Visa Compelling Evidence 3.0. Details, Pros and Cons, Impact

The Visa Compelling Evidence 3.0 or CE 3.0 initiative was enacted on April 15th, 2023. Read our comprehensive guide covering its most essential aspects, peculiarities, and benefits, and get ready to boost your business efficiency with Chargebackhit.

Over the past few years, fraud has become increasingly problematic for retailers, particularly those who accept payments online with card-not-present transactions (CNP). Between 2019 and 2021, yearly Visa CNP sales and disputes increased worldwide by nearly 50% and 30%, respectively.

Many of these disagreements may be the product of friendly fraud, also known as first-party misuse, and thus may be incorrectly labeled as fraudulent. Compelling Evidence 3.0 (CE3.0), an upcoming effort from Visa, aims to equalize the rules and chances by creating a more equitable and transparent ecosystem for merchants, issuers, and cardholders.

Credit card networks always have the final say regarding disputes over chargeback transactions. They make the chargeback rules that show which disputes are valid, and if acquirers and issuers can’t agree, they make the final decision in the dispute process between the two.

Visa introduced substantial changes in its chargeback rules that went into effect in April 2023 and significantly impacted how businesses fight invalid and friendly fraud chargebacks. What new rules were revealed in light of the recent Visa chargeback update, and how can e-commerce merchants get ready?

Table of Contents

What is Compelling Evidence 3.0?

To avoid complicated statements while describing Compelling evidence or CE 3.0, we should define it as sufficient evidence that the cardholder took part in the transaction and successfully received goods or services or both.

The release of Compelling Evidence 3.0 aims to update the rules for solving disputes submitted with the reason code 10.4 (Fraud—Card Absent Environment).

Financial institutions, banks, and credit card companies typically represent the interests of cardholders in a dispute. In this era of cardholder-friendly, no-liability policies, it is increasingly common for banks to take the side of cardholders.

Therefore, the more compelling the evidence requirements are, the better are chances for a merchant or acquirer to prove that the cardholder took part in the transaction, obtained goods or services as a result of the transaction, or benefited from the transaction.

Compelling evidence can take many forms, including but not limited to a telephone number, additional transaction data, signature receipts, confirmations of delivery, etc.

Compelling Evidence 3.0 (CE 3.0) is the most recent iteration of Visa’s requirements, which have not been officially updated since 2015. According to new Visa regulations, the following no longer qualifies as “compelling evidence”:

- Matching data elements with previously undisputed transactions

- Quantity of previous transactions without customer disputes

- The ages of prior undisputed transactions

- The dispute liability

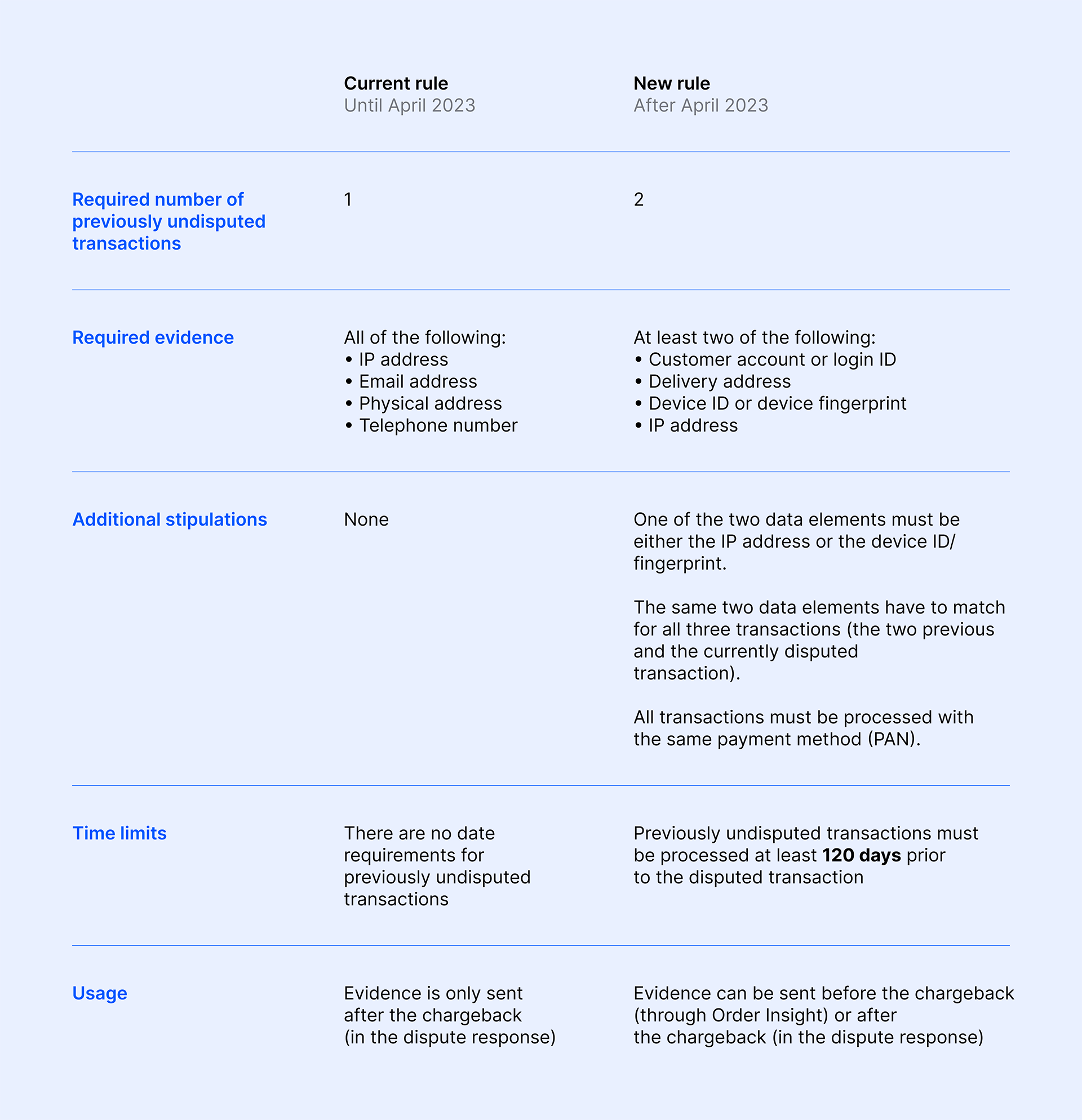

Starting in April 2023, compelling evidence also needs to include the device ID or device fingerprint or the IP address in addition to the customer account/login ID or delivery address/physical address. Two of these items must validate the disputed transaction and other previously undisputed transactions.

Subsequently, two previous transactions (undisputed) made by the customer within the past 120 days prior to the current disputed transaction are required to be considered compelling evidence. Lastly, liability shifts to the issuer under CE3.0 standards.

Compelling Evidence 3.0 Requirements for CNP Transactions

Let’s take a detailed look at the CE3.0 requirements for a card-not-present environment that stepped into the game in April 2023.

Before implementing CE3.0, compelling evidence had to include the IP address, email address, physical address, and phone number associated with the transaction. In comparison, compelling evidence for digital downloads had to include two of the following: IP address, device ID/device fingerprint, and the purchaser name and email address associated with the customer account.

Merchants only needed to supply one of the prior historical transactions of any age. In this case, dispute liability fell to the acquirer if the issuer provided a valid explanation for why the customer continues to dispute transactions.

Why are the Rules Changing?

The chargeback procedure was created by the Fair Credit Billing Act of 1974. Still, the legislation was vague on the specifics of establishing the validity of fraud disputes and deciding on resolving disputes. Visa, Mastercard, American Express, and Discover each have their own equivalent (but not identical) chargeback process; this was the responsibility of the major credit card networks.

It’s in the best interest of the card networks to resolve disputes and chargebacks in a manner that does not aggravate the merchant and issuing bank while still reassuring the customer that their card payments are secure. To accomplish this, they regularly review and update their chargeback rules based on changes in the industry, the economy, and reviews from cardholders, merchants, and other interested parties.

Merchants must stay up-to-date on all changes to card network rules. If you follow the rules, you won’t have to worry about liability shifts for fraudulent charges, costly penalty fees, or even losing your merchant account. This new update for 2023 is of particular interest to online retailers because it specifies new compelling evidence requirements to fight false fraud claims in a card-not-present environment.

How Does Visa Compelling Evidence 3.0 Work?

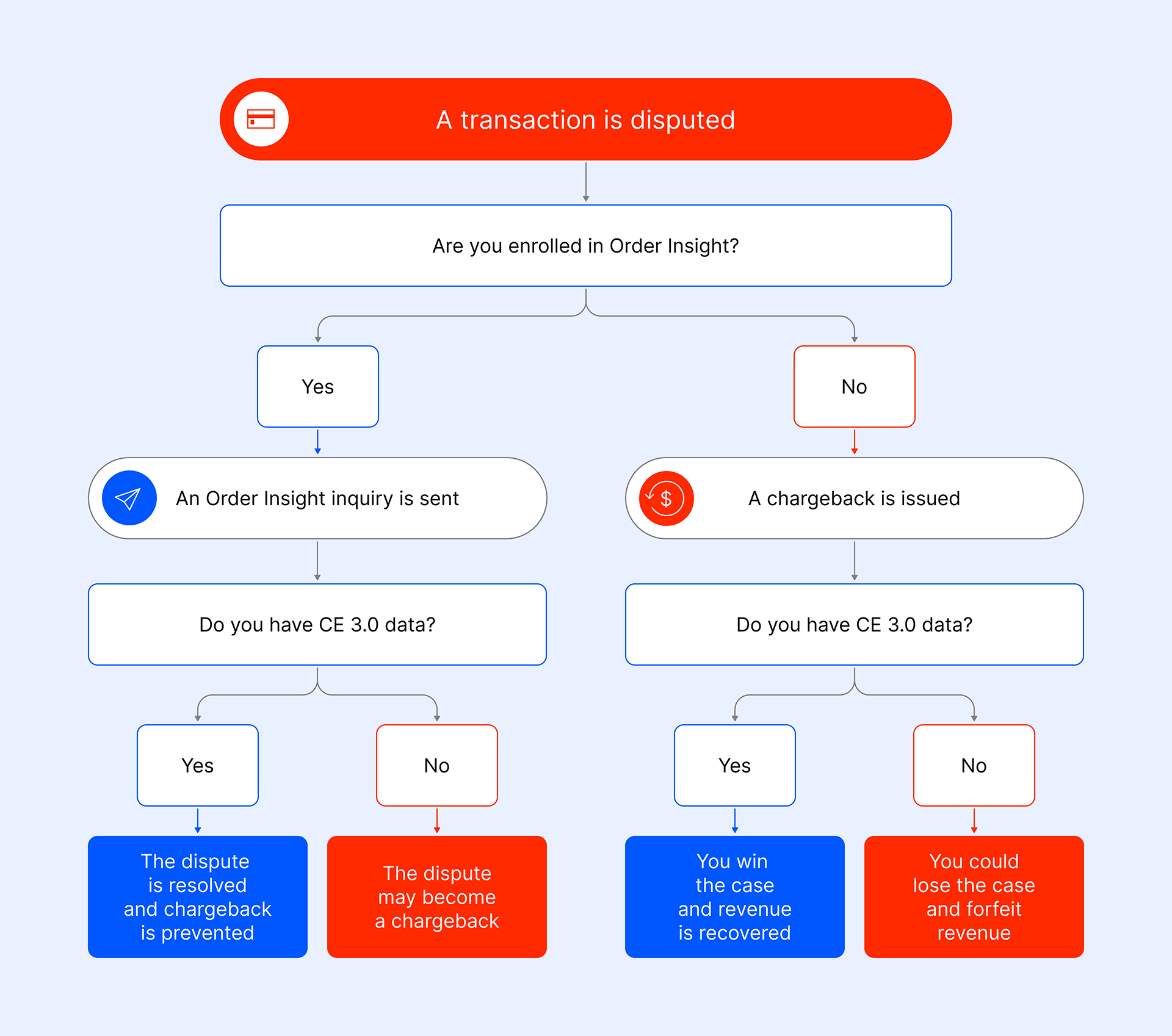

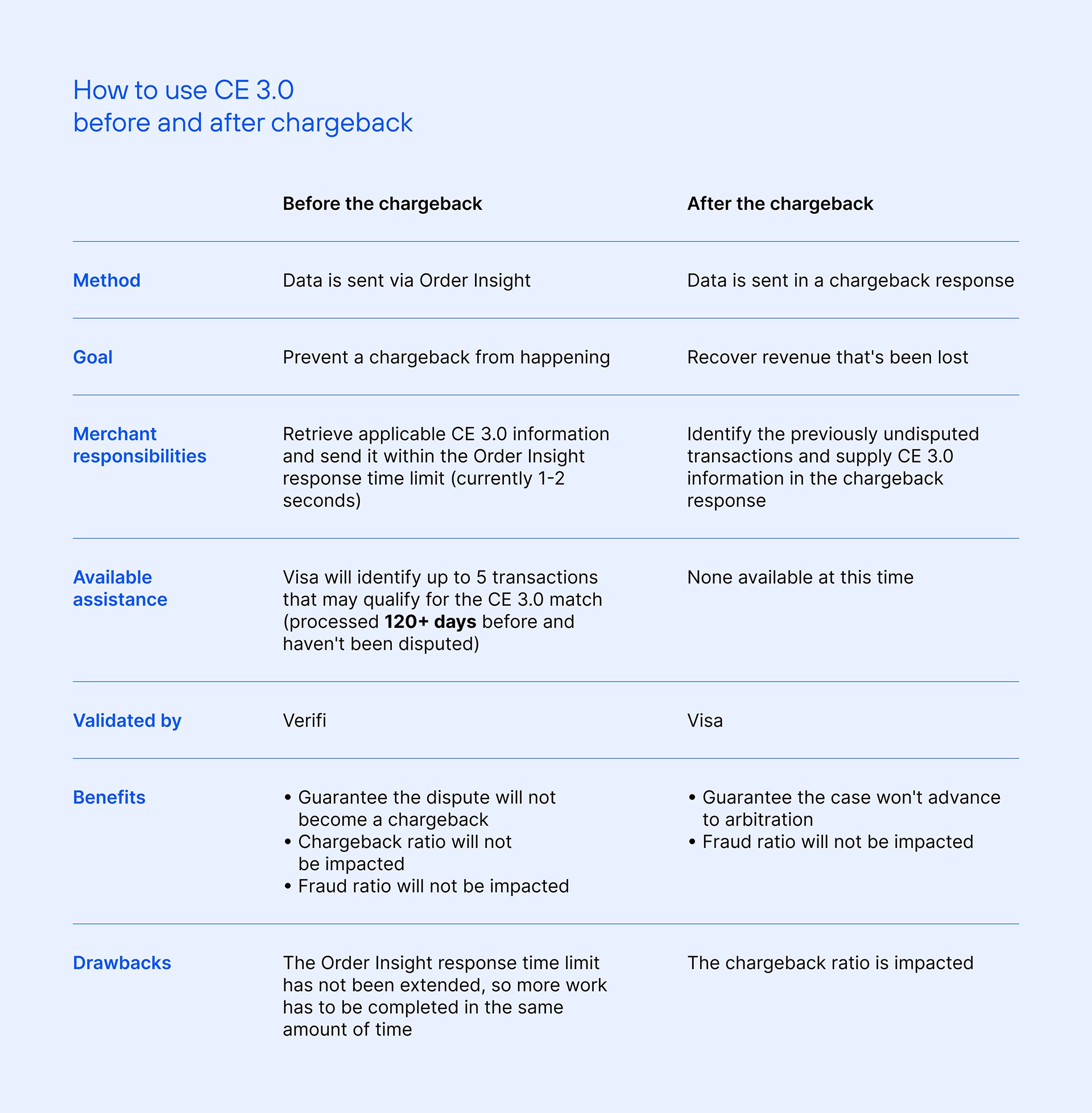

In either the pre-dispute phase, when queries come in via Order Insight, during the representment process, or the post-dispute phase, when the chargeback can be looked up in Visa Resolve Online, merchants can submit compelling evidence against fraud claims.

Up to five previously undisputed transactions older than 120 days that have never been reported as fraud will be pre-selected by Visa when a pre-dispute appears in Order Insight.

Order Insight data will examine and prevent the dispute from progressing to a chargeback if you can provide the necessary same data elements for two previously undisputed transactions of those five. Your chargeback rate or fraud ratio won’t change because the issuer will handle the cardholder’s disagreement.

Suppose the dispute has escalated to chargeback, and you want to battle it through the representment process. In that case, you and your acquirer must identify the prior transactions containing matching data elements, fill out the appropriate paperwork, and submit your data to VROL. Even if your representation is upheld, the chargeback will still register as a fraudulent activity but won’t increase your fraud ratio.

Qualification Criteria

Disputes may not always be resolved as CE3.0-protected disputes. Before announcing the specifics of this initiative, Visa gathered proof of concept data from several merchants and issuers. To define the purchasing relationship between the cardholder and the seller, all parties must work together to collect the same data from the seller and provide it to the issuer.

As a primary point, CE3.0 security only pertains to Visa disputes under 10.4 Other Fraud—Card Absent Environment. To avoid being wrongly accused of friendly fraud in disputes and pre-disputes involving reason code 10.4, merchants should require sellers to establish and provide purchase details of a pattern of prior, legitimate transaction history to help prove the cardholder participated in the transaction at issue and it should not be considered fraudulent.

- At least two transactions with the same payment method settled at least 120 days prior to the dispute date. All prior fraud claim dispute transactions are ineligible.

- Minimum two of the core data elements must match between two previous transactions and the disputed transaction, with one of the two being either an IP address or a Device ID.

Core Data Elements

- User ID

- IP Address

- Shipping Address

- Device ID

Applying CE 3.0 in Two Ways: Before and After the Chargeback

With the latest version of the Visa Compelling Evidence 3.0 tool, merchants can provide proof of two separate transactions instead of just one. These should be more than 120 days old, should not have been flagged as false claims, and should pertain to the contested transaction.

There are two goals to the CE 3.0 effort. First, it changes compelling evidence standards. The second and more crucial benefit is that it provides a novel approach to avoiding chargebacks.

Fighting invalid chargebacks has always been an option, provided you have sufficient proof. On the other hand, Visa now allows you to share compelling evidence before a chargeback is submitted.

Pre-Dispute

The possibility of stopping disputes before they are even initiated could be a significant shift for many merchants. CE 3.0 is a positive indicator for chargeback management in general, however, when viewed on a larger scale.

When a merchant can successfully prevent a dispute from being submitted, they save revenue and prevent their dispute ratios, fraud ratios, or chargeback rate from taking a hit.

Approximately two-thirds of all disputes are almost certainly occasions of friendly fraud disputes. As a direct consequence, retailers are experiencing significant revenue loss, not at the hands of criminals but at the hands of their customers.

Participating merchants can provide issuers with purchase details, which is made possible by the Order Insight solution offered by Verifi. This is done to prevent a disputed transaction from developing into a chargeback.

Post-Dispute

Following the pre-arbitration procedure currently in place, sellers have the opportunity to collaborate with their acquirer to submit transaction data elements that meet the CE3.0 qualification criteria to recover revenue lost due to fraudulent disputes that were not legitimate (Visa 10.4).

How Visa CE 3.0 Could Impact Your Business: Pros & Cons

Reduced Chargebacks: Having the option to present evidence prior to a dispute has been shown to significantly reduce the number of friendly fraud disputes and false fraud claims.

Maintaining a low chargeback rate is easier for retailers if they can prevent chargebacks from occurring. The fraud ratios should also decrease. Therefore, business owners’ exposure to long-term risk will decrease.

Representation is never simple, but the CE 3.0 rules offer retailers more tools to simplify it. To recover lost profits, merchants now have more proof at their disposal.

Sadly, there will be much stricter standards for evidence of previous transactions. Most shops will have to pay more attention to each sale’s core transaction data elements and make their transaction records more accessible and organized.

It’s also worth noting that the new rules will benefit some kinds of merchants more than others, such as those who operate on a subscription basis.

Next Steps for Merchants

Prepare Your Data

We must definitely stress this. CE 3.0 choices are useless without data elements. Visa has specified the evidence required to use the new requirements. Now is the time to locate and store the information for fast access.

Integrate Order Insight

If you aren’t already enrolled in Verify Order Insight, consider doing so. Visa suggests using Order Insight to share relevant evidence to provide a satisfactory answer to a dispute. As a result of the integration process, you can streamline and simplify the process for quicker, more cooperative solutions.

Benefit From Professional Help

What about the tool that prevents the dispute even before it appears? Chargebackhit suggests a dispute-avoidance solution that gives additional order details to issuers and customers at the initial customer inquiry.

FAQ

How does Compelling Evidence 3.0 (CE3.0) differ from CE2.0 and CE1.0?

CE3.0 is a project code name. The updated rules with CE3.0 (effective April 2023) enable the acquirer to resolve the dispute rather than providing compelling evidence that the cardholder could dispute further.

How can issuers obtain Order Insight data (file feed vs. API)?

Order Insight data can only be obtained through VROL’s transaction Inquiry, accessible via VROL’s User Interface or API.

What happens if earlier transactions are disputed or reported as fraud too late?

To help mitigate this potential problem, the undisputed transactions discovered by the system will have transaction processing dates more than 120 days after the disputed transactions; thus, the undisputed transactions will be out of time frames for a fraud dispute.

What exactly is a data package to the issuer?

The issuer will receive a data package containing two undisputed transactions, item descriptions, and the corresponding CE 3.0 data elements for the two undisputed transactions.

What is the effect on the metrics of the Visa Fraud Monitoring Program (VFMP) and Visa Acquirer Monitoring Program (VAMP)?

When a merchant uses Verifi Order Insight’s pre-dispute option to supply the necessary details, the fraud disputes are automatically closed without affecting the dispute metrics or ratios.

The fraud record (TC40) will be deleted for CE3.0 transactions before and after a dispute, but this will not affect the VFMP metrics.

PayPal

PayPal Blog

Blog