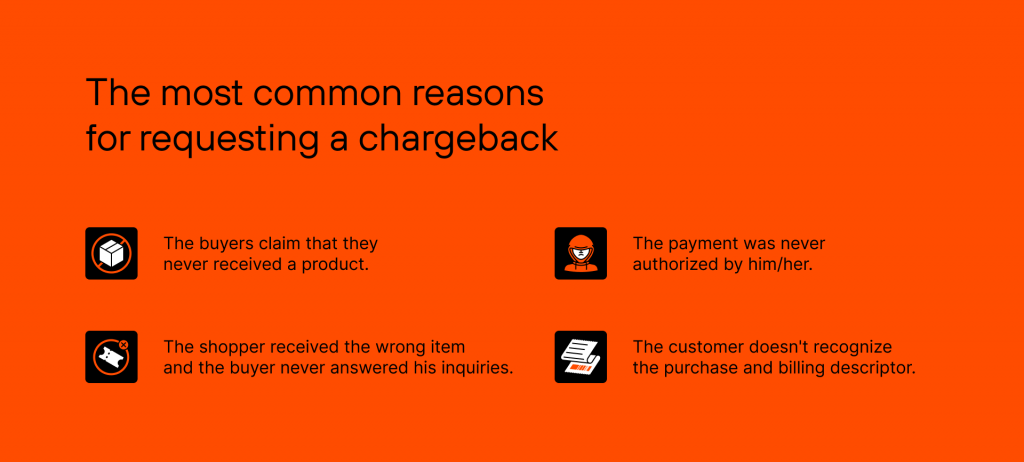

When a client files a chargeback, the main aim is to receive a refund while keeping an item. The most common reasons for requesting a chargeback are:

The consumer intentionally opens a chargeback instead of reaching out to the business. Some buyers consider filing a chargeback an easier way to obtain a refund, but chargebacks are much more harmful to the company.

The terms Chargeback Fraud and Friendly Fraud are often used interchangeably, but they don’t mean the same thing. The main difference between these terms is that chargeback fraud is an intentional action, while friendly fraud often occurs by a consumer’s mistake.

Customers who intend to commit a chargeback fraud usually wouldn’t contact the support service. They will mostly avoid any communication with the merchant, unlike those who engage in friendly fraud. The latter are inclined to communicate with the business and explain the reason for requesting a chargeback.

Chargeback fraud can be considered illegal, as it involves making false claims to financial institutions to receive a refund or reimbursement for a transaction.

In many countries, making false claims to a financial institution is a crime punishable by fines or even imprisonment. Though, it’s often difficult for merchants and financial institutions to prove that a chargeback resulted from fraudulent actions rather than a misunderstanding (especially in cases of friendly fraud).

The Card Networks Policy governs both issuing and acquiring banks. Obviously, the card network is subjected to the law, but cases when the consumer faces legal action due to chargeback abuse happen quite rarely.

The reason is that tracking chargeback fraud requires the involvement of multiple local and government law enforcement agencies, and depending on the damages, a fraudster may be punished. However, the cost of judicial interference is high, often higher than that of products or services provided.

Despite mounting evidence of the prevalence of chargeback fraud, little action has been taken to curb this widespread issue. Five key reasons contribute to the continued success of fraudulent chargebacks:

Addressing the challenge of chargeback fraud necessitates a comprehensive approach that includes improved reason codes, raising consumer awareness about the distinctions between chargebacks and refunds, updating outdated regulations, promoting thorough due diligence by banks, and providing merchants with effective resources to combat fraudulent chargebacks.

As chargeback fraud increases uncertainty and criminality in online payments, the government law doesn’t have the required resources to track such cases and penalize them. The merchants must therefore install their own protection mechanisms, and implementing the correct strategy for fighting chargeback fraud may save the company a lot of money.

Indeed, fighting chargebacks can be expensive for the merchants, especially when it comes to the arbitration process, which can cost around $500 despite winning or losing. However, using the 3D-Secure authentication and anti-fraud systems may simultaneously reduce the chargeback ratio and chargeback fraud volume.

The most effective solution remains to benefit from chargeback management services like Chargebackhit.

We're here to help you safeguard your profits and keep your customers satisfied.

Reach outThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.