Pre-Arbitration Chargeback: Process & Considerations

In this article, we will delve into the concept of pre-arbitration cases, highlighting their distinctions from other forms of disputes. Additionally, we will explore strategies for achieving success in pre-arbitration cases and proactive measures to avoid their occurrence altogether.

Table of Contents

What is Pre-Arbitration Chargeback?

Pre-arbitration is a process that occurs when a cardholder disputes a charge on their credit card and the merchant disagrees. The merchant may enter a pre-arbitration process with the cardholder to resolve the dispute. During this process, the cardholder and the merchant negotiate to reach an agreement without involving a third party. If an agreement is not reached, the cardholder may file an arbitration chargeback, and the merchant may respond with a defense.

Why Do Pre-Arbitrations Occur?

Pre-arbitrations are typically not sanctioned by issuers unless cardholders can furnish additional evidence to substantiate their claims.

After a chargeback representment, issuers scrutinize evidence provided by the cardholder. In some cases, they may identify omissions or inaccuracies in the information presented by the merchant. Regardless of the reason, it usually signifies an oversight or the inadvertent exclusion of vital evidence by the merchant. Consequently, the bank initiates a chargeback pre-arbitration.

For merchants, pre-arbitration is unfavorable as it elevates their overall chargeback ratio and potentially escalates legal expenses if they choose to pursue the dispute further.

When a chargeback reaches the pre-arbitration stage, merchants are left with only two options: accept the chargeback or contest it. It’s worth emphasizing that decisions made at this stage regarding the initial chargeback are typically considered final, as arbitration represents the final step in the chargeback process. The sole exception might occur if the merchant can furnish fresh, additional evidence and is willing to pay an extra fee.

How Do Pre-Arbitration Cases Work?

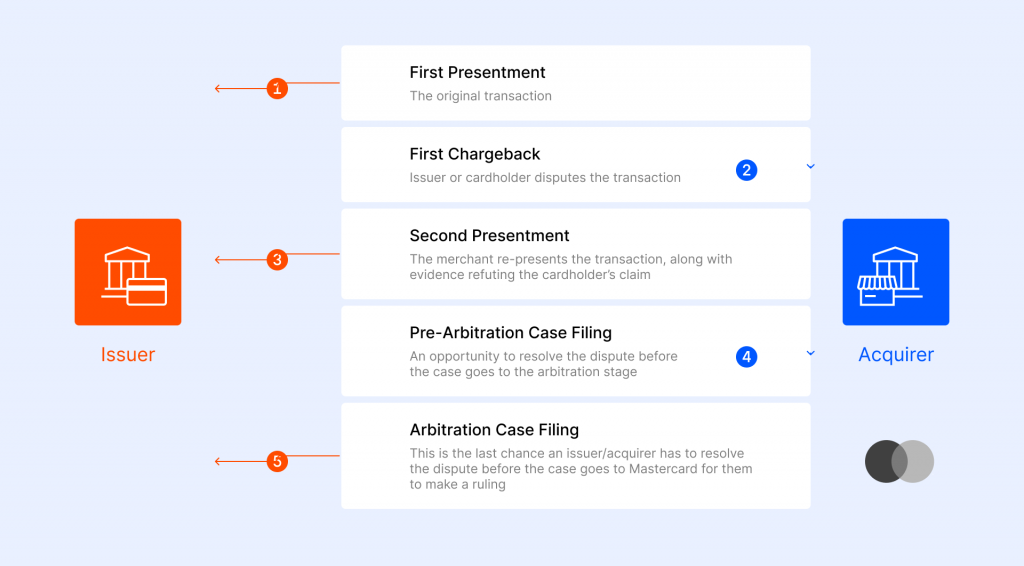

Prior to advancing to the arbitration stage, chargeback cases must progress through several preceding phases in the dispute resolution process:

- First Presentment

- First Chargeback

- Second Presentment

- Pre-Arbitration

- Arbitration

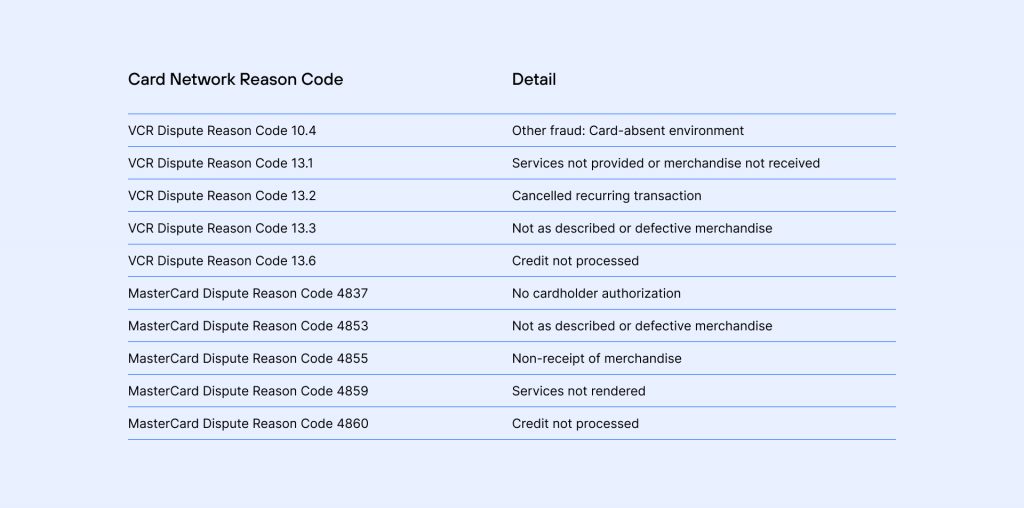

It’s important to note that different payment networks enforce distinct regulations and procedures pertaining to chargebacks. In this context, we will focus on the two largest networks: Visa and Mastercard. Each of these companies maintains stringent guidelines regarding pre-arbitration chargebacks, which are outlined below.

Pre-Arbitration Chargebacks with VISA

Visa allow cardholders to file pre-arbitration chargebacks if the merchant and cardholder cannot reach an agreement. Pre-arbitration chargebacks must be filed within 120 days of the transaction and accompanied by the customer’s written statement of the dispute. The merchant can then respond with a defense, and if the dispute is not resolved, the customer may choose to file an arbitration chargeback.

Pre-Arbitration Chargebacks with Mastercard

Mastercard also allow cardholders to file pre-arbitration chargebacks. The cardholder must file the pre-arbitration chargeback within 120 days of the transaction. Frankly speaking, Mastercard doesn’t have the step of ‘Pre-Arbitration Chargeback.’ By Mastercard’s terminology, this step calls the ‘second presentment.’ And it is the last step before the Arbitration.

Pre-Arbitration Dispute Reasons

Is It Possible to Win Pre-Arbitrations for Merchants?

Securing victory in a chargeback case doesn’t necessarily mark the end of the road. In nearly all cases, a dispute resolved in favor of the merchant through representment can escalate to pre-arbitration.

While having this option might appear reasonable, the reality is that merchants seldom prevail in a second dispute resolved via arbitration. One primary reason is that card networks typically opt for the most expedient solution, as previously mentioned.

Moreover, issuers typically initiate pre-arbitration because they possess new evidence to bolster their case. Merchants, on the other hand, often have no additional evidence to provide, having likely exhausted all available resources during the initial chargeback dispute.

Taking cases to arbitration is also financially disadvantageous. Additional fees, which can amount to thousands of dollars, are involved, not to mention the significant investment of time and resources.

Winning a pre-arbitration dispute is not unattainable, but unless the transaction involves a substantial dollar value, it may not justify the effort.

It’s crucial to understand that triumphing in a pre-arbitration does not guarantee success in the subsequent arbitration if the cardholder chooses to escalate. For merchants, mounting a comprehensive defense in response to pre-arbitrations is essential to enhance their chances of success.

How to Prevent Pre-Arbitration?

Representment and pre-arbitration constitute resource-intensive and time-consuming procedures for merchants, with relatively low chances of success in second or pre-arbitration chargebacks.

Navigating this intricate process involves dealing with multiple stakeholders and navigating ever-changing regulations, which can be overwhelming for merchants.

A more proactive approach is to prevent pre-arbitration scenarios from arising altogether. The key lies in decisively winning chargeback disputes during the initial representment phase while implementing strategies to reduce chargebacks in the long term.

Chargebackhit boasts a reputation built on experience, offering tailored chargeback management solutions. We assist merchants throughout every stage of the chargeback process, allowing them to refocus on business growth and sustainability.

Pre-Arbitration Chargeback FAQ

What is a Pre-Arbitration Chargeback?

A pre-arbitration chargeback, or second chargeback, occurs when a cardholder disputes a transaction a second time, usually due to new information or dissatisfaction with the initial chargeback outcome, often resulting from unresolved disputes or insufficient evidence.

What is the Process for Handling a Pre-Arbitration Chargeback?

When a pre-arbitration chargeback happens, merchants face two choices: accept it, incurring a financial loss and potential harm to their chargeback ratio, or contest it with additional evidence. Contesting involves submitting evidence to the card network for review, but winning is often difficult, and the outcome is usually final.

How Can Merchants Reduce the Risk of Pre-Arbitration Chargebacks?

To reduce pre-arbitration chargeback risks and maintain sound payment practices, merchants should enhance customer service, maintain thorough transaction records, employ effective fraud prevention, clarify refund policies, and consider partnering with chargeback management services for dispute resolution.

PayPal

PayPal Blog

Blog