Maximize Your Chargeback Reversal Win Rate

Contact our team to get an expert consultation and assistance

Contact us

Did you know that, according to the Midigator’s The Year in Chargebacks report, an average merchant can lose from 2 to 7% of its annual revenue due to chargebacks? If you operate on the Internet and provide goods and services to your customers, you must be familiar with the process of chargeback reversal.

Chargeback management is not the best part of the payment industry for none of the businesses. It causes both time and revenue losses in charges for reversed payments and expenses for resources allowing to fight and prevent chargebacks most efficiently.

At the same time, knowledge of how to argue chargebacks can help merchants improve the customer journey of their clients and optimize all the internal processes related to payments.

This article will help you understand what the chargeback reversal process represents and which tips and tricks you should apply to save money and nerves.

Table of Contents

A chargeback reversal is when an issuer marks the chargeback as invalid as a result of investigating and reviewing the compelling evidence. Chargeback reversal means that the funds of the disputed payment would be returned to the merchant’s balance.

To reach the chargeback reversal stage, you have to be ready to prove that the dispute filed by the customer is either ineligible or does not correspond to reality.

There are two ways to react to the chargeback: you can accept it, and then funds would be returned to the customer, or you can represent the original transaction to the client (this process is also called “representment.”)

Chargeback reversal is vital for businesses as it allows them to recover lost revenue, reduce chargebacks in the long run, defend their reputation, and ensure their persistence and growth. Let’s explore these aspects of chargeback reversal a little more closely:

As mentioned previously, managing chargebacks is an integral part of doing business for all Internet companies. Chargebacks can have a massive negative impact on the P&L of the company and lead to non-financial losses. Chargeback reversal allows companies to avoid four crucial things:

Ignoring chargebacks can lead your company to more significant expenses than your income. Accepting chargeback means you would be charged three times: losing the transaction amount itself, paying the chargeback commission, and losing goods or services you have already provided to the client (especially for merchants who sell physical goods).

In the payments chain, all participants are aware of each other’s actions. This means that acquirers, card schemes, and issuing banks know whether merchants initiate representment.

If the merchant provides compelling evidence for 100% of invalid chargebacks, the issuer would more likely believe it’s the client’s fault, not the merchant’s. As a result, the issuing bank can decline the customer’s request whenever they initiate a chargeback against respectable merchants.

The behavior of the fraudulent users shows that they are likely to file multiple chargebacks at the same time. By reacting to chargeback, the merchant sends a message to customers that it collects enough information to prove that the chargeback was invalid. It means that fraudulent users would not treat this merchant as the one who always accepts chargebacks and would not file disputes against it in the future.

Bearing in mind that card schemes track the number of chargebacks and their ratio to sales is an essential part of chargeback management.

If a merchant’s chargeback ratio reaches limits for several months in a row, some fines could be applied, which can also lead to the suspension of the account.

Successfully represented chargebacks are counted into monitoring programs of schemes, but it can help merchants to decrease the ratio from a long-term perspective.

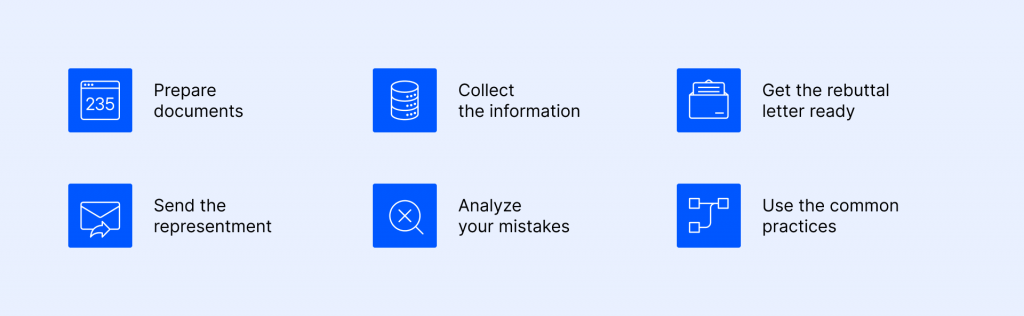

Chargeback reversal is the primary purpose of representment. To succeed, merchants must be aware of the process and provide the most accurate proofs possible for invalid chargebacks. Here are some tips to get ready to fight disputes:

There are four main types of chargebacks: Merchandise/Service not provided, Fraud, Duplicate processing/Paid by other means, and Canceled recurring transaction.

There are similar reasons for all card schemes, whether it’s Visa, Mastercard, AMEX, or Discover. The proofs the issuing bank would pay attention to depend on why the chargeback was initiated.

For instance, chargebacks with fraudulent reasons have to be fighted with the evidence which confirms that the real user has initiated the purchase and that this user is an actual cardholder.

For Merchandise/Service not provided chargebacks, it’s better to provide copies of checks or bills of lading – proofs that the customer has received goods.

When you know which data is needed, you can organize the processes to collect it. For example, the user’s personal information (like email, first name, last name, city of residence, etc.) must be provided during the registration. Also, it is great to have device information, user action logs, and timestamps to add to compelling evidence.

A rebuttal letter is the document you would include all your evidence in. This one has to be formal and as specific as possible. It’s essential to confirm your arguments with visual evidence, so when you state that a user is a real person and the card was not stolen, attach screenshots/copies of something that supports this statement.

Whenever your rebuttal letter is ready, it’s time to submit the evidence. Do that as soon as possible; you shouldn’t wait until the deadline. Some payment providers/acquirers allow sending the evidence via API, which enables merchants to automate this process – this helps merchants save resources and gives more time for preparing other documents.

In case your representment was successful, take a moment to mark the types of evidence which have been sent. That experience can be helpful for further reversals. Moreover, you can also analyze the success rate depending on the issuer and then decide whether to send compelling evidence.

Last but not least, several payment service providers and acquirers provide an auto-representment which is general practice in the payments industry. Auto-representment is when fighting specific types of disputes (fraud chargebacks for which there was a liability shift, chargebacks for already refunded transactions, chargebacks sent outside the timeframe allowed by the schemes) is handled on the PSP/acquirer side.

Now you know everything to start fighting chargebacks, but this process requires day-to-day improvements to reach maximum efficiency. The more you experiment, the more expertise you will gain.

Remember that the chargeback representment process is complex, and it usually requires a lot of resources. But if you manage to automate it, you will save a lot of money and time. And the Chargebackhit team is here to help you with that.

Contact our team to get an expert consultation and assistance

Contact usThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.