Eliminate up to 90% of Your Chargebacks & Fraud with Chargebackhit Prevent

Contact us to receive your step-by-step guide now

Get a consultation

Based on the information published by NASDAQ, 86% of chargebacks are cases of friendly fraud. The main risks for merchants, in this case, are the following:

The latest chargeback rules set by Visa are the answer to the current fraud and chargeback landscape. In this article, you’ll learn the key takeaways for merchants:

For starters, let’s get on the same page with the terminology.

Table of Contents

A chargeback is a forced refund performed on behalf of a customer. In other words, it returns the payer’s money for a credit card transaction without the merchant’s consent. Chargeback reverses a money transfer from the consumer’s bank account, line of credit, or credit card.

The purpose of chargebacks is to protect consumers from fraudulent business practices. After a customer files a dispute with their bank, the chargeback process begins, and the disputed transaction funds are held until the issue is resolved.

Some of the most common reasons for chargebacks include damaged or defective items, merchants not providing the goods or services on time, buyer’s billing confusion, and criminal fraud.

The origin of chargebacks can be traced back to 1974 when the United States passed the Fair Credit Billing Act. This act sought to make credit card payments more trustworthy by allowing cardholders to dispute fraudulent charges.

While chargebacks can cause numerous problems for businesses, they are essential to modern credit card payments.

A Visa chargeback is a process by which a Visa cardholder disputes a transaction and requests a refund from the merchant through their issuing bank.

Each credit card network has its own chargeback process, reason codes, and other differentiating details.

Merchants need to understand the unique chargeback processes for each credit card network to deal with them efficiently.

Visa has a set of standard chargeback regulations that merchants are expected to follow to process transactions and handle chargebacks. Some of the main rules include the following:

10.4 Other Fraud—Card Absent Environment – a common friendly fraud reason code, especially when the cardholder doesn’t recognize the transaction on their statement.

12.5 Incorrect Amount – it usually may result from misunderstandings about fees or taxes included in the final price.

12.6.1 Duplicate Processing – a cardholder claims a double charge to their account because a single transaction was processed twice.

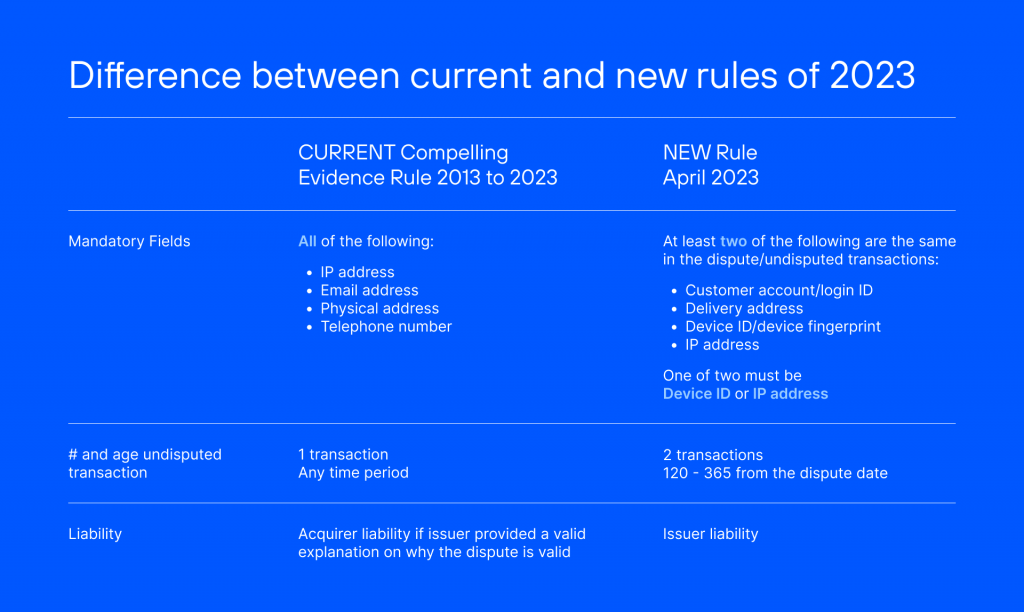

In order to reduce all types of fraud, Visa announced changes to its dispute program. These changes will go into effect on April 15, 2023. The name of the new mandate is Compelling Evidence 3.0.

Compelling evidence is “proof that the cardholder participated in the transaction, received the goods or services, or benefitted from the transaction,” according to Visa’s guidelines.

• Reduces fraud and dispute ratios

• Reduces revenue lost to disputes

• Reduces overall dispute processing expenses

• Drives network value for sellers.

Sellers using VisaNet for payment processing benefit from these services to protect their revenue.

An early adopter of the latest Visa mandate – Prevent, a solution by Chargebackhit based on Order Insight & Consumer Clarity. It’s a tool to prevent chargebacks by sharing the transaction details with the issuing bank and the user in real time, without the need for a refund. With Prevent, issuing banks won’t let payers create disputes or chargebacks in cases of friendly fraud. Stay tuned to our updates to learn more.

Contact us to receive your step-by-step guide now

Get a consultationThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.