All-in-One Fraud Prevention Tool

Chargebackhit can take care of fraudulent transactions. But don't take our word for it.

See for yourself

Criminal fraud is a pressing issue most e-commerce business owners face. Instances of credit card fraud and identity theft continue to increase, even with advancements in technology for fraud protection. Since the cost of criminal fraud is left for the company to bear, it has become increasingly necessary for merchants to utilize the market’s best protection and detection tools.

Even with merchants employing the best business practices to reduce merchant error chargebacks and friendly fraud drastically, online fraud is nipping their revenue in the bud. So how can you protect your company from credit card fraud?

The only way to solve this pressing problem is to implement comprehensive fraud prevention tools in your business. A fraud prevention tool is a system, program, or software developed to allow merchants to detect and prevent theft from occurring in the first place. This tool can function well by analyzing transaction and customer data using several indicators and machine learning.

Table of Contents

There is no clear-cut solution or universal fraud prevention tool, so you need to attempt to find a system or software that uses various tools and offers you an insane level of security. You would also need to add a protection strategy to back up this software; you are sure to avoid any potential.

The software you opt for should be able to:

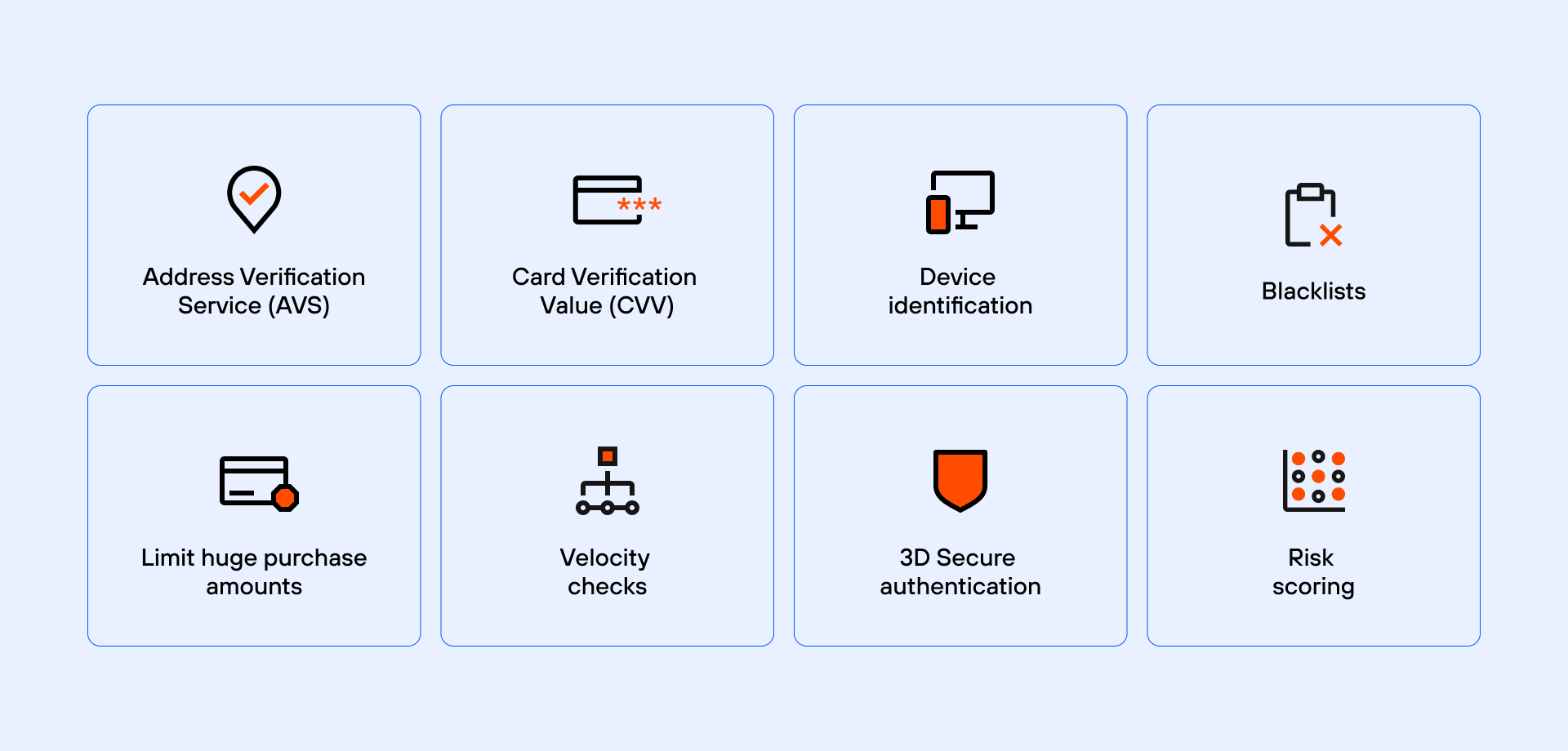

Selecting the right tool for your business is challenging. The system must be able to adjust and adapt to your needs, but there are vital functions it must possess. No single tool can prevent all potential fraud, so your business requires a myriad of tools with a wide variety of functions. So, which fraud detection tools are available in the market right now?

It is a form of screening that verifies the billing address the shopper provides with the card’s billing address.

It is a detection feature that provides a merchant with information about a customer’s location. This data is generated from the shopper’s IP address. With this information on order history and traffic, you can get enough data to analyze fraud patterns, such as the locations with the highest cases.

This fraud detection tool is not usually accurate. For example, the Geo marker might place a customer at a location closest to the nearest big city or just be incorrect. To tackle this problem, you can use GPS and Wi-Fi networks to determine location data by requesting access to a shopper’s location. You would even get notified when someone gains access to a shopper’s account from a suspicious location.

Technology has made it easier to detect fraud. This fraud prevention tool includes a feature that recognizes devices used to access a client’s account. When the account is accessed using a different device, you will notice.

It is another feature that helps monitor financial crimes easily. When a criminal begins to make multiple transactions in a short time, the checker takes note of this suspicious activity. It does this by measuring transaction speed and frequency. Using velocity checking, you can also monitor a fraudster’s activity using IP address, billing address, and device fingerprinting. With these, you can flag their activity when they make small purchases using multiple stolen cards and block them.

This fraud prevention tool uses many data indicators and keys to determine the possibility of theft. It inspects the transaction and user data and ranks it to tell you how probable it is to be fraudulent. This scoring would then approve, reject, or flag the transaction for manual review. In addition, some tools implement machine learning for analyzing previous transaction records to make data-driven decisions determining whether a transaction is fraudulent or not.

Some issuing banks and credit card providers allow this fraud prevention tool to use their highly comprehensive software and strategies. By doing so, they can share transaction data, which can be analyzed with machine learning. This way, the fraud prevention tool can make more accurate decisions.

While using Artificial intelligence and machine learning, a fraud prevention tool should be able to analyze transaction history, build models to understand it, and score new transactions for financial crimes.

Online fraudsters use effective and efficient technologies to tug at the vulnerabilities of your business till they find a way in. To beat them at their own game, you must use a great strategy backed up with the best fraud prevention tool and software.

These tools are remarkable, but you must use them correctly to get results. We advise e-commerce business owners to use comprehensive software like Chargebackhit, which offers one system for all fraud- and chargeback-related business needs. Attempt to keep up with these fraudsters. Ensure you pick great software that can handle these problems so that you can focus on other pressing matters.

An effective fraud prevention tool should have some of the following features:

With the rising of e-commerce, we can see many businesses being affected by fraud. In fact, according to the Mercator Advisory Group, it is expected to be a 33 million volume of chargeback frauds in 2022.

However, there are some ways to defend your company against it or, at least, some of it. Nowadays, several technologies are designed to protect companies from fraud. So, if you are looking for a Fraud Prevention Service Providers, we can name a few on our top list for you:

Many options are available, and each merchant should choose the one most adapted to their business.

A fraud prevention tool can help merchants notice if any criminal activity might be taking place. A solid prevention strategy should then be at the top of your priorities. Sellers should work on their best practices related to security, as well as invest in reliable fraud prevention tools. This way, the quantity of unlawful activity can at least be reduced. Other than that, it’s not simple to know when you’ve been scammed.

In the United States, according to the federal law Fair Credit Billing Act, cardholders can’t be charged for more than $50 related to fraud, regardless of the unauthorized paid amount. However, credit card providers sometimes choose to apply a zero-liability policy. As a result, the merchant or the issuing bank is usually accountable for the expenses.

In some cases, the cardholder cannot be charged, such as:

Prevention needs to be your first step when considering reducing chargebacks. Our Prevent solution is here to save your business revenue and help you fight chargeback costs. But how, you ask? Using Clarity and Order Insight, we can share data from the purchase with the issuing bank and cardholder. This way, the client can review all the information, confirm that a legitimate transaction was made, and end the dispute before requesting a chargeback.

But Chargebackhit’s offer does not stop here. If you need a solution to Resolve your disputes or Recover revenue with a representment process, we are also here for you. Let us help you fight chargebacks on all fronts.

Chargebackhit can take care of fraudulent transactions. But don't take our word for it.

See for yourselfThank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.