Ready to Protect Your Business from Fraud?

Chargebackhit uses Order Insight and much more. Learn how we can help safeguard your online transactions

Contact our team

Verifi Order Insight is a powerful tool designed to help merchants better manage their chargebacks and disputes. By providing detailed information about each transaction, Order Insight allows merchants to quickly and easily identify the root causes of disputes and take action to prevent them from happening in the future.

With Order Insight, merchants can reduce chargeback rates, increase revenue, and improve overall customer experience. In this article, we will explore the key features of Verifi Order Insight and discuss how it can benefit merchants of all sizes.

Table of Contents

Fraud transactions are unauthorized or illegal transactions carried out using payment methods such as credit cards, bank transfers, and other electronic payment systems. Fraudulent transactions can take many forms:

Fraudulent transactions can result in significant financial losses for merchants, payment processors, and financial institutions, as well as negatively impact customer trust and confidence in the product they buy. Therefore, payment industry players have implemented various measures, such as fraud detection tools, to prevent and mitigate fraud transactions, especially friendly fraud, considering its growing popularity.

Friendly fraud, also known as chargeback fraud or friendly chargeback, occurs when a customer initiates a chargeback or dispute with their bank or credit card issuer, claiming that a legitimate transaction was unauthorized or fraudulent. In some cases, friendly fraud occurs when customers forget they made a purchase or don’t recognize the merchant’s name on their billing statement.

However, in other cases, friendly fraud is intentional. The customer may dispute the transaction to avoid paying for the goods or services or obtain a refund after receiving the goods or services.

Friendly fraud can be challenging for merchants to identify and prevent, as the customer initially authorized the transaction, and the merchant may have already delivered the goods or services. Therefore, merchants may lose revenue and value of goods or services and may be liable for chargeback fees to boot.

Friendly fraud can also impact the merchant’s reputation and relationship with their payment processor. Many chargebacks may result in the merchant’s account being terminated or facing restrictions on their payment processing.

Fraud can have significant negative impacts on payment processing for all parties involved in the transaction, including customers, merchants, and payment processors. Here is how fraud affects payment processing:

In response to the risk of fraud, payment processors can implement various measures to reduce the risk of fraudulent transactions:

By implementing these solutions, businesses can fight friendly fraud and reduce fraudulent chargebacks’ financial and reputational impact. However, it is essential to note that no solution can completely eliminate the risk of friendly fraud. That’s why businesses should regularly review and update their fraud prevention strategies to stay ahead of evolving threats.

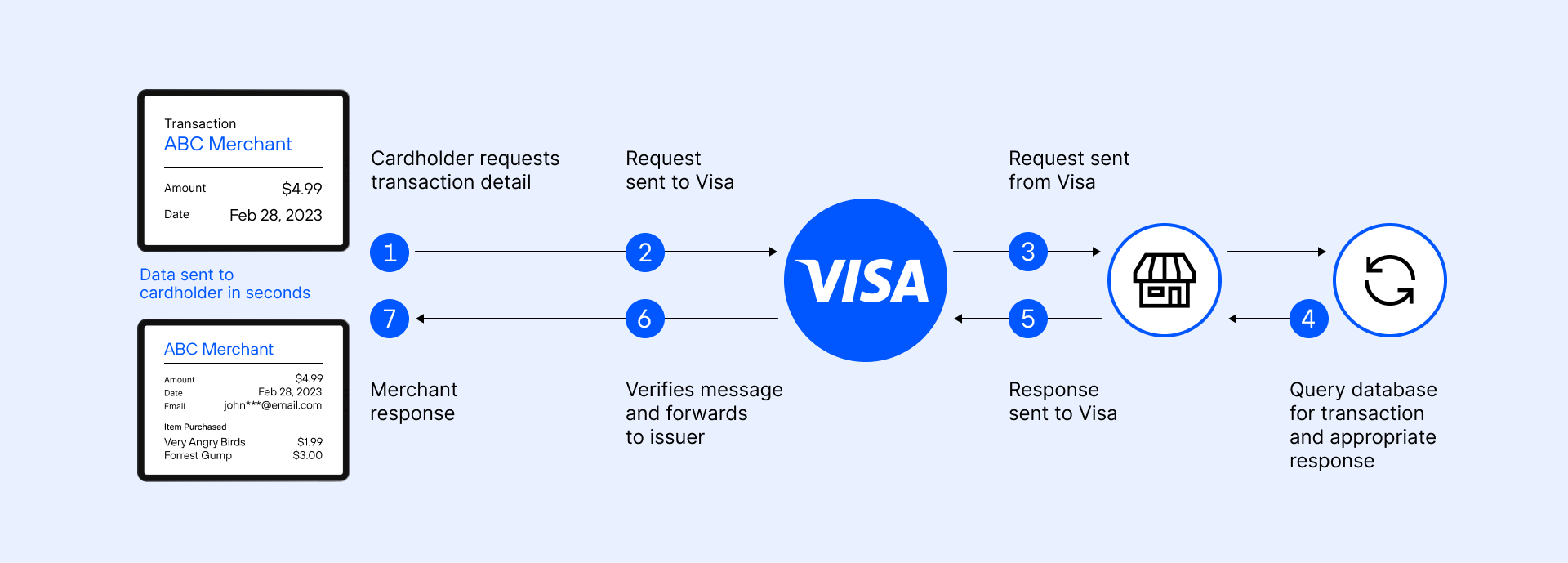

Verifi Order Insight is the most popular fraud detection and prevention tool that can help businesses combat friendly fraud. This tool uses various methods to help businesses identify and prevent chargebacks, including friendly fraud chargebacks. Here’s a more detailed look at how it works:

Verifi Order Insight provides real-time alerts to merchants when a chargeback is initiated by a customer, allowing them to resolve the dispute before it escalates to a chargeback. This can be particularly effective for preventing friendly fraud, as it enables the merchant to address any issues or concerns the customer may have before they file a chargeback.

Verifi Order Insight provides merchants with detailed transaction data, including information on the customer, the product or service purchased, and the payment method used. This information can be used to identify patterns and anomalies that could indicate fraudulent activity, including friendly fraud chargebacks.

Verifi Order Insight allows merchants to collaborate with issuers to resolve disputes and prevent chargebacks. This collaboration can help merchants provide evidence to support legitimate transactions and dispute illegitimate chargebacks. Issuers can also use the data provided by Verifi Order Insight to better identify and prevent fraudulent activity, reducing the risk of chargebacks.

Verifi Order Insight also offers a range of chargeback prevention tools, including customizable transaction fields, custom chargeback reason codes, and real-time data validation. These tools can help businesses prevent chargebacks by reducing transaction data errors and providing customers with accurate information.

Verifi Order Insight is an excellent choice for businesses that want to reduce chargebacks and prevent fraud.

Verifi Order Insight helps merchants reduce chargebacks by providing real-time alerts, detailed transaction data, and collaboration with issuers. By identifying potential chargebacks early and resolving disputes before they escalate, businesses can reduce the risk of lost revenue and damage to their reputation.

Verifi Order Insight can help businesses prevent various types of fraud, including friendly fraud, by analyzing transaction data and identifying patterns and anomalies that could indicate fraudulent activity. This can help companies to detect and prevent fraud before it results in a chargeback.

This tool is also a time saver! Verifi Order Insight automates many chargeback and fraud prevention processes, saving businesses time and resources. The tool provides real-time alerts, detailed transaction data, and collaboration with issuers, reducing the need for manual chargeback management.

Overall, Verifi Order Insight can be an effective tool for businesses looking to reduce the risk of chargebacks and fraud, improve customer service, save time and resources, and increase revenue.

Chargebackhit uses Order Insight and much more. Learn how we can help safeguard your online transactions

Contact our teamThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.