Visa Acquirer Monitoring Program (VAMP): What Online Merchants Need to Know

Visa is making some important changes to its monitoring programs that will affect how merchants in the European region manage fraud and disputes. Here’s the lowdown.

TL;DR: From April 1, 2025, Visa will be retiring the Visa Dispute Monitoring Program (VDMP) and the Visa Fraud Monitoring Program (VFMP), and replacing them with the new Visa Acquirer Monitoring Program (VAMP). With this update, VAMP introduces a new fraud metric and its thresholds, which will roll out in two phases.

Table of Contents

What is the Visa Acquirer Monitoring Program (VAMP)?

The Visa Acquirer Monitoring Program (VAMP) identifies entities with high chargeback rates and takes corrective action to reduce these rates. Its purpose is to reduce risk and enforce compliance among acquirers and merchants by monitoring their chargeback rates.

The VAMP evaluates acquirers using specific thresholds and metrics, imposing fines and increased scrutiny on those exceeding acceptable levels.

Revised Visa Acquirer Monitoring Program: What’s Changing for European Merchants?

After April 1, 2025, Visa will retire VDMP and VFMP and combine them into one enhanced VAMP program with a single metric that counts both fraud and non-fraud disputes together. This change affects merchants operating in the Visa Europe region.

VAMP will incorporate new criteria centered on confirmed enumerated transactions.

Enumerated transactions are the transactions that have passed Visa’s security check. They are monitored and confirmed through sophisticated tools such as the Visa Account Attack Intelligence (VAAI) Score system. This method is highly effective at minimizing false positives and catch real fraud, making the system more secure and reliable for both merchants and customers.

These transactions are identified and verified by the Visa Account Attack Intelligence (VAAI) Score system instead of ROC-blocked transactions. Moreover, VAMP will shift from non-compliance assessment-based enforcement to risk-based enforcement, which offers more flexibility and ability to cater to different risk appetites.

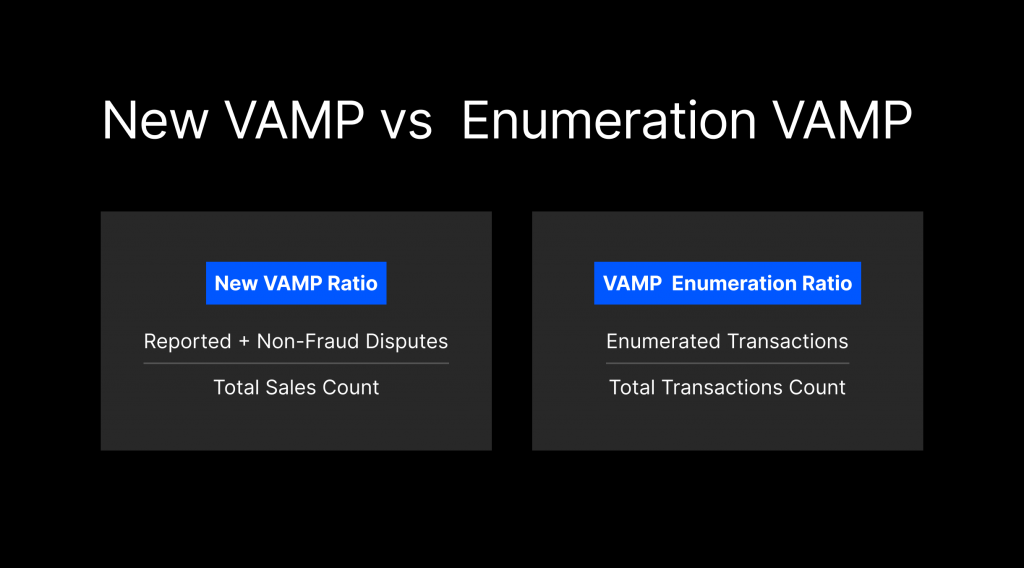

Here’s how the new criteria are calculated:

Every month Visa will review acquirers and their merchants. This includes a deep dive into non-fraud disputes in card not present transactions, fraud incidents and enumeration performance. The card network will use the total sales from the previous month as the basis for the performance review.

Visa’s main goal is to join efforts with acquirers to maintain a secure payment environment. As part of this partnership a Visa representative may reach out to acquirers to discuss the results, provide a remediation plan and address any questions. Plus Visa offers a performance dashboard in OneERS so clients can see what’s driving their performance.

Criteria and Threshold Changes

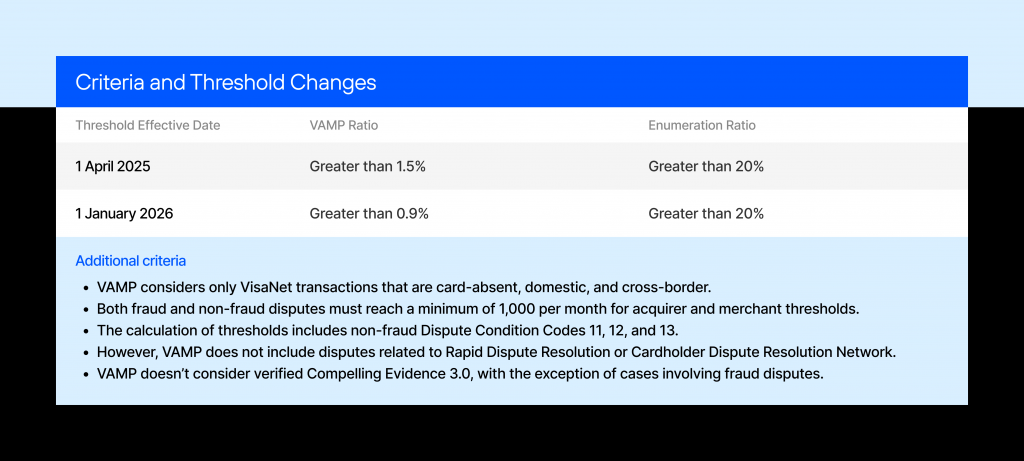

Starting April 1, 2025, VAMP will exclude Rapid Dispute Resolution (RDR), Cardholder Dispute Resolution Network (CDRN), and confirmed Compelling Evidence 3.0 (CE3.0) from its threshold calculations.

This change means that, after the new rules take effect, using RDR, CDRN, and CE3.0 will not only help you resolve disputes but also reduce fraud.

As a result, the thresholds for the new Visa monitoring metric in Europe will become stricter, changing in two iterations:

If you’re flagged for the first time within a 12-month period, you’ll get a three-month grace period to get your practices in order without penalties. Post-grace period, enforcement fees will apply to each dispute (fraud and non-fraud) for merchants exceeding specified thresholds.

What does the VAMP update mean in practice?

Overall, this update is great news for merchants who already use RDR, CDRN, and C.E 3.0 as a part of their chargeback management and fraud prevention service. Excluding these tools from the threshold calculations will allow merchants to use them as a silver bullet to reduce fraud and chargebacks and comply with stricter monitoring rules and fraud limits.

To stay in the green, implement strong monitoring, chargeback management, and antifraud strategies:

1. Sign up for Prevent alerts: if your MIDs are leveraging Prevent alerts, you can reduce fraud & dispute ratios by up to 90%;

2. Have clear refund, cancellation, and subscription policies: having clear and transparent terms of service can save you from numerous payment disputes and help defend your case to the card issuers if a dispute occurs;

3. Make your terms of service agreement easy to find: provide a full version of your Terms of Service on the checkout page or as a pop-up with a requirement to agree to them before submitting the order;

4. Track shipping: use carriers and services that provide online tracking and delivery confirmation whenever possible;

5. Keep detailed records of all customer interactions: having IP addresses, timestamps, email correspondence, and order history can be valuable evidence in case of a chargeback dispute;

6. Immediately refund any payment you’re sure is fraud: unless you’re covered by some form of liability shift, as with 3D Secure, a proactive refund will save you from chargeback fees;

7. Remove non-obvious write-offs: don’t charge people in an ambiguous way;

8. Implement an easy cancellation and refund policy: for subscription businesses, offering an online cancellation button is a must for a better customer experience and a good reputation among financial institutions;

9. Leverage advanced fraud detection tools: using them will help spot fraudulent transactions early on and prevent potential disputes;

10. Stay in touch with your acquiring bank: regular contact will help you stay updated on your chargeback and fraud metrics and give you tips on how to improve them.

For more actionable chargeback prevention strategies, read our Chargeback Prevention Checklist!

PayPal

PayPal Blog

Blog