Get all-round chargeback protection for your business

Our team of financial technology savvies is here to help

Reach out

Chargebacks have increasingly become a severe problem for merchants. What was intended to protect cardholders from unfair online transactions and increase the usage of credit and debit cards in e-commerce has essentially become a means of draining revenue.

Chargeback protection refers to any strategy, service, or technology a merchant employs to protect themselves and their business from excessive reimbursements. It is a paid service (similar to insurance) offered by different platforms to “protect” your business and reduce the liability of these chargebacks.

According to Mastercard, 615 million global chargebacks were expected in 2021, which is far from being an insignificant number. And even more worrying is the fact that $25.3 billion (stated by NRF) were spent in return frauds in the US. This is essentially a result of customers getting away with fraud, therefore, keeping the purchased goods and getting a refund.

With this in mind, most merchants would opt to ensure the sustainability of their business by protecting it against chargebacks using any of these platforms or service providers. Each of these service providers has varying methods, protection levels, and costs.

Some would offer a chargeback guarantee using an automatic process that monitors and inspects pending transactions and refunds the merchant if it eventually results in a dispute. Others would fight these disputes on your behalf when they arise. Regardless of the exact service, the concept is the same — shifting the responsibility from the merchant to a dedicated service provider.

Table of Contents

You should already understand the purpose of chargebacks in the e-commerce industry, but here is a brief explanation. Chargebacks are essentially a means to protect consumers who purchase goods and services online using credit and debit cards. With this scheme in place, these buyers can get their “cash back” in the case of stolen card information, unauthorized transactions, criminal activity, devious merchants, etc.

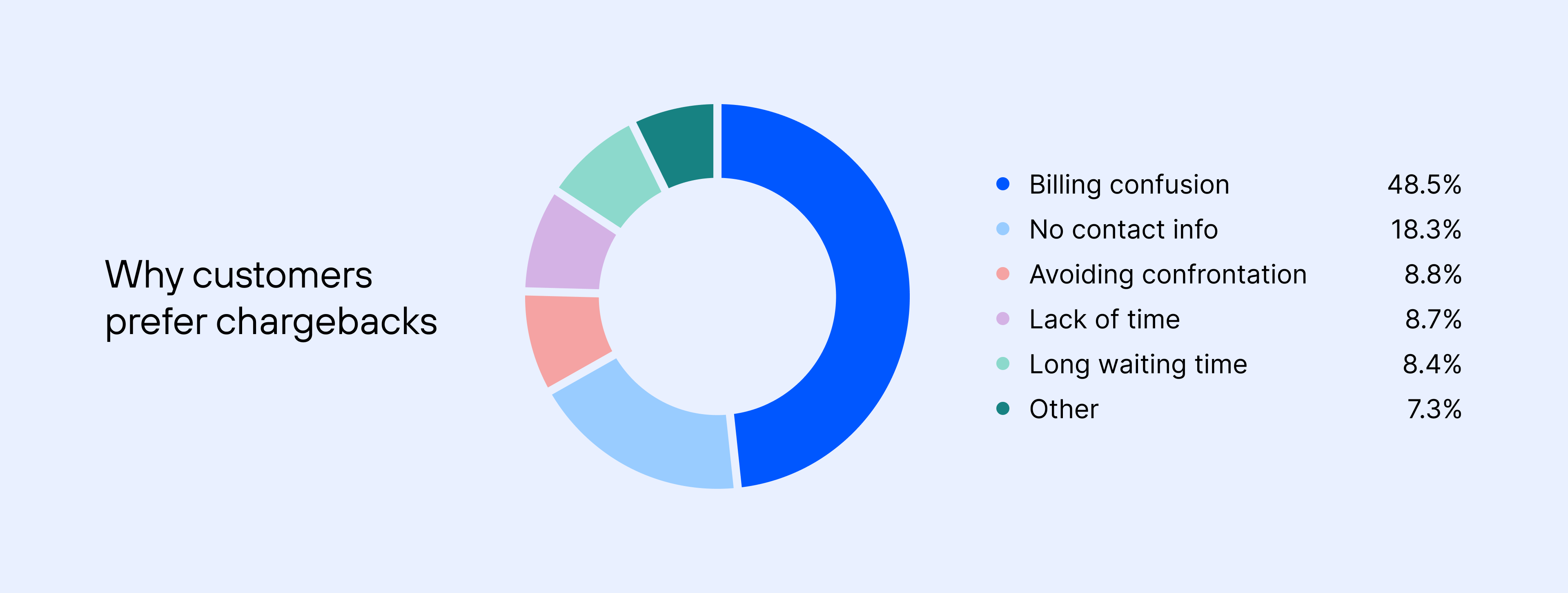

Although chargebacks are effective for the purpose they were created, there is a reduction in the efficiency of the process because the number of fraudulent cases and disputes opened by customers is increasing.

To stay ahead of this and protect their revenues, merchants employ a chargeback management strategy from service providers, who take a percent from each chargeback they resolve.

Every tool or service falls under one of the three phases in the chargeback process. It can either aid in preventing a fraudulent sale, solve the issues that arise from a customer’s complaints before an actual chargeback is requested, or settle the costs of qualified reimbursements.

Chargeback protection encompasses all the strategies, services, and tools employed in the process before and after the customer opens a dispute. In all circumstances, pre-transaction prevention is always better because even when resolved before an actual dispute, the chargeback still counts. The best way to address these concerns is to use several approaches made up of prevention and other aspects of chargeback protection.

To help you understand better, let us explain these three categories of chargeback protection, the tools you can utilize in these cases, and how they help solve problems in their respective phases.

In this phase, a merchant can still recognize and prevent a phony transaction from processing. To do this, you have to be able to identify and put a stop to the fraud before it occurs.

Merchants can use various services and tools designed for this process to combat the rising problems. There are three primary forms of pre-transaction chargeback protection tools we would address: fraud screening, fraud scoring, and merchant practices.

This involves using tools or systems before a transaction to inspect a buyer in a bid to determine whether they are fraudulent. This process helps minimize issues that may lead to difficulties in the future. Tools used in this process include:

Merchants can use this tool to measure the risk level of an order before the system processes it. The tool uses machine learning to make data-driven decisions based on the history of the traits and trends it identifies in the context of suspicious and fraudulent behavior.

This information supplies results that determine whether the transaction should be processed or flagged as suspicious. You can set the fraud scoring tool to reject flagged transactions or submit them for manual evaluation automatically.

There are several ways merchants can improve their relationships with customers to improve fulfillment and loyalty. By improving and optimizing aspects of the business, like customer service and logistics, you can reduce the chances of repayments in business. Some practices you can implement are:

This phase comes after a customer opens a dispute at their bank. You can use some tools and strategies in this phase, but it is not ideal because a conflict is already open and counts towards your record. There are two tools merchants can use here:

Using chargeback protection services, merchants can avoid excessive chargebacks. Some platforms such as eBay, PayPal, Stripe, and Shopify offer protection services.

When selecting a service to use, it is crucial to find out the exact terms of the job and its description. These platforms offer various plans, so you may need to employ more than one.

It is practically impossible to avoid all issues associated with your business as a merchant, but there are ways to prevent the excessive ones from crippling your business.

At Chargebackhit, we take chargeback prevention and protection seriously. We offer three different solutions that can help you reduce your ratio. We help you prevent disputes and save your revenue, resolve disputes quickly, and recover lost revenue in the long run.

Boost your efficiency and ROI with Chargebackhit and grow your business using our flexible chargeback prevention tools, strategies, and platform. We offer a comprehensive service for chargeback management that would suit your specific needs. Reach out for a free quote today!

Our team of financial technology savvies is here to help

Reach outThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.