The Complete Mastercard Chargeback Guide has 600+ Pages

Filling out the form below instead and contacting our team of chargeback pros will take you less than a minute

Get a consultation

Mastercard is one of the world’s most widely accepted forms of payment, with over 190 million merchants accepting the card globally. However, even with the convenience and security of Mastercard payments, chargebacks can still occur.

Chargebacks happen when a customer disputes a transaction and requests a refund from their bank or card issuer. They can be a major headache for merchants, resulting in lost revenue and added fees.

This article will provide a concise overview of the Mastercard chargeback guide, including the process for handling chargebacks and the rights and responsibilities of merchants and acquirers.

Table of Contents

First, it’s essential to understand the types of chargebacks on the Mastercard network. Mastercard classifies chargebacks into several categories:

Fraud. Fraud chargebacks occur when a transaction is deemed fraudulent, such as if a customer’s card was stolen and used without permission.

Authorization. Authorization chargebacks occur when a merchant fails to obtain proper authorization for a transaction.

Processing errors. Processing errors can include issues such as duplicate charges or incorrect amounts.

Customer disputes. Lastly, customer disputes happen when a customer is unsatisfied with a purchase and wants a refund.

It’s worth mentioning that most online merchants mainly face fraud chargebacks. However, different types of disputes may prevail in specific industries.

To minimize the risk of chargebacks, merchants should make sure that they are following best practices for accepting Mastercard payments. This includes:

Additionally, merchants should ensure that their systems can detect and prevent fraud. This can be done through fraud detection software or by implementing other security measures such as 3D Secure.

Merchants will receive a chargeback notification from their acquiring bank when a chargeback occurs. This notification will include the reason for the chargeback and other relevant information needed to respond to the chargeback. It’s crucial to respond to chargebacks promptly, as failing to do so can result in the chargeback being automatically ruled in favor of the cardholder.

The Notification of Chargeback is the first stage of the chargeback process. It occurs when the cardholder’s bank notifies the merchant’s acquiring bank about a chargeback initiated by the cardholder. Here’s an explanation of this stage:

Following the notification of the chargeback, the acquiring bank will debit the merchant’s account and credit the customer’s account. However, this is a temporary credit that can be converted into a debit if the chargeback is reversed. During the 1st chargeback phase, the merchant can either accept or dispute the chargeback. The Merchant then typically has up to 10 days to respond.

If the merchant decides to dispute the chargeback, they must provide the acquiring bank with evidence and complete a number of forms. Typical evidence that the merchant will have to demonstrate includes:

Once the issuing bank has received the information, they will then pass it to the issuing bank. The issuing bank will review the evidence and then rule in favor of the merchant or cardholder. If the issuing bank rules in favor of the cardholder, then the merchant can’t appeal the decision, their only option is arbitration.

The Chargeback Reversed stage refers to the outcome of the chargeback process when the issuing bank rules the decision is in favor of the merchant. It occurs when the acquiring bank successfully challenges the cardholder’s dispute and reverses the chargeback. During this phase, the merchant’s account will be credited for the full transaction amount + any fees incurred, and the cardholder’s account will be debited the original transaction sum.

If the cardholder disagrees with the decision of the First Chargeback, they can choose to initiate the pre-arbitration phase. This happens when they believe they have strong evidence to further support their case or they want to change the chargeback code and make a new case.

The cardholder compiles additional evidence and submits it to their issuing bank, requesting a review of the chargeback decision. This evidence should address any deficiencies in the initial representment or provide new information that supports the cardholder’s position.

If the issuing bank is satisfied with the evidence, they then notify the acquiring bank, who then informs the merchant of the chargeback and shares the latest evidence. The merchant can either accept the new chargeback or dispute it. If they choose to dispute it, they again need to provide evidence. The issuing bank will then rule in favor of the cardholder or merchant.

The final step of the chargeback process is known as arbitration. The card association (Visa, Mastercard, American Express) steps in and comes to a final solution in favor of the merchant or cardholder.

Arbitration is seen as a last resort as the fees range between $500 and $900, and the success rates are not high. Arbitration also takes between 10 to 45 days. Most merchants only opt for arbitration for large transactions.

How it works is the acquiring bank contacts the card association who then starts reviewing the evidence brought forth by the issuing and acquiring banks. They will then make a final decision, and either the chargeback will stand or be reversed.

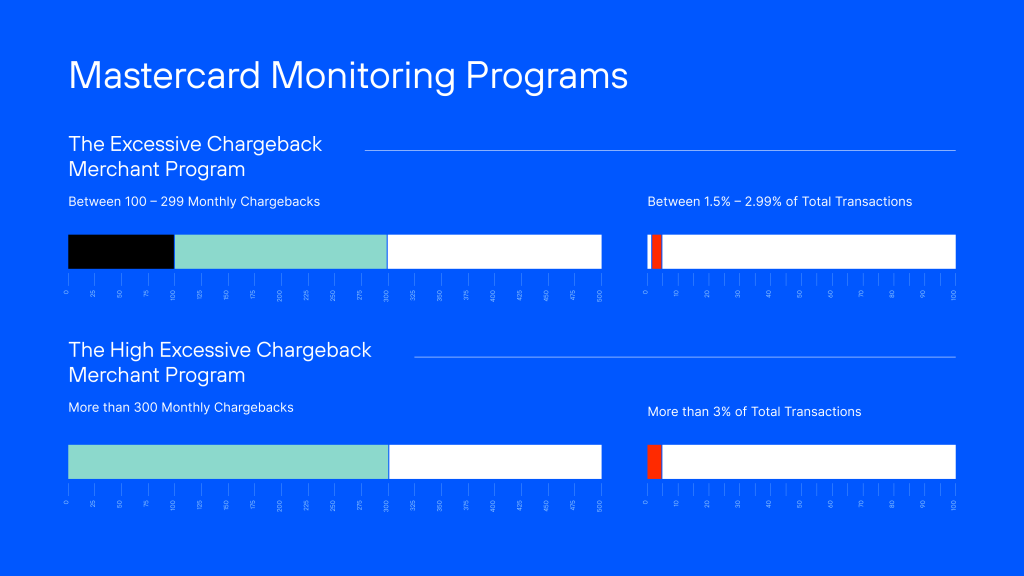

It’s also worth mentioning that the Mastercard chargeback guide pays significant attention to the Mastercard Excessive Chargeback program. It’s a program designed to monitor and address high levels of chargebacks on a merchant’s account.

Under this program, merchants may be placed into one of several levels of increased scrutiny, depending on the rate of chargebacks they experience. This can include increased reporting requirements, fines, or even termination of their merchant agreement with Mastercard.

The program aims to protect consumers from fraudulent activity and ensure merchants can effectively manage and prevent chargebacks.

Respond. Merchants must provide evidence that the transaction was valid to respond to a chargeback. The evidence can include receipts, invoices, or shipping records. It’s vital to provide clear and concise documentation, as the proof provided will be used to determine the outcome of the chargeback.

Dispute. Merchants have an opportunity to dispute a chargeback. This can happen if the merchant believes that the chargeback results from a processing error or that the customer is disputing the charge in bad faith. To dispute a chargeback, merchants will need to provide additional evidence and make their case to the card issuer through their acquiring bank.

Prevent. To avoid chargebacks, merchants should follow best practices for accepting Mastercard payments and have a sound fraud detection system in place. When chargebacks occur, it is important to respond to them promptly and provide clear and concise evidence.

By understanding the Mastercard chargeback process and taking steps to minimize the risk of chargebacks, merchants can protect their revenue and maintain positive relationships with their customers.

In conclusion, the Mastercard chargeback guide provides a clear and consistent process for resolving chargeback disputes. By understanding the different types of chargebacks and the rights and responsibilities of merchants and acquirers, entrepreneurs can take the necessary steps to minimize the risk of chargebacks and ensure a fair and timely resolution of disputes.

Filling out the form below instead and contacting our team of chargeback pros will take you less than a minute

Get a consultationThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.