Reduce Chargebacks – Increase Revenue

It's easy when you have the right tools at hand

Let's Have a Chat

When you own an online business featuring credit card payments, it should not come as a surprise if you have to deal with chargebacks. This happens when a cardholder asks for a refund when finding an unrecognized transaction. The customer can then file a chargeback, and the bank will open an investigation to address this matter.

In this section, you will find some tips on how to reduce chargebacks in different situations. We will focus on two main aspects throughout this topic: prevention and reversal.

Table of Contents

Chargeback costs are going up, so how can you escape them? Prevention is the initial step so that these disputes don’t have such a significant impact on your revenue. Therefore, merchants should focus on managing their business practices and developing a prevention strategy to reduce chargebacks.

To know how to prevent and reduce chargebacks, you must first understand the reasons behind them. Generally, chargebacks can originate from criminal fraud, merchant error, or friendly fraud.

However, the majority are friendly frauds. In fact, according to PaymentsDive, ⅓ of consumers admitted to committing friendly fraud in 2020. And this number is expected to increase if sellers don’t take preventive actions.

It’s imperative to start preventing more chargebacks from happening. Therefore, your company must begin by evaluating its risks and implementing an anti-fraud strategy. With this approach, you lower the possibility of transaction issues.

Let’s start by outlining how a chargeback is filed:

So, how can you reduce the risk of chargebacks? First, pay attention to your chargeback ratio, as it is your primary indicator regarding these disputes. In fact, you should try to be under a 0.9% ratio so that you are not identified as a high-risk seller.

Then, it would be best if you evaluated which improvements can be made to lower your chargeback risk. Removing merchant errors is a priority, namely if they are frequent. Sellers should work on best practices and solve internal issues to avoid this kind of chargeback. In addition, merchants also need to invest in efficient fraud prevention tools to minimize e-commerce security threats.

On average, a seller has to deal with more than 200 occasions of fraud related to chargebacks and can lose more than $30,000 every month due to disputes. However, they can reduce chargebacks and their possible financial impact.

One of the first steps is understanding your level of vulnerability and looking at how much chargebacks are costing your company. When you are looking to reduce chargebacks, you should pay attention to the many variables that affect your cost of chargeback:

Ultimately, you can lose your merchant account, which is not good for your business, to put it mildly. Therefore, detecting fraud and preventing more chargebacks is vital. Your organization should invest in fraud protection, with platforms like Chargebackhit that can help access transaction data.

When receiving chargeback notifications, sellers first need to look at the reason code shared by the issuing bank and identify the chargeback trigger. They can either do it by themselves or with the help of an Intelligent Source Detection. But what information does the reason codes give sellers? Well, it will essentially let them know the chargeback cause.

There are three main chargeback causes. When unauthorized transactions occur, we are usually facing criminal fraud. On the other hand, most of the time, any business or processing problem is a merchant error. When there is no valid reason for a chargeback, we can expect to be a victim of friendly fraud, which can either be a misunderstanding or an attempt of cyber shoplifting.

For example, the Visa reason code 12.5 — Incorrect Amount is related to the difference between the authorized and transaction amounts. As 13.3 — Not as Described or Defective Merchandise/Services is about the product or service being different from what was described on the company’s website.

Fighting chargebacks is also crucial through Representment. Prevention tools will be a great help for you to gather all the evidence needed to present a complete Representment package. Also, stopping disputes before they become chargebacks is very effective. That is why resolve tools are here to make it easier for merchants to refund clients during the so-called pre-disputes, which means before a chargeback is filled.

There are many ways to reduce chargebacks, starting with eliminating criminal fraud. Fraud detection tools play a big part here. It is recommended to have tools such as:

According to LexisNexis, Geolocation is the most used prevention tool in the United States, covering 57% of retailers. Next on the list is OTP/2-Factor with 53%, closely followed by real-time fraud detection and authentication with a payment instrument.

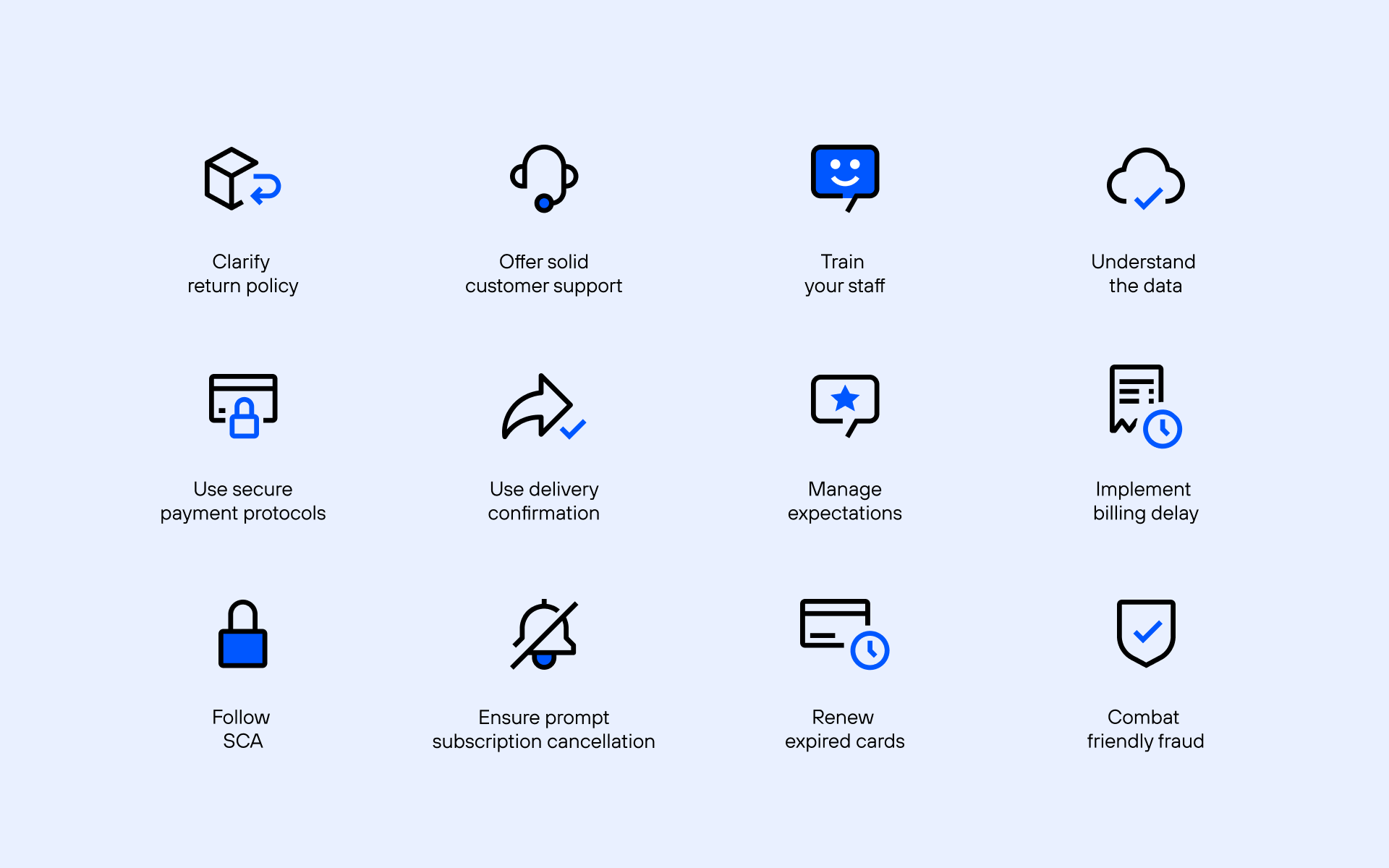

There are some other actions that you can take to reduce chargebacks. However, it is fair to say they are not going to disappear. Here are some ways to lower the number of chargebacks on your company:

In 2020, LexisNexis stated that, on average, for $1 lost to fraud, merchants have an additional cost of $2.36. This can have a significant negative impact on revenue. That is why it is essential to control credit card payments to reduce chargebacks.

In fact, online purchases usually have card-not-present payments. This can open the door to fraud, as cybercriminals only need the card details. On top of that, it is harder to identify who’s making the purchase.

Therefore, verifying the purchaser’s identity using fraud protection filters is one way to reduce credit card chargebacks. For example, you can request the cardholder’s billing address with an Address Verification Service (AVS) and confirm if it matches the address in the bank documents. Another option is to ask for the card security codes (CVV/CVC) and the bank identification number. This way, sellers can reduce the odds of a fraudulent transaction.

Online booking is more convenient for most people nowadays, so hotels are increasing their digital presence. Therefore, they can face a considerable number of chargebacks. Below, you can find some reasons for this to occur:

Refused or Delayed Refund. Buyers might directly ask your company for a refund. However, the bank will quickly validate a chargeback when you don’t give them a quick answer or take more time than stated on your Terms of Services to refund them.

Services cancellation. When a service is canceled, sellers most likely have to refund the client. Especially if they want to reduce chargebacks in hotels. Otherwise, this might be a good reason for a bank to issue a chargeback.

No high quality ensured. Every step of your buyer’s journey counts. Ensure that the service delivered corresponds to the service offered on the website, so clients don’t have to ask for a refund. And if they ask for it, try to solve it as soon as possible by providing a replacement or making the return process easy.

Overall, you not only want to reduce the risk of chargebacks by preventing them, but you also want to avoid a bad review. This can happen when clients feel that a company isn’t corresponding to their expectations and don’t give them the proper support.

You can try to overturn it, but you cannot refuse it. By presenting a representment package with the evidence, you can attempt to reverse the situation. Some evidence examples that can be used are:

Still, the specific documentation can vary if you are a physical goods, digital goods, or services merchant. In any case, it is important to share as detailed information as possible.

When dealing with friendly fraud, yes. In this situation, Chargebackhit’s Recover tool will be crucial during your representment process. It will enable the merchant to submit evidence about the transaction and prove that it is legitimate. With the evidence in hand, the issuing bank will decide whether to reverse the chargeback or not.

It’s important to remember that the cardholder’s bank is the one making the final decision. So, be aware that if the evidence doesn’t prove a valid transaction was made, chances are that your company will lose the money from the item.

Now that you know how to reduce a chargeback, it’s time to act on it. With the right tools like Chargebackhit alerts & notifications, you can efficiently avoid chargebacks. Either when you’re still in the pre-dispute phase or through representment.

Your company needs to be vigilant and work quickly to reduce chargebacks. This is why Chargebackhit offers a Prevention solution that provides details about the purchase, which can be shared with banks and cardholders to stop a chargeback. On the other hand, our Resolve solution will provide you with automatic resolutions to valid disputes before they become chargebacks. And in the case of friendly fraud, we can help you build a good representment package with our Recover solution.

It's easy when you have the right tools at hand

Let's Have a ChatThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.