Win disputes with minimum effort

Get expert advice and make informed decisions with Chargebackhit team

Get a consultation

A dispute is a process through which a cardholder can challenge a transaction that appears on a credit or debit card statement.

The card issuer typically handles disputes, and the goal of the dispute process is to challenge the charge and determine whether the cardholder or the merchant is liable for it. Disputes can be raised for various reasons, including fraud, unauthorized or incorrect charges.

Although there are multiple dispute and chargeback reasons, fraud is definitely the most prevailing one. Fraud disputes are common because fraud is a widespread issue in the e-commerce industry.

Fraudsters may use multiple methods to obtain goods or services fraudulently, including using stolen credit card information, creating fake accounts, or manipulating payment systems. Furthermore, nearly 50-80% of consumers who file chargebacks admit to committing friendly fraud, according to a Solidgate study.

Friendly fraud occurs when a consumer disputes a legitimate charge on their credit card bill, falsely claiming that they did not make the purchase or that the product was not as described. This type of fraud can be costly for merchants, as they not only lose the sale but also face chargeback fees and may even lose their ability to accept card payments if they have a high rate of chargebacks.

There are two fundamental types of fraud disputes:

So how can the merchants protect themselves in these cases and win such disputes?

Table of Contents

A no-cardholder authorization dispute occurs when a cardholder disputes a charge on their credit card statement because they didn’t authorize the transaction.

This type of chargeback can occur for a variety of reasons, such as if the cardholder’s card was stolen and used without their knowledge, if the cardholder’s card was used to make a purchase through a phishing scheme, or if the cardholder was not given the opportunity to authorize the transaction at the time of purchase.

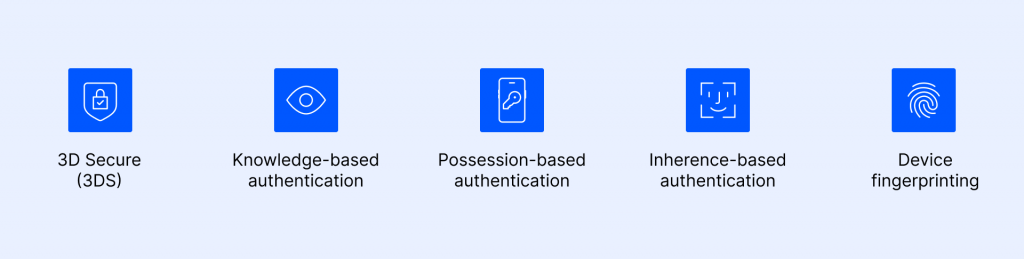

Generally, there are several methods and tools to prevent chargebacks and win disputes of this type:

3D Secure (3DS): 3DS is a security protocol developed to help prevent credit card fraud in online transactions. It requires the cardholder to provide additional authentication, such as a one-time code sent to their phone, to complete the transaction. This helps to verify the cardholder’s identity and prevent fraudsters from using stolen card information to make purchases.

This type of authentication involves verifying the cardholder’s identity by asking them to provide information that only they should know, such as their mother’s maiden name or the last four digits of their social security number.

This type of authentication involves verifying the cardholder’s identity by requiring them to provide something they possess, such as a mobile phone or a security token.

This type of authentication involves verifying the cardholder’s identity using biometric data, such as a fingerprint or a facial scan.

Device fingerprinting is a technique that involves collecting information about a device’s characteristics and the user’s browsing environment to create a unique “fingerprint” for the device. This fingerprint can be used to identify and track the device and help prevent fraud by providing the merchant with evidence of who made the purchase.

Furthermore, besides purely technical tools intended to prevent unauthorized charges, the merchants can also use the following techniques to avoid “no cardholder authorization disputes”:

In addition to the aforementioned things, it is a must-have to use a fraud prevention service like Chargebackhit to help identify and prevent chargebacks.

A Questionable Merchant Activity chargeback occurs when a cardholder disputes a charge on their credit card statement because they believe the merchant’s behavior was suspicious or questionable.

This type of chargeback can occur for many reasons, such as if the cardholder believes that the merchant was operating a fraudulent business, if the cardholder was promised one thing but received something different, or if the cardholder was charged for goods or services that were not delivered.

Merchants who receive a Questionable Merchant Activity chargeback may be required to provide evidence that their business practices were legitimate and that the transaction was conducted in good faith to win the dispute. Generally, we can highlight the following subtypes of questionable merchant activity disputes:

This chargeback is a type of chargeback that occurs when a cardholder disputes a charge on their credit card statement because they did not receive the goods or services that they paid for.

This type of chargeback can occur if the goods or services were never delivered, if the goods or services were not as described, or if the goods or services were not of the quality that was promised.

Merchants who receive a Goods/Services Not Received chargeback may be required to provide evidence that the goods or services were indeed delivered or that the cardholder received what they paid for to win the dispute.

It is important for merchants to keep detailed records of all transactions and to communicate clearly with their customers to try to prevent this type of chargeback.

How to win?

To successfully dispute a Goods/Services Not Received chargeback, the merchant must provide evidence that the cardholder received the goods or services in question. This may include:

If the documentation is digitally signed, a signature log or certificate must be included as part of the submission, with verifiable information such as access records, IP logs, timestamps, etc.

The merchant should also provide written communication detailing the availability of the products or services to confirm that the cardholder was aware of it. The best practice would be to use a Prevent product from Chargebackhit.

There are a variety of reasons why a merchant might provide an inaccurate product description. In some cases, it might be an unintentional mistake. The merchant might not have thoroughly researched the product and therefore might not have all of the correct information.

In other cases, the merchant might intentionally provide an inaccurate description to boost sales. This could be done to make the product seem more appealing than it really is, or to hide certain flaws or drawbacks that the product might have.

How to win?

It is difficult to say exactly which information or documentation may be required by the credit card issuer in a chargeback dispute, as it will depend on the specific details of the case. However, in general, a merchant may be asked to provide the following types of information:

An Incorrect Amount chargeback occurs when a cardholder disputes a charge on their credit card statement because the amount of the charge differs from what they expected.

This type of chargeback can occur for such reasons as if the cardholder was charged the wrong amount, if the cardholder was charged multiple times for the same transaction, or if the cardholder was charged for goods or services they did not purchase.

How to win?

To dispute an Incorrect Amount chargeback, the merchant must provide evidence that the cardholder knew and approved of the amount being charged, and that the charged amount was correct. This may include:

It is particularly important to include written communication with the cardholder if the cost of the purchase changed after the contract was signed, as the cardholder must have acknowledged and approved the new price.

Subscription businesses are considered risky in terms of chargebacks because they involve recurring billing, which can lead to misunderstandings or disputes between the merchant and the customer.

Customers may forget that they signed up for a subscription and be surprised when they see a charge on their credit card statement, or they may feel that they needed to be given more notice or information about the subscription terms. This can lead to chargebacks, as customers may dispute the charge in an attempt to get a refund.

Additionally, subscription businesses may have higher chargeback rates because customers may feel that they are not getting value for their money and may be more likely to request a chargeback as a way to cancel the subscription.

How to win?

Please note that there are also other types of questionable merchant activity disputes. The topic is somewhat complicated, but the Chargebackhit team has developed a suite of products to protect merchants from fraud and help them prevent chargeback disputes, resolve them properly – or even recover potential revenue loss due to fraudulent customer activity.

Get expert advice and make informed decisions with Chargebackhit team

Get a consultationThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.