How Do Ethoca Alerts Fight Fraud and Stop Chargebacks?

Are you willing to know an efficient, cost-saving way to protect your business from chargebacks and false declines? Here come the Chargebackhit Ethoca alerts, a chargeback management tool on guard for your online business.

A unified all-in-one solution aimed to prevent chargebacks and customer dispute losses before they become your headache. No more separate tools for verification and alert unification. If you want to learn more about the key to preventing fraud and customer dispute, put aside doubts and continue reading our guide.

Table of Contents

What is a Chargeback Prevention Alert?

Before we approach the pros of Ethoca alerts, let’s explore the definition of a chargeback prevention alert. Services known as chargeback prevention alerts warn merchants when a cardholder files a dispute over one of their transactions.

This tool boosts the merchant issuer collaboration and enables the merchant to intervene and directly resolve the issue with the customer, thereby preventing a chargeback and false declines. This significantly reduces the number of fraud and customer disputes.

How Do Alerts Help Prevent Chargebacks?

Let’s take a closer look at the chargeback issuing process. For instance, the cardholder complains to the bank about a fraudulent account charge. Then, the issuing bank takes action toward chargeback and transaction cancellation, which creates a poor cardholder experience.

Being a part of the chargeback alert system allows the bank to warn the alert provider before the final stage. Then, the alert provider notifies the merchant in return. If the transaction still needs to be fulfilled, the merchant can cancel it and offer a refund option to the cardholder, eliminating the need for a chargeback.

N.B. A refund is a more beneficial option for merchants than a chargeback as it doesn’t include any chargeback fees. After all, it excludes the possibility of merchant account termination and doesn’t spoil account history details.

What Are Ethoca Alerts?

Ethoca is a Toronto-based technology solution provider focused on eCommerce fraud chargeback prevention, chargeback, and false declines avoidance, along with lost income recovery from costly fraud claims. Since being founded in 2005, the main Ethoca customers are eCommerce merchants and issuer network partners.

Ethoca alerts allow your online business to try and resolve the dispute directly with the customer. As a result, the Ethoca collaboration network significantly boosts the trustworthiness and relationships with issuing banks.

Along with that, Ethoca alerts help to avoid penalties, fines, and fees. All in all, this experience leads to consumer clarity improvement and improves the poor cardholder experience.

How Do Ethoca Alerts Work?

Ethoca Alerts is a collaborative tool that enables merchants, acquirers, and issuers to share fraud and dispute data, minimizing or even eliminating their negative influence on your online business. This efficient and cost-saving tool allows a much faster dispute resolution process and excludes the necessity for chargebacks.

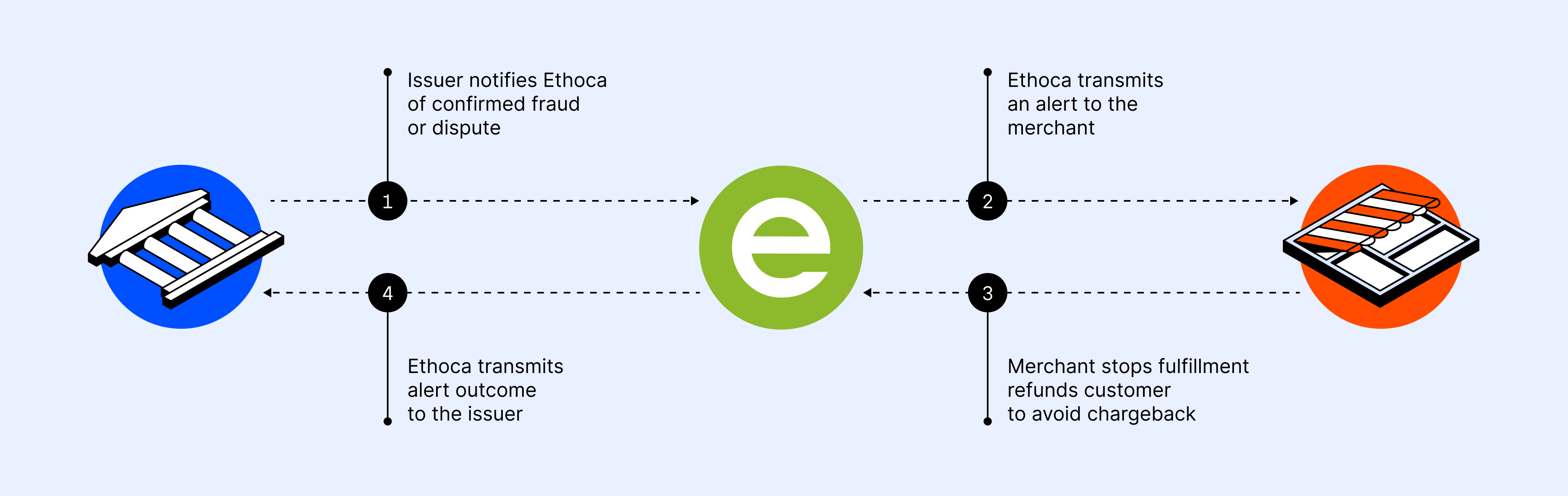

Verified card fraud incidents from Ethoca network card issuer customers are quickly sent to retailers, allowing both to minimize their fraud and chargeback costs dramatically. So what are the working principles of Ethoca alerts? Here is the typical process that will improve an order and account history.

- Ethoca gets a notification from the issuer of a confirmed cardholder dispute or fraud.

- Ethoca sends near real-time alerts to the merchant right away.

- Merchants may stop a transaction fulfillment and suggest a refund to the customer. This might help to avoid, prevent or interfere the fraud and customer dispute. Fraudsters are not allowed!

- Ethoca sends an instant alert outcome to the issuer. Merchant and issuer liable losses are recovered by the card issuers on first contact with the cardholder.

Ethoca Alerts for Merchants

Businesses with a validated fraud alert can suspend fraudulent order fulfillment and give a refund to the customer. As a result, a merchant can resolve the dispute, reduce inventory loss, and save time, money, and nerves on the chargeback process. Then, using data directly from the issuer will help to update fraud rules and avoid future fraud cases.

In case of receiving an alert, the merchant undertakes four steps:

- Suspend the service or cancel the order.

- Use link analysis trying to uncover more fraudulent transactions.

- Revise and update fraud policies to prevent future fraud.

- Issue a refund or credit to the consumer (without any need for a chargeback)

Ethoca Alerts for Issuers

eCommerce fraud has an immediate negative impact on your issuing company. Processing chargebacks and operating costs rise while you’ll keep taking losses on low-value and 3-D Secure transactions. Quite importantly, increased fraud results in higher decline rates.

Customers suffer as a result of lower acceptance and interchange income. These reasons are enough to undertake necessary actions to stop losing opportunities immediately. Aren’t they?

By joining Ethoca’s network, you enable merchants to act rapidly on confirmed fraud intelligence, providing you with demonstrated and instant benefits.

All you need is to transmit confirmed fraud evidence to Ethoca while Ethoca Network delivers it to the merchant network partners as near real-time alerts. It’s that simple!

The sooner you submit your proven fraud data, the sooner merchants can take action to halt fraud, refund transactions, and reduce chargebacks. This increases acceptance while decreasing the cost of your issuing business.

What does It Take to Start?

Begin forwarding confirmed fraud transactions to Ethoca. The sooner you provide them with your fraud data, the sooner online businesses on the Ethoca Network will be able to prevent the scam with Ethoca chargeback alerts.

You’ll know you may avoid processing the chargeback in the following cases. As soon as merchants acknowledge they have stopped fulfilling the fraudulent order.

Or in case of reimbursing the transaction using the Ethoca Portal. Ethoca will engage with you to maximize your performance and continuously improve your fraud loss prevention outcomes.

Ethoca Chargeback Alerts Benefits

What are the benefits of using Ethoca alerts for your online business? Protect your revenue income with Ethoca chargeback alerts fighting chargebacks while saving relationships with your bank. At the same time, among other privileges from using chargeback alerts are:

- To avoid false alarms, all chargeback warnings are linked to an existing chargeback. This eliminates the possibility of the network flagging transactions by mistake.

- Real-Time Loss Prevention: Avoid additional billings and order fulfillment losses by terminating rebills following an initial chargeback notification.

- More Efficient Staff Allocation: Remove part of the load of chargeback management from your staff and allow them to concentrate their efforts on building your business.

- Fraud and customer disputes are resolved fast and efficiently

The essential advantage of chargeback prevention alerts is that they allow merchants to handle customer complaints in a direct way that does not classify as a chargeback in the card networks and acquiring banks’ perspective.

Why don’t you take a look at some numbers 2022 Chargeback Field Report?

- Over the last three years, 65% of retailers reported a rise in friendly fraud.

- Card networks develop new tools to help customers resolve complaints before they become claims and dispute cases.

- Buy Now and Pay Later programs have a 29% increase since the economy gets out of the post-Covid age.

The following figures mean the rise in demand for all-in-one solutions for customer dispute losses prevention and a way to reduce fraud.

Chargebackhit Meets Ethoca Alerts

Chargebackhit gives your business an option to use the Ethoca chargeback alerts efficiently. Reduce fraud and chargeback without any additional effort.

Eliminate the necessity to handle all the issues related to the Ethoca registration and entrust us with this while focusing on what makes your online business grow.

Chargebackhit is your reliable and trustworthy way to reduce fraud. An efficient all-in-one solution for fraud and chargeback costs optimization and chargeback problems related to business needs. Prevent and resolve fraud and chargebacks easily with Chargebackhit!

Conclusion

Ethoca chargeback alerts offer merchants an excellent, cost-saving solution for managing disputes and friendly fraud while lowering chargeback rates.

Nevertheless, it does not address the underlying reason for chargebacks. You can undertake a few basic steps to gradually lower the likelihood of chargebacks:

- Give a detailed explanation of the items and services.

- Make customer service accessible.

- Respond to client communications as soon as possible.

- Before any transactions are completed, establish clear and detailed terms of service.

- Address internal issues like fulfillment, descriptions, or quality assurance shortcomings as soon as possible to avoid chargebacks.

Any other ways to boost your business and reduce fraud and customer dispute with Ethoca alerts? Surely, there is a much shorter way – delegating all your chargeback-related tasks to Chargebackhit, a top-notch customer dispute resolution tool for your business.

FAQ

How many fraud and chargebacks can be prevented by Ethoca alerts?

What data elements are included in an Ethoca Alert?

Every Ethoca Alert includes the following details: Credit Card Number, Authorization Date/Time, Transaction Amount, and Merchant Descriptor.

How are they sent?

Via Portal – Ethoca sends an email to the merchant once a new Ethoca Alert becomes available. To access the portal, the merchant clicks a link in the email message and enters their login and password. Once on the portal, the merchant can view and act on any Ethoca Alerts. Also, Ethoca includes a web service API that may be used to ingest and act on Ethoca Alerts automatically.

What action does the merchant take when they receive an Ethoca Alert?

Just refund the transaction right away and point the outcome in the Ethoca portal (or API) with the “Stopped” comment field set to “Refunded on date/time.”

How many fraud and chargebacks can be prevented by Ethoca alerts?

Few aspects that impact: The greater the number of transactions, the higher the coverage. Customers in the United States are more likely to be served by the collaboration network than those in other countries. Established firms may have better coverage than new merchants.

How much do Ethoca alerts cost?

Ethoca alerts’ preventative cost depends largely on the number of notifications you receive. On average, the cost of each alert received runs between $35 and $40.

How long does it take to set up Ethoca alerts?

Average time for new merchants: 45 – 60 days. Existing merchants that set up alerts: 20 – 30 days. Existing merchants switching alert providers: without delay.