Everything You Need to Know About Authorization Holds

When used correctly authorization holds can improve your business’ cash flow, improve your inventory management and reduce chargebacks. In this concise guide, we will help you understand how credit authorizations impact your business and identify strategies you can use for seamless transactions.

Table of Contents

What Is an Authorization Hold?

An authorization hold, also known as a pre-authorization or card authorization, is a temporary hold placed on funds in a bank account or credit card limit. It is used by sellers to verify a payment method and ensure that sufficient funds or credit are available to cover a transaction.

When a customer makes a purchase or engages in a transaction, the merchant sends a request to the payment processor or bank to verify if the customer’s account or card has the necessary funds or credit. The payment processor or bank places an authorization hold on the specified amount, effectively “reserving” those funds for the merchant.

During the authorization hold period, which can range from a few hours to several days, the funds are temporarily unavailable to the customer for other purchases or withdrawals. However, the actual charge or transfer of funds does not occur until the merchant captures the payment, typically when the goods are shipped, or the service is provided.

Authorization holds are commonly encountered in various scenarios, including hotel bookings, rental car reservations, online purchases, and restaurant tabs. For example, when reserving a hotel room, the hotel may place an authorization hold for the expected cost of the stay to ensure the guest has the necessary funds. Similarly, when renting a car, the rental company may place an authorization hold to cover any potential damages or additional charges.

The authorized amount may differ from the final transaction amount. In some cases, such as restaurants or gas stations, an additional amount may be temporarily authorized to account for potential tips or variable charges. The final charge, which replaces the authorization hold, reflects the actual amount of the transaction.

Why Should You Use Authorization Holds?

Authorization holds are a powerful tool for merchants, providing numerous benefits that contribute to the smooth operation and financial security of their businesses. Temporary authorization helps protect merchants, guarantees payment, and improves inventory and resource management.

Protecting Merchants

Authorization holds help mitigate the risk of fraudulent transactions. By verifying the validity of a customer’s payment method and ensuring sufficient funds or credit, merchants can detect potentially fraudulent activities before completing a transaction. This reduces the chances of accepting payments from stolen cards or unauthorized users, protecting the merchant from financial losses.

Authorization holds also act as effective chargeback prevention. Chargebacks occur when customers dispute transactions and request a refund directly from their bank or credit card issuer. Authorization holds help prevent chargebacks by confirming that the customer’s payment method is valid and has adequate funds. By securing authorization before completing the transaction, merchants can provide evidence of customer consent and reduce the likelihood of chargebacks caused by claims of unauthorized or fraudulent transactions.

Guaranteeing Payment

Thanks to a temporary authorization, the merchant verifies the availability of funds or credit on a customer’s payment method before completing a transaction. These funds are then taken from the buyer and, once the transaction is complete, automatically released to the merchant, ensuring payment. Authorization holds also generate customer commitment. By obtaining authorization, the merchant confirms that the customer has explicitly authorized the transaction and intends to make the purchase. This commitment from the customer reduces the likelihood of non-payment or cancellations.

By implementing authorization holds, merchants can have confidence in receiving payment for their products or services. These holds act as a financial guarantee, verifying the availability of funds, confirming customer commitment, and securing payment before completing the transaction. This helps protect the merchant’s revenue, cash flow, and overall business stability.

Managing Inventory

Authorization holds help merchants manage inventory by reserving products for customers who have initiated a purchase. Here are examples of how authorization holds assist in inventory management:

- Online Retail: When a customer places an order, the merchant can use an authorization hold to reserve the items in their shopping cart. This ensures that the inventory is allocated to the customer, reducing the risk of overselling and ensuring the availability of products.

- Hotel Bookings: Hotels often place authorization holds on customers’ credit cards to secure their reservation. By doing so, the hotel ensures that rooms are reserved for confirmed guests, preventing overbooking and managing room availability.

- Ticket Sales: Event organizers or ticketing platforms may use authorization holds to reserve tickets for customers during the purchasing process. This guarantees that the tickets are set aside for the customer while they complete the transaction, preventing others from purchasing the same seats.

- Vehicle Rentals: Car rental companies commonly place authorization holds on customers’ credit cards to secure the rental. This helps manage the availability of vehicles and ensures that a reserved car is available to the customer at the specified pick-up time.

In these examples, authorization holds allow merchants to allocate inventory or resources based on confirmed customer intent. By reserving items during the authorization hold period, merchants can better manage their inventory, prevent over-commitment, and ensure a smoother customer experience.

Managing Resources

Authorization holds help merchants manage resources effectively by temporarily reserving funds or credit for specific transactions. Here are examples of how authorization holds assist in resource management:

- Service-Based Businesses: Service providers, such as contractors or consultants, may place authorization holds on clients’ payment methods before commencing work. This ensures that the necessary resources, such as labor or equipment, are allocated to the client’s project, preventing overbooking and enabling efficient resource utilization.

- Event Planning: Event organizers often require upfront deposits or authorization holds to secure venues, equipment rentals, or catering services. These holds guarantee the availability of resources and allow the organizer to plan and allocate resources accordingly.

- Subscription-Based Services: Companies offering subscription-based services, such as streaming platforms or membership sites, may utilize authorization holds to verify payment methods and ensure resources, such as bandwidth or server capacity, are allocated to active subscribers.

- Online Marketplaces: E-commerce platforms may place authorization holds on sellers’ funds to cover potential returns or disputes. This helps manage resources by ensuring that sufficient funds are available to process refunds or resolve any issues that may arise during the transaction process.

By utilizing authorization holds, merchants can effectively manage resources, allocate them to specific transactions or customers, and prevent overcommitment or resource shortages. This enables streamlined operations, optimized resource utilization, and improved overall efficiency in delivering products or services.

Understanding the Process of Credit Card Authorization Holds and Releases

The process of credit card authorization holds and releases involves several steps to verify and secure funds for a transaction. Here’s a breakdown of the process:

- Authorization Request: When a customer makes a purchase using a credit card, the merchant initiates an authorization request. The request is sent to the acquiring bank or payment processor to verify the card’s validity and the availability of funds.

- Hold Placement: Upon receiving the authorization request, the acquiring bank or payment processor places a temporary hold on the customer’s available credit or funds. The held amount is typically equal to the total transaction value or an estimated amount based on the merchant’s request.

- Funds Reservation: The held amount is reserved for the merchant, reducing the customer’s available credit limit or temporarily freezing the corresponding funds in their bank account. This ensures that the funds are set aside for the transaction and unavailable for other purchases.

- Transaction Completion: After the authorization hold is in place, the merchant proceeds to fulfill the transaction by delivering the goods or services to the customer.

- Capture or Settlement: Once the transaction is completed, the merchant captures or settles the authorized funds. This process converts the authorization hold into an actual charge, and the funds are transferred from the customer’s account to the merchant’s account.

- Hold Release: If the transaction is canceled, refunded, or not completed within a specified timeframe, the authorization hold is released. The held funds become available again to the customer, and the hold is removed from their credit card or bank account.

- Hold Expiration: In some cases, if a hold is not captured or released within a certain timeframe, it may expire automatically. The held funds are then released back to the customer, restoring their credit limit or making the funds available in their bank account.

How long does credit card payment take to process? An authorization hold can be implemented instantly, and then once the merchant completes the transaction, they will receive the funds on the same or the following day.

The Impact of Authorization Holds on Credit Card Limits and Available Balances

Temporary authorization holds have an impact on credit card limits and available balances as they temporarily reduce the available credit or freeze a portion of the funds on the card.

When an authorization hold is placed on a credit card, the held amount is deducted from the available credit limit. For example, if a $100 authorization hold is placed, the available credit will be reduced by $100 until the hold is released or expires.

The funds corresponding to the authorization hold are temporarily frozen or set aside from the available balance on the credit card. This means that the customer cannot use those funds for other purchases or transactions until the hold is released or expires.

Authorization holds can limit the customer’s purchasing power since the held amount is deducted from their available balance or credit limit. It’s important to consider the potential impact of authorization holds when planning for other purchases or managing credit card usage.

Once the authorized transaction is completed, and the merchant captures the funds, or if the hold expires due to time limits, the held amount is released. This increases the available credit and restores the funds to the available balance on the credit card.

How Can Authorization Holds Help Prevent Chargebacks?

Authorization holds play a crucial role in preventing chargebacks by providing an additional layer of protection for merchants. Here’s how authorization holds help in this regard:

- Validating funds: Authorization holds verify the availability of funds or credit on a customer’s payment method before completing a transaction. This helps ensure that the customer has the necessary resources to cover the purchase, reducing the likelihood of chargebacks due to insufficient funds.

- Reducing fraud risk: By placing an authorization hold, merchants can confirm that the payment method used by the customer is legitimate and not associated with fraudulent activity. This helps prevent unauthorized transactions and lowers the risk of chargebacks resulting from fraudulent purchases.

- Confirming customer intent: Authorization holds require customers to explicitly authorize the transaction by providing their payment details. This confirms their intention to make the purchase, making it more difficult for customers to dispute the charge later as unauthorized or fraudulent.

- Reserving inventory or services: When an authorization hold is placed, it ensures that the necessary inventory or services are set aside for the customer who has initiated the purchase. This helps prevent chargebacks caused by customers claiming non-receipt of goods or services that were actually available to them.

While a preauthorization charge contributes to chargeback prevention, it’s important for merchants to follow best practices to maximize their effectiveness. This includes providing clear product or service descriptions, accurate pricing information, and maintaining open lines of communication with customers to address any concerns or issues promptly.

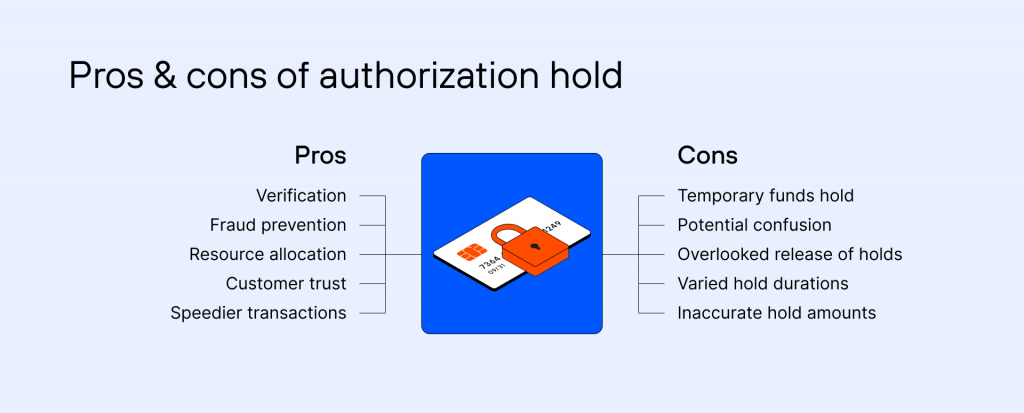

Pros and Cons of an Authorization Hold

Here are the key pros and cons of an authorization hold!

Pros of Authorization Holds:

- Verification: Authorization allows merchants to verify the validity of a payment method and ensure sufficient funds or credit are available before completing a transaction.

- Fraud prevention: By placing an authorization hold, merchants can mitigate the risk of fraudulent transactions and reduce the likelihood of chargebacks.

- Resource allocation: Authorization holds help merchants manage inventory and allocate resources, ensuring that goods or services are available for customers who have committed to a purchase.

- Customer trust: Customers often feel more secure knowing that their payment method has been authorized, leading to increased confidence in the transaction and the merchant.

- Speedier transactions: Once an authorization hold is placed, the subsequent payment capture can be processed quickly, reducing checkout time and improving the overall customer experience.

Cons of Authorization Holds:

- Temporary funds hold: Authorization holds can tie up funds in a customer’s account or credit limit for a certain period, limiting their availability for other purchases or transactions.

- Potential for confusion: Customers may be unaware of authorization holds and may mistakenly assume that the held amount has been charged, leading to confusion or frustration.

- Overlooked release of holds: Sometimes, authorization holds are not released promptly by the issuing bank or payment processor, causing delays in funds becoming available again to the customer.

- Varied hold durations: The duration of authorization holds can vary depending on the merchant, payment processor, and type of transaction, making it difficult for customers to predict when funds will be released.

- Inaccurate hold amounts: Occasionally, authorization holds may be placed for higher amounts than the actual transaction, causing temporary discrepancies between the held amount and the final charge.

Merchants should communicate clearly with customers about the hold process, its duration, and any potential discrepancies to ensure a transparent and satisfactory experience for all parties involved.

Tips for Merchants to Properly Use and Manage Credit Card Authorization Holds

Here are some tips for merchants on how to use and implement credit card authorization holds effectively:

- Understand Payment Processor Policies: Familiarize yourself with the policies and guidelines of your payment processor regarding authorization holds. Different processors may have specific requirements, timeframes, and procedures for placing and releasing holds.

- Set Clear Policies: Establish clear policies regarding authorization holds and communicate them to your customers. Inform them about the temporary nature of holds, the specific circumstances in which holds may be placed, and the expected duration of the holds.

- Obtain Explicit Customer Consent: Ensure that customers are aware and provide explicit consent for authorization holds during the checkout process. This can be done through prominent disclosures or checkboxes that customers must acknowledge before completing the transaction.

- Specify Hold Amounts: Clearly define the amount to be authorized as a hold, ensuring it accurately reflects the anticipated transaction value. Over- or under-authorization may lead to customer dissatisfaction or issues during the settlement process.

- Monitor Hold Expiration: Keep track of the expiration dates and time limits associated with authorization holds. Release holds promptly when transactions are canceled, not completed, or if holds expire to avoid inconveniencing customers or tying up their funds unnecessarily.

- Provide Clear Information to Customers: Clearly communicate with customers about the hold process, including the reason for the hold, the expected duration, and any potential impact on their available funds or credit limits. Transparency and proactive communication help maintain trust and customer satisfaction.

- Train Staff on Hold Procedures: Ensure that your staff is well-informed about authorization hold procedures, their purpose, and how to address customer inquiries or concerns. This enables your team to provide accurate and helpful information to customers.

- Regularly Review and Adjust Policies: Continuously review your authorization hold policies and procedures to ensure they align with industry best practices and evolving payment regulations. Make necessary adjustments to improve the customer experience and mitigate any potential issues.

Implementing credit card authorization holds effectively can help merchants streamline transactions, reduce fraud risk, and ensure a smoother payment process. By following these tips, merchants can maximize the benefits of authorization holds while providing a positive customer experience.

Everything Else About Authorization Holds: FAQ

How to remove hold on debit card?

To remove a hold on a debit card, contact your bank or financial institution. Provide them with the necessary information, such as the hold amount and transaction details. They will review the hold and, if appropriate, release it, making the funds available again on your debit card.

What is a pre-authorization charge?

A pre-authorization charge, also known as a pre-auth or hold, is a temporary hold placed on funds in a customer’s account to verify the validity of a payment method. It confirms that the customer has sufficient funds or credit available before completing a transaction, but it is not an actual charge and will be released or converted into a charge later.

How does a hold on funds work?

A hold on funds, also known as an authorization hold, temporarily sets aside a specific amount in a customer’s account. It verifies the availability of funds or credit for a transaction but does not result in an actual charge. The hold ensures the funds are reserved for the merchant until the transaction is completed or the hold is released.

Who can put a hold on your bank account?

Typically, authorized entities such as banks, financial institutions, and government agencies can place a hold on a bank account. This can occur in situations like legal judgments, tax debts, or suspected fraudulent activities. However, the specific rules and procedures can vary depending on jurisdiction and the nature of the hold.

How do I release an authorization hold?

To release an authorization hold, contact your bank or payment processor and provide them with the necessary details, including the hold amount and transaction information. They will review the request and release the hold, making the funds available again to the customer.