The Power And Efficiency of Mastercom Collaboration For Smooth Chargeback Prevention

Chargebacks are disliked by everyone who works in the payment industry. The card networks make an effort to reduce chargeback rates, usually by creating new rules and requirements for retailers to follow. However, with the release of Mastercom Collaboration, Mastercard is attempting a new strategy. Which exactly? Keep reading to learn more in our detailed guide from Chargebackhit experts.

Table of Contents

What is Mastercom Collaboration?

In the early stages of a chargeback, the Mastercom Collaboration tool can help merchants and their customers work out their differences. This initiative is a quick and efficient resolution that definitely eases the dispute process. The hope is that by establishing a new contact channel between merchants, issuers and acquirers, disputes can be resolved more rapidly and favorably.

In other words, Mastercard provides a “Collaboration” service to stop chargebacks. This tool prevents chargebacks that act like a warning system that notifies you whenever a transaction has been challenged.

With this advanced notification, you can investigate whether or not giving a refund to the cardholder is an appropriate response to their complaint. If that’s the case, no chargeback will occur. Mastercard developed Mastercom to help businesses react to pre-chargeback inquiries.

When cardholders question transactions because they forgot they made them and don’t recognize the information on their billing statement, this can sometimes resolve disputed transactions without turning them into a chargeback. One example is when cardholders dispute transactions because they don’t recognize the information.

How Does Mastercom Collaboration Work?

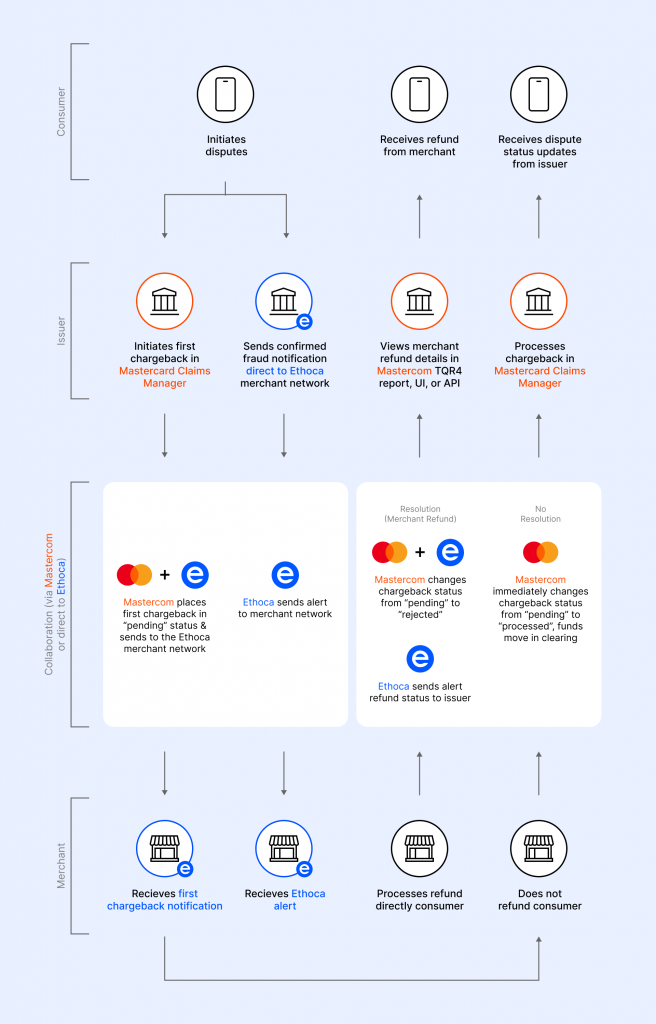

Until recently, the Mastercard Collaboration tool was inaccessible to anyone but collaborating issuers and merchants who had registered for Ethoca’s chargeback alert service. When a cardholder from an enrolled issuer starts a dispute, enrolled merchants get an alert. They have a brief window to respond to the alert by issuing a refund and removing the need for the cardholder to file a transaction dispute.

Mastercard initiated the procedure of acquiring banks into the Mastercard Collaboration process in July of 2022. Whether or not the issuing bank and the merchant are Ethoca participating issuers determines the sequence of events when a dispute arises. If so, Ethoca will forward the inquiry and handle the dispute resolution process.

If the issuer is not a member of the Ethoca merchant network, the request will go straight to the acquirer. The acquirer can either directly query the merchant for guidance or act according to the pre-set rules.

The following are some of the choices that are accessible to the retailer (through their acquirer):

- Accept the cardholder disputes and give a refund to the cardholder. Mastercard may assess additional fees for processing the dispute and any refund they issue, but this will not be considered a chargeback.

- Put the dispute down, or ignore it. A first chargeback will follow from this, which the retailer can try to get rid of through the represetment process. However, it will still be factored into the percentage of chargebacks experienced by the seller.

Request

The issuer will notify you of a disputed transaction and provide you with a chance for refunded transactions. You can receive the alert in one of two ways:

If you have signed up for Ethoca alerts, you will receive a notification about the request. You can expect to obtain it from your third-party service provider or the Ethoca portal, as usual.

Without Ethoca alerts, your acquirer will receive Collaboration requests and be notified.

What Response Options Do Acquirers & Merchants Have?

Once the request for collaboration has been accepted, a response must be provided within the subsequent 72 hours. There are a total of four distinct responses available to you.

RESPONSE CODE A: Funds Movement Request

Your refund can be managed through your account.

You are prepared to take financial responsibility for the dispute, and you would like Mastercard to manage the refund procedure.

RESPONSE CODE B: Refunded

A refund has already been issued for the transaction.

You have already admitted that there was an issue and returned the transaction before the collaboration request was even sent.

Response Code C: Start of the Refund Process

You have it in mind to reverse the transaction on your own.

You are prepared to take financial responsibility for the disputed charge and intend to issue the refund for the transaction via your customer relationship management (CRM) or order management system within the next five business days.

What are the positive outcomes of using the Mastercard Collaboration process tool?

It is most beneficial for every merchant to use the Mastercom Collaboration process in reducing chargebacks whenever it is feasible. It is possible that it would be more beneficial to battle a first chargeback in specific scenarios, such as high-value transactions in which you have a significant amount of compelling evidence that argues in your favor. However, in most cases, the only way to keep a cardholder’s dispute from becoming more serious is to satisfy the disappointed cardholder with a refund.

A prompt refund can also change a negative customer experience into a positive one. A lengthy dispute cycle is unnecessary if the customer has a valid reason for wanting a refund. If you can make them pleased, they may return as loyal customers.

How Mastercom Collaboration Could Impact Your Business

The Mastercard Collaboration tool will undoubtedly be an improvement. It strikes a better balance and offers businesses a fighting chance to shape the course of a dispute before it escalates to a chargeback.

The following are essential advantages for retail businesses:

Reduce the number of chargebacks

The ability to receive advanced notifications enables merchants to stop many chargebacks before they occur.

Streamlined diagnostics

The ability to quickly access more comprehensive data enables merchants to discover and resolve issues more quickly.

A reduction in expenses

Merchants can cancel orders before they’re fulfilled, which would save money on both the goods and the delivery.

A more positive customer experience

A quicker and more amicable resolution can help reduce the number of upset customers and negative evaluations.

Next Steps and Adviсe for Merchants

Merchants now can resolve disputes before a chargeback is issued, thanks to a recent update to Mastercom Collaboration. This aligns smoothly with the requirement of some kinds of disputes that the cardholder tries to resolve with the merchant before raising the dispute with their issuing bank.

Because of this, Chargebackhit has created a communication tool for the chargeback management dispute system that is ready to use with no additional configuration. Our Chargeback tool equips you with everything you need to swiftly navigate and coordinate the settlement of any disputes that may arise, all while saving time and effort thanks to the automation of routine tasks.

FAQ

When did Mastercom Collaboration go live?

Mastercard released an improved version of its Collaboration tool for all participants in the digital payments process in September 2022. Working together will alert you when a cardholder disputes a charge, much like an early notification system to alert merchants of a potential cyberattack. This tool helps to improve the chargeback process significantly and aids merchants in avoiding chargebacks.

Who is affected by collaboration?

The new Mastercard Collaboration update impacts all members of the payments industry. Typically, this ecosystem includes merchants, acquirers and issuers. This initiative positively influences the chargeback process and helps to resolve disputes smoothly.

How exactly?By avoiding or fighting disputes and subsequent chargebacks by sharing near real-time information early in the Mastercard dispute cycle for a quick resolution.

What does this mean for acquirers and PSPs?

Collaborative requests are treated as chargebacks if neither the acquiring bank nor the PSP responds to them within 72 hours. As a result, it is crucial for merchants and acquiring institutions to have an effective decision structure and open lines of direct relationship.

How is this different from Visa’s Rapid Dispute Resolution (RDR)?

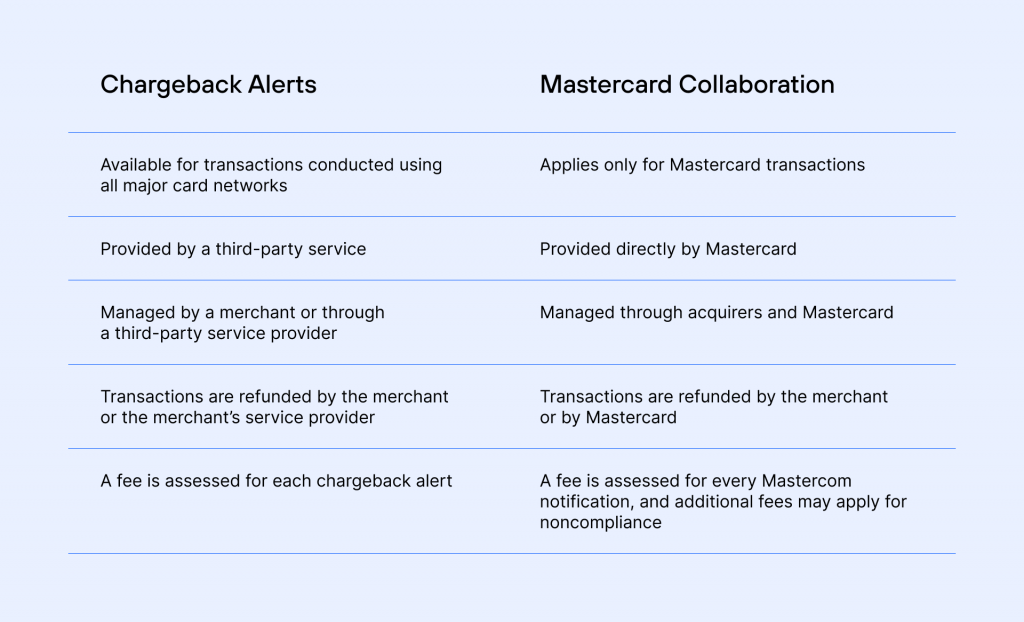

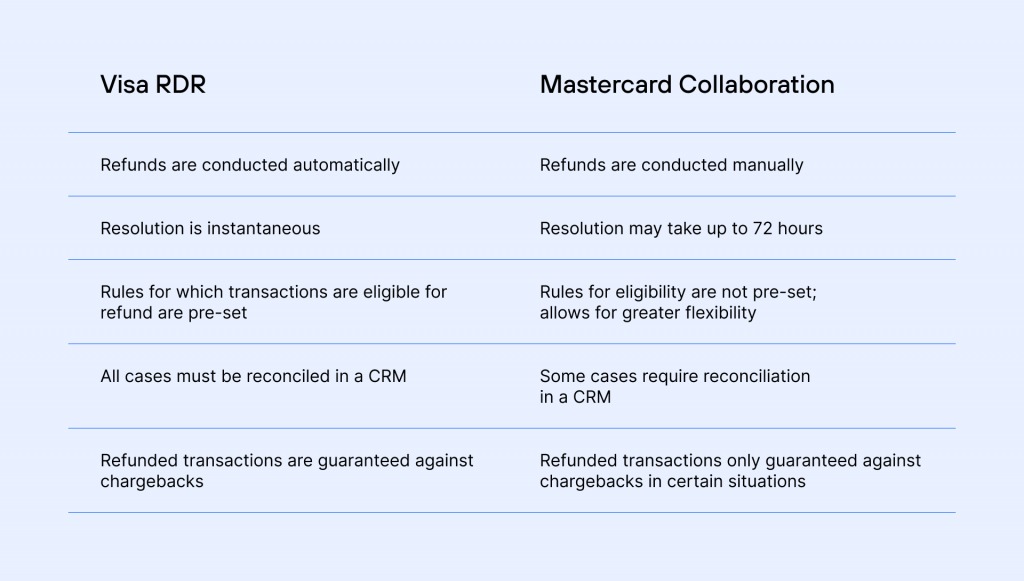

To avoid chargebacks, you can also use Rapid Dispute Resolution (RDR) as a chargeback management tool.

Several features of Collaboration and RDR for quick resolution are shared. They share characteristics unique to a given company (Collaboration for Mastercard and RDR for Visa). Also, both options are accessible to all issuers and acquirers of the card brands (as well as the retailers that work with an acquirer) because they are embedded in the card brands’ technology.

However, that is where the parallels end. The dissimilarities outweigh the similarities.

Conclusion

To avoid chargebacks, retailers can use Mastercom Collaboration as a chargeback management tool or any other available methods. Deflection tools are helpful in preventing an unmanageable chargeback ratio. However, overusing them can cause you to decrease sales revenue due to mistakes that could have been prevented with a more data-driven strategy.

By examining customer and transaction data related to these events, you can learn what situations, policies, and business practices lead to collaboration requests and other dispute-related scenarios.

That dispute resolution tool will allow you to resolve and efficiently deal with disputes. At the point they first arise, you can take specific measures to stop them from occurring again.