Explore the ROI of Our Chargeback Prevention Service

Decrease your chargeback ratio, cut costs, and enhance customer experience in one go

Get in Touch

Chargebacks can hurt businesses a lot. They cost money, take up significant time, and potentially damage a business’ reputation to a point where a merchant can lose their license. Therefore, for any merchant, doing whatever is possible to reduce the number of such claims is very important.

Most of the time, it’s possible by providing excellent customer service, offering refund options, keeping in touch, and using secure payment protocols. However, there are still occasions when a consumer goes straight to their bank and illegitimately disputes a transaction, which can lead to a chargeback.

To prevent this from happening, you can use chargeback prevention alerts, as these provide the opportunity for your company to resolve a customer’s issue directly and quickly. One such service is Verifi, which offers notifications to merchants whenever a customer files a dispute. This guide will help you understand what this service is, what it offers, how it can help you secure your ROI and more.

Table of Contents

The CDRN stands for Cardholder Dispute Resolution Network and is a service provided by Verifi, a leading provider of chargeback prevention and dispute resolution solutions. Verifi CDRN is designed to help merchants manage and resolve transaction disputes and chargebacks more effectively.

CDRN operates as a comprehensive platform that allows merchants to receive and respond to chargebacks in real time. When a customer initiates a chargeback, Verifi CDRN provides the merchant with a notification containing detailed information about the dispute. This includes the reason for the chargeback, transaction details, and any supporting documentation provided by the customer’s bank.

Verifi is a company founded in 2005 and based in LA. Verifi CDRN (Chargeback Dispute Resolution Network) brings together various issuing banks to help merchants prevent and fight illegitimate payment disputes. Here’s how Verifi CDRN alerts work:

Verifi CDRN alerts lead to the freezing of the chargeback process for 72 hours. That gives your company plenty of time to fix whatever the problem is. If their claim is genuine, you might end up providing the customer with a refund or a replacement product. Otherwise, you can decide to fight the claim with your evidence if it seems like fraud.

When you enable Verifi CDRN alerts and start getting Verifi refund notifications, you can enjoy the following benefits:

Verifi refund notifications allow you to solve the problem proactively. Even if you end up sending the money back to the customer, you save a lot more with Verifi CDRN than you’d have to pay otherwise. That is why it’s essential for anyone wanting to avoid the extra cost of payment disputes to utilize Verifi refund notifications.

There is another large service with a similar network of issuing banks that offers the same notifications. Known as Ethoca, this company is based in Canada and works mainly with banks based in Asia, Europe, and Canada. Verifi, on the other hand, primarily supports US banks. Both these networks overlap with one another quite a bit, though.

If you sign up with both Ethoca and Verifi, your chances of getting alerts are much higher because you can access an extensive network of banks. On the other hand, this also means that you might pay double the amount and get duplicate notifications whenever a bank falls inside these services’ networks.

There are many reasons why hiring a dispute management company is a good idea if you face too many customer claims. Here are some of the main ones:

On average, you can expect to avoid/resolve a little less than half (around 41%) of the claims made by customers when dealing with digital goods. However, with physical products, this number falls to about 21%. CDRN alerts can prevent up to 40% of chargebacks! The effectiveness of CDRN alters depends on the:

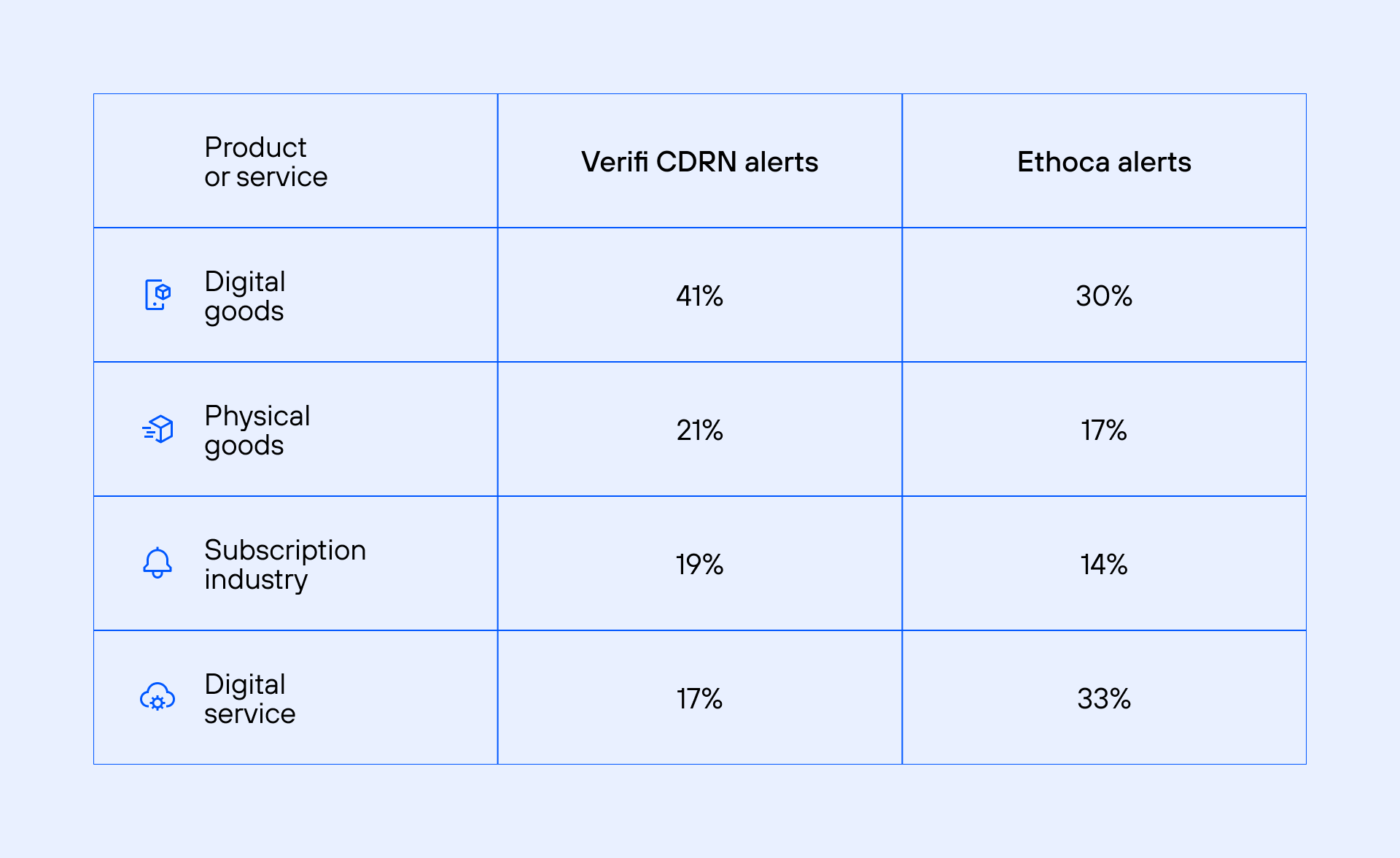

Here is how Verifi CDRN Alerts and Ethoca Alerts stack up against one another and their chargeback prevention percentage across different products:

If you sell digital goods then it makes sense to use Verifi as they have a big edge over Ethoca in terms of chargeback prevention percentage. However, if you are in the digital services business, then partnering with Ethoca Alerts can save a ton in chargeback fees.

Other than some basic financial information, your preventive alert network requires access to your sales system to help resolve issues. Because of such an easy process, there’s no hassle that you have to deal with to start getting alerts that can help your business a lot in the long run.

To get started with a preventive alert network, you will typically need the following information and access:

Additionally, depending on the specific preventive alert network you are using, there may be additional requirements or documentation needed. It’s best to consult with the provider of the preventive alert network to understand their specific onboarding process and any additional information they may require.

Verifi CDRN Alerts and Ethoca Alerts are both services designed to help merchants detect and manage potential chargebacks or disputes. They provide real-time notifications to merchants when a customer initiates a chargeback and integrate with the merchant’s payment processing system and monitor transaction data to identify potential chargebacks. Here is a look at some of the key similarities and differences between Verifi CDRN Alerts and Ethoca Alerts.

Similarities:

Differences:

Chargebackhit is a service that offers Verifi CDRN and Ethoca’s network coverage to give merchants the peace of mind they need to focus on running their business. We will take care of all your needs when it comes to preventing, resolving, and fighting payment claims.

The first step is to try and prevent such claims from taking place via Consumer Clarity and Order Insight. If such an issue arises, our service will get the relevant notification via an alert network and follow up with the issuing bank accordingly.

In case of fighting a claim, we will also help you build a strong and evidence-backed response to help you win against fraudulent cases. Utilizing CDRN, RDR, and other tools, we even offer automatic dispute resolution without the need for your involvement.

So, if you want to let the professionals take over your chargeback prevention needs, get in touch with Chargebackhit. Learn more about our products and services, and let us work on your behalf to save your ROI and enhance your business’ reputation.

Decrease your chargeback ratio, cut costs, and enhance customer experience in one go

Get in TouchThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.