Know your merchant chargeback rights

Or let us take care of protecting your business from fraud

Get a consultation

A credit card chargeback is a reversal of a credit card transaction at the cardholder’s request. This forceful retrieval occurs when the customer has been ripped off or scammed by a merchant. This feature aims to protect cardholders from unauthorized transactions or theft.

Alas, some individuals take advantage of this system, going around the merchant and contacting the bank directly. Often, it may simply be an error, a misunderstanding, or even intentional criminal fraud. This system is often used to the detriment of the merchant, so in this guide, we address the way merchants should react to illegal disputes, the merchant chargeback rights, and other essential factors to be aware of.

Table of Contents

Not all issues like this are legitimate, and it is necessary to be able to differentiate legitimate ones from fraudulent ones. It is always better to let the legitimate ones go because fighting it does not help your case or standing, but all fraudulent repayments should be fought using the “representment” process. Because when merchants contest chargebacks, they imply that the refund is not justified. Representment involves submitting valuable and convincing evidence to the customer’s issuing bank to prove the transaction’s legitimacy and overturn their claims. And this is actually one of the merchant rights.

Even if they can count on their merchant chargeback rights, some prefer to ignore the representment process, especially when the amounts are not high. However, lost revenue is not the only consequence. Chargebacks also add to your ratio. In fact, the chargeback ratio can affect the fees card companies collect from you for processing payments on your platform. We advise merchants to employ good management software to protect them from fraud and prevent consequences and lost revenue. Other than that, you should also know the merchant rights and the necessary steps and procedures to follow to help reduce the curve.

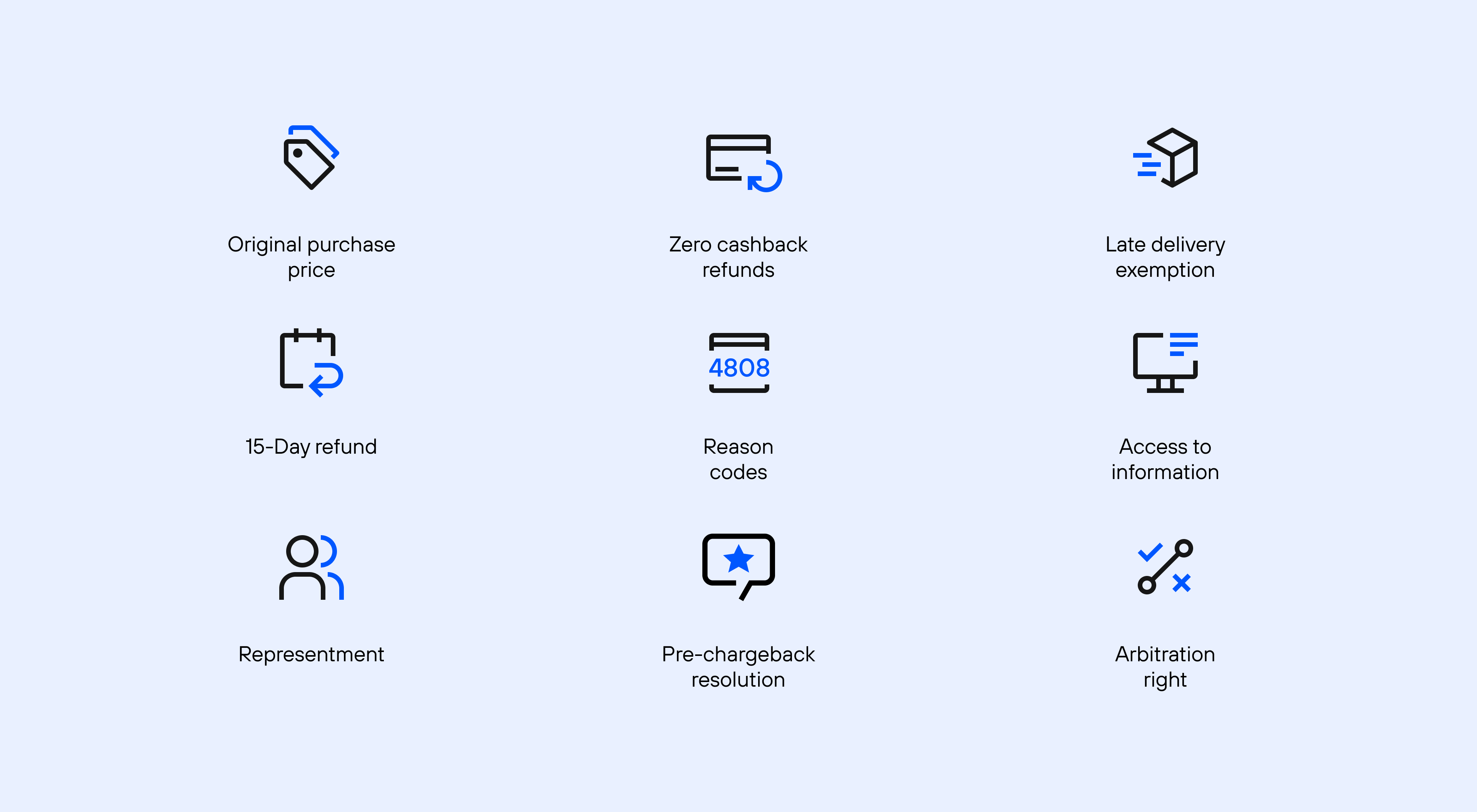

Several protection mechanisms are available to merchants in every case. Some of these include:

You must fight any illegal issues filed against you. By doing so, you get a chance to regain lost revenue. Frequent repayments make your platform an easy target for fraudsters, so fight when you can.

You need compelling evidence to win any case, so ensure you have all the necessary documents before committing time to fight. The great idea is to get experts like Chargebackhit to take over such strenuous tasks while you focus on your company.

The policy does not focus on protections for merchants. It was created with the customer in mind, so it does not offer many safety nets for sellers. The Fair Credit Billing Act says that buyers do not require your permission to lay complaints with their issuing bank and file for a chargeback. It means that a “no refund policy” or “no return policy” does not protect your company.

It is crucial to clarify your terms and conditions and keep evidence of transactions and purchases that can prove your case. By following the strict rules set by credit card companies, you can scale out of the problem without hassle.

Depending on the reason code and card provider, customers can file a dispute with their banks within 60 to 120 days of a transaction. Merchants must respond to the query within 30 to 45 days, based on the reason code and card issuer. Until the repayment is challenged and proved illegitimate, it remains legal in every way.

Customers can also file a case if they do not get a refund after returning the merch. According to the law, they must wait 15 days, and if the seller doesn’t reply within that period, you can file a dispute. The consequence for not responding within the specified timeframe is usually an extra charge from the issuer bank. This time limit favors both sides, especially the merchant, who can ensure that the goods have arrived and the refund is rushed out.

Merchants must defend their rights in the chargeback process to protect their revenue, reputation, and overall business interests. By actively participating in the process, merchants can present their case and provide evidence to challenge unjustified chargebacks. To prepare for chargeback disputes, merchants should have the following information:

By having this information readily available, merchants are better equipped to respond to chargeback disputes with compelling evidence. It helps strengthen their position, demonstrate the legitimacy of the transaction, and increase the chances of a successful defense in the chargeback process.

Unfortunately, credit card chargebacks are on the rise. And we know you want to focus on growing your business instead of worrying about theft and fraud.Leave it to us! Chargebackhit will make decisions based on your business’ transaction and user data to Prevent, Resolve, or Recover chargebacks. These are precisely the three solutions we have available to reduce your chargeback ratio.

Our Prevent solution will act on your pre-disputes to ensure that chargebacks are not filed by sharing all the details about the purchase to validate the transaction. The Resolve solution will help sellers quickly solve disputes, either automatically or based on the seller’s decision. Last but not least, our Recover solution is the one that will give all the support to build a robust repesentment package with solid evidence against abusive chargebacks.

Or let us take care of protecting your business from fraud

Get a consultationThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.