Chargeback Fees Seem Inescapable

But "seem" is the key word here. Check out our tools designed to protect your revenue.

Contact us

A chargeback fee is a changeable amount a bank charges for each dispute. The seller always pays for it regardless of its origin: merchant errors, criminal or friendly fraud. This should not be underestimated because it can significantly impact your business revenue. So, how can sellers manage this fee? In this article, we will outline the chargeback fees implications. We will also explain how they can be avoided with chargeback prevention.

Table of Contents

Firstly, it’s essential to understand the definition of a chargeback. So, it’s a dispute for reimbursement of a specific amount previously deducted from the cardholder’s account. If a claim is valid, there’s not much a merchant can do. The best option is to accept it. However, if an illegitimate claim is in place, sellers can try to recover their money through representment and prove it was a valid transaction.

In both cases, the merchant must pay the bank a fee to cover the associated dispute costs. That is what we call a chargeback fee. The amount of it depends on the bank. Unfortunately, business owners are not always aware of chargeback fees when starting their enterprise and do not understand their actual costs.

With eCommerce at the center of transactions, friendly fraud has become more recurrent. According to the Paypers, over 60% of U.S. and 44% of British shoppers have filed chargebacks in the past 12 months. Friendly fraud accounts for up to two-thirds of all credit card fraud, costing the industry over $132 billion annually.

Friendly fraud happens when a non-valid dispute about a transaction between a client and a merchant is started. It’s harder to prevent because either a misunderstanding or malicious intent can cause it. However, merchants can fight them through representment if they have the evidence to prove that a legitimate transaction had occurred. The only issue here is that a fee will always be charged, which is terrible news for the merchant’s income.

Criminal fraud chargebacks occur when a customer initiates a chargeback as a result of fraudulent activity committed by a criminal. In this scenario, the criminal may have gained unauthorized access to the customer’s payment information or engaged in fraudulent transactions using stolen credentials. The customer, unaware of the fraudulent activity, disputes the charges with their credit card issuer or bank.

Criminal fraud makes up over 80% of chargebacks and can have significant implications for businesses, as they not only result in financial losses but also pose challenges in terms of proving the legitimacy of the transaction. The burden of proof often falls on the business to demonstrate that the transaction was valid and authorized. If fraud is discovered, the merchant needs to refund the sale, must pay a chargeback fee, and can be cut off from their payment processor if substantial or frequent fraud occurs.

Merchant error chargebacks occur when customers initiate chargebacks due to errors or mistakes made by the merchant during a transaction. These errors can range from incorrect billing amounts, duplicate charges, shipment issues, product or service quality concerns, or other issues resulting from the merchant’s actions or oversights. Merchant errors can have the following Implications for businesses:

Chargeback fees are expenses incurred by businesses in response to chargeback disputes initiated by customers. These fees are typically imposed by payment processors or acquiring banks to cover the costs associated with managing and resolving chargebacks. The following are common chargeback fees that businesses may encounter:

To understand where the chargeback fees come from, we need to outline the steps of how a chargeback happens:

According to LexisNexis, every dollar ends up in a $2.36 additional fee and other related purchase costs. A chargeback fee is usually not less than $20 and can reach $100. Therefore, it can eliminate your profit and mean an increase in costs.

If your company faces many disputes, it will have even higher chargeback fees, damaging revenue even more. The fee may be determined by a series of factors, such as chargeback history and the type of products or services. For example, if you use Shopify, the regular chargeback fee is $15, but with PayPal, it will be $20.

The chargeback fee allows the acquiring bank to pay for its allocated time and resources. But the fee is not a fixed cost and can be different for each bank. Besides that, the chargeback fee amount will also be affected by the business’s risk level. If the risk is significant, the fee can also be higher. This means sellers need to be cautious about their chargeback ratio.

In addition, most banks will not likely want to work with you if you’re a high-risk seller. Those who accept working with such a merchant will have to impose a higher fee for extra safety. Furthermore, if the risk is too high from a card network’s perspective, sellers may have to enroll in a chargeback monitoring program, such as the Visa Dispute Monitoring Plan (VDMP). You can pay up to $50 for each chargeback in this program and, in some cases, an additional $25000 monthly review fee.

Sellers must focus on finding solutions to reduce disputes first. In fact, according to IS, 44% of merchants are ready to put their efforts into fraud detection improvement. For that, some actions can be taken, such as:

Preventing fraud is vital to reducing disputes. Sellers can implement 3-D Secure technology and tools like geolocation, card security codes, and address verification services. In fact, according to FIS, 82% of merchants use 3-D Secure for a better customer experience.

The best way to handle chargebacks is before they become disputes. Chargeback alerts play a big part here because they can let you know whenever a client wants to dispute a transaction. The problem is solved with no additional charges if the client gets a refund in advance.

Focus on business best practices to reduce your chargeback fees. This means simple refund policies, excellent customer service, clear billing descriptors, accurate product descriptions, etc.

A merchant should ensure straightforward shipping, cancellation, and return policies. Transparency is critical when dealing with customer satisfaction. Go into detail about every option they have if they want to return the item bought. It should be easy to access the policies through the seller’s website. This way, clients will not find solving their issues hard and will not need to ask for a chargeback.

High-quality customer service is more than shipping and returns policies. In fact, it has to be available to clients during the whole buying process. Besides, cardholders should have easy access to the merchant’s contacts on the website. Customer service must be efficient and promptly get back to anyone needing assistance. Do not hesitate to credit the amount of a valid refund request to avoid disputes and fees.

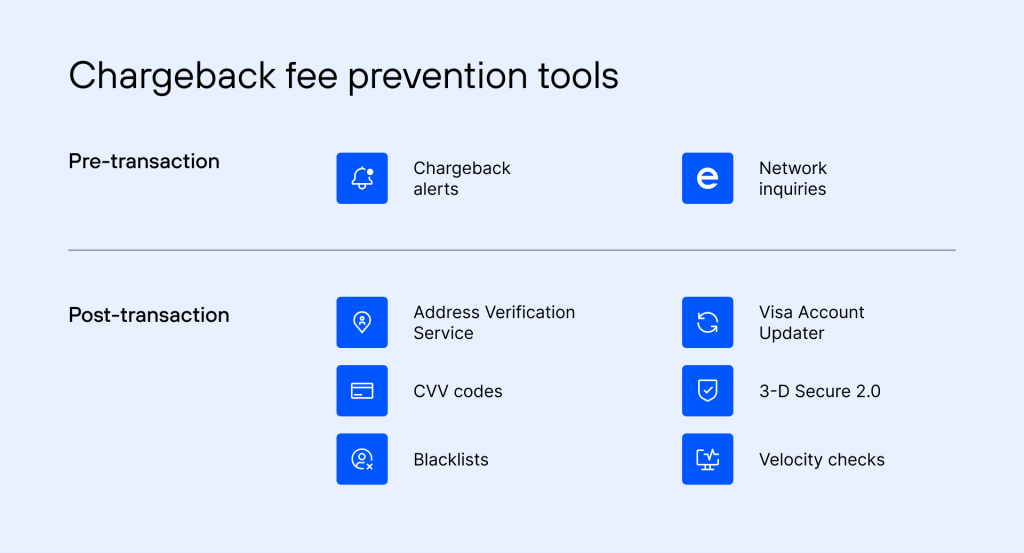

Numerous chargeback fees can be avoided with the right tool on the seller’s side. So, in what tools should sellers invest? We can divide them into pre- and post-transaction chargeback prevention and source detection tools.

Pre-transaction tools help detect and prevent fraud. In this case, we have two categories:

Post-transaction acts on existing disputes to manage potential chargebacks and stop them from increasing the chargeback ratio. Here, we outlined such tools:

No, because they exist to cover banks’ costs in a dispute between a cardholder and a company. When a chargeback is filed, sellers will have to cover a fee. Even if the chargeback is reversed, fees still must be paid because the bank has already processed the costs. It means that even when merchants fight through representment and win the case, they will recover the money from the sales, not the amount paid for the fees. However, if you can avoid a dispute by refunding the client before the dispute takes place, you will have no associated fees.

Apart from many other downsides of the chargeback process, sellers also need to worry about chargeback fees affecting their revenue stream. Therefore, preventing fraud and chargebacks in general is on top of the list to reduce disputes, automatically decreasing merchants’ expenses. With fewer disputes, fewer and lower fees must be covered. Chargebackhit provides a chargeback prevention service to lower the risk of chargebacks against your company. Our Prevent tool will help you deal with possible disputes before they turn into chargebacks, using accurate transaction data and protecting your business from revenue loss.

But "seem" is the key word here. Check out our tools designed to protect your revenue.

Contact usThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.