Don't Let Chargebacks Get the Best of You

Start winning chargeback disputes with us today and keep your revenue flowing

Get personalized tips

There is no guarantee of winning a chargeback with 100% certainty. The outcome of a chargeback dispute depends on several factors, including the reason for the chargeback, the policies of the issuing bank and the acquiring bank, and the evidence provided by both the merchant and the cardholder. However, there are steps you can take to increase your chances of winning a chargeback dispute.

Table of Contents

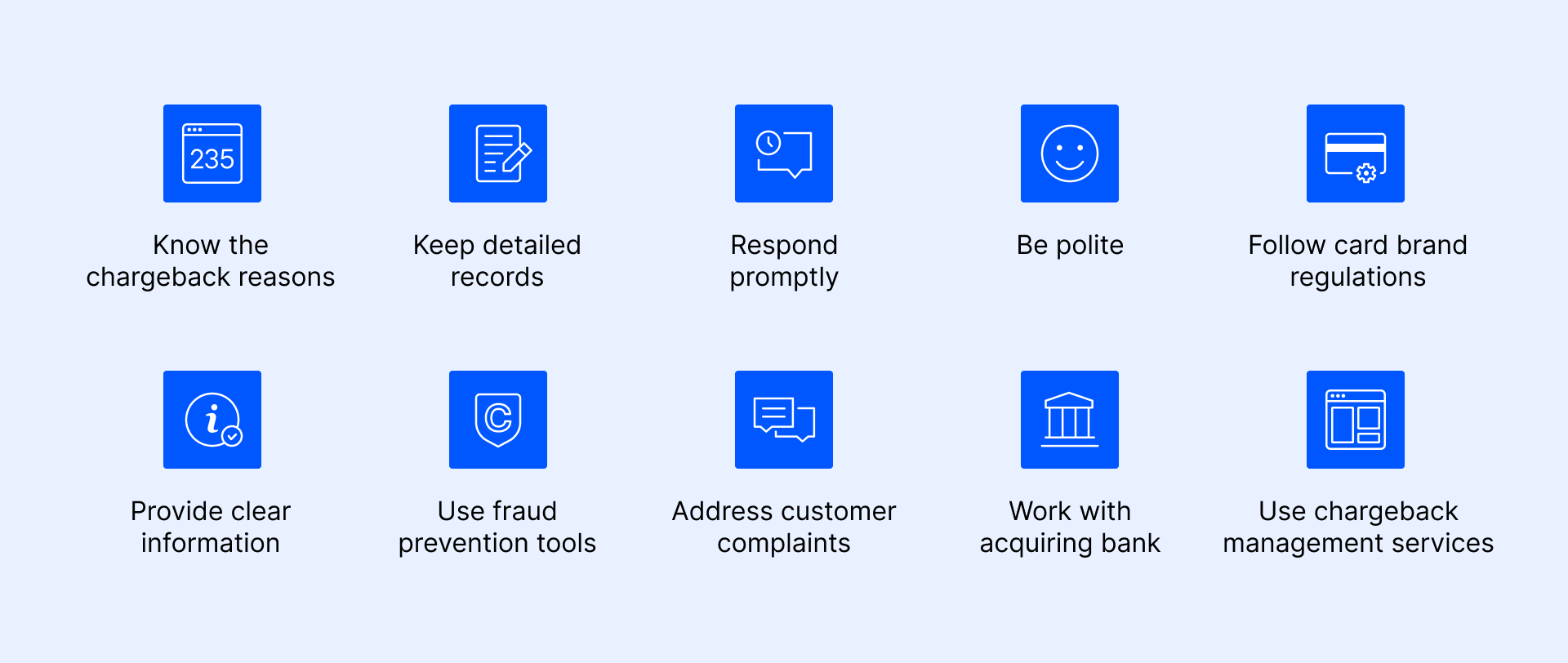

To win a chargeback as a seller, you must be proactive and take the necessary steps to dispute the chargeback. Here are some quick tips to help you win a chargeback:

Understanding why chargebacks occur can help you avoid them in the first place. Common causes include unauthorized transactions, processing errors, disputes over goods or services received, and fraud. For instance, if a customer claims that they never received their order, you can show proof of delivery to refute their claim. In other cases, a customer may claim that the product they received was different from the description. In this case, it’s important to have a clear product description and detailed images to show that the product was as advertised.

To dispute a chargeback, you need to provide evidence to support your case. This can include order details, delivery confirmation, tracking information, or communication with the customer. Be sure to gather as much evidence as possible to strengthen your case. Keeping accurate records of all transactions, including receipts, invoices, and any other relevant documentation, can help you prove that a transaction was valid and authorized.

You have a limited amount of time to respond to a chargeback, so it’s important to act quickly. Failing to respond within the allotted time can result in an automatic loss of the dispute. Be sure to provide all the necessary documentation and evidence when responding to the dispute. Also, make sure to provide clear and concise information. Responding to the chargeback request as soon as possible and providing all the evidence you have to support your case can increase your chances of winning the dispute.

Being professional and courteous in your interactions with the cardholder and their issuing bank can help to build a good relationship and increase your chances of a successful outcome. It’s also essential to stay calm and professional when disputing a chargeback. Emotional or unprofessional responses can hurt your chances of winning the dispute. Stick to the facts and provide concise information, avoiding unnecessary details to support your case.

Making sure that your business practices comply with the rules set by the card brands (Visa, Mastercard, etc.) can help to avoid chargebacks and demonstrate that you are a responsible merchant.

Ensuring that your billing descriptors and transaction details are clear and accurate can help cardholders easily identify the charges on their statement and reduce the likelihood of disputes. Chargebackhit uses Ethoca Consumer Clarity, Verifi Order Insight, and other tools to eliminate billing confusion and cases of friendly fraud.

Implementing fraud prevention tools, such as address verification, CVV verification, and 3-D Secure can help to reduce the risk of fraud-related chargebacks.

Responding quickly and effectively to customer complaints can help resolve disputes before they escalate into chargebacks.

Your acquiring bank can provide valuable support and advice on avoiding chargebacks and winning disputes. Building a good relationship with your acquiring bank can benefit your business.

Using a chargeback management tool like Chargebackhit can help you automate the dispute process, reducing the amount of time and effort required to dispute chargebacks. Additionally, chargeback management tools can provide valuable insights into chargeback trends, allowing you to identify patterns and take steps to prevent chargebacks from happening in the future.

In conclusion, chargebacks can be a frustrating and time-consuming experience for online sellers. However, by understanding the reason for the chargeback, gathering evidence, responding promptly, being professional and concise, and using a chargeback management tool, you can increase your chances of winning a chargeback dispute. It’s important to take proactive steps to prevent chargebacks from occurring in the first place, such as improving customer service and product quality.

Start winning chargeback disputes with us today and keep your revenue flowing

Get personalized tipsThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.