Let Chargebackhit automate your dispute representment and recover lost revenue faster.

By clicking “Get started” you agree to our Privacy Policy

Every month, they lose thousands of dollars due to chargebacks – disputes that eat into revenue and require hours of manual work.

Cardholders can dispute transactions with a few taps, and issuers are incentivized to side with them since they bear the financial burden of chargebacks. Merchants, on the other hand, don’t have the hours to track down evidence, compile documents, draft responses, and analyze success rates for every single friendly fraud dispute.

The takeaway is clear: dispute management has outgrown manual methods.

That’s why we’ve extended Chargebackhit beyond chargeback prevention into a full-cycle dispute management platform, giving merchants a smarter, more efficient way to handle disputes from start to finish.

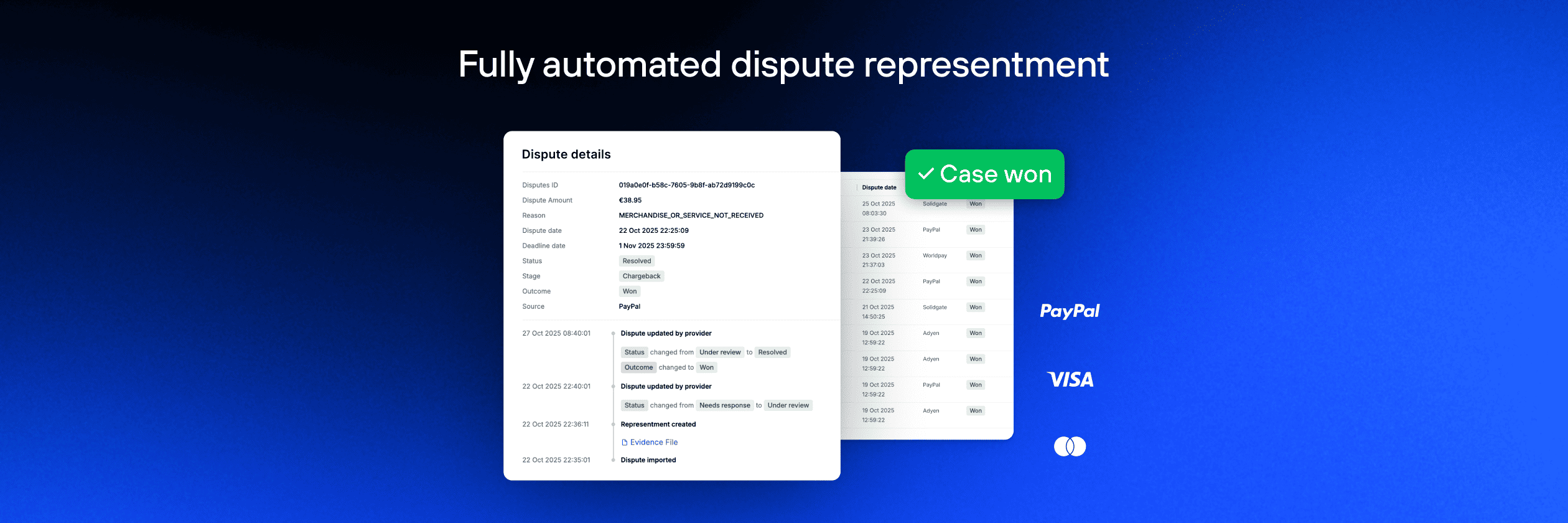

Chargebackhit now offers fully automated dispute representment for PayPal and cards – a tool that helps you recover lost revenue faster, reduce operational effort, and win more disputes on autopilot.

Table of Contents

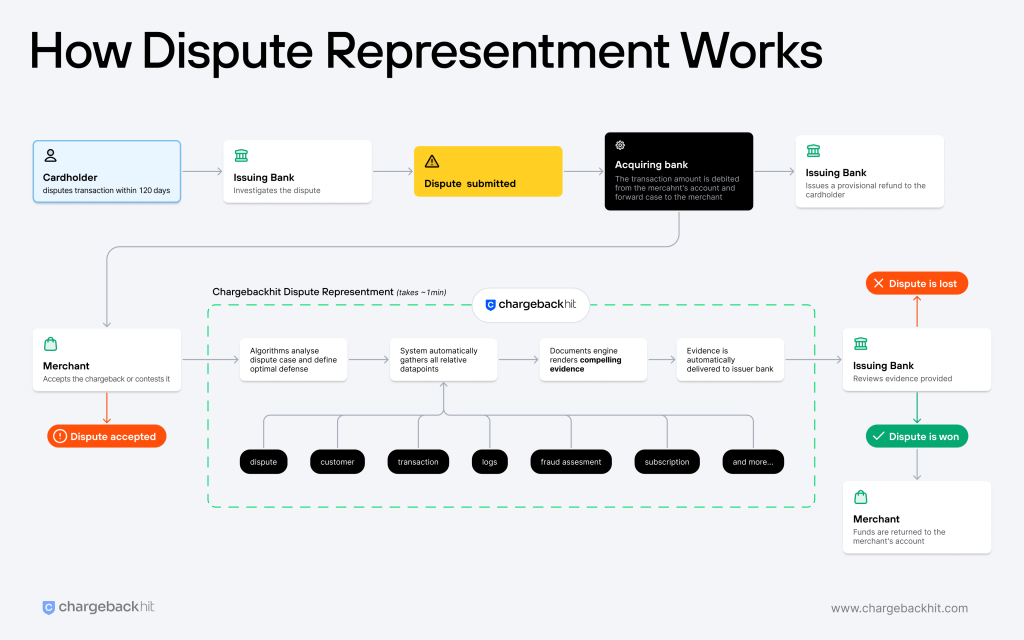

Chargeback representment is the process of contesting a chargeback by providing evidence that a transaction was legitimate. Traditionally, this process was manual, time-consuming, and error-prone, leading to the following problems:

Our automated dispute representment eliminates these challenges for PayPal and card chargebacks. Autorepresentment acts as an always-on dispute analyst and attorney that fights disputes immediately, intelligently, and effectively.

With Chargebackhit:

This leads to faster resolution, higher win rates, and a major boost in operational efficiency.

Autorepresentment is a major upgrade for Chargebackhit users, providing smarter, faster, and more reliable dispute management – all while removing operational overhead.

Merchants can view the status of each dispute in real-time, with clear insights into win rates and revenue recovered.

| Benefit | How it helps | Impact example |

| 100% Automation | No manual effort required | Saves 10+ hours/week for a typical mid-sized merchant |

| Increased Win Rate | Smart evidence selection and dispute strategy | Boosts success rate from 20% to 60-65% on average |

| Revenue Recovery | Automatically challenges all illegitimate disputes | Recover thousands of dollars monthly that might otherwise be lost |

| Faster Resolution | Dispute resolution within 24-48 hours | Shortens the dispute lifecycle by up to 50% |

| Data-Driven Insights | Learn patterns, identify fraud trends | Optimize future dispute strategies, reduce repeat disputes |

| Stronger Bank Relationships | Win more disputes, maintain trust | Improves long-term credibility and lowers bank friction |

Chargebackhit’s fully automated dispute representment solves the most significant pain points for merchants: lost revenue, manual work, slow resolutions, and lack of transparency. By automating the dispute process, businesses recover revenue faster, improve win rates, save operational resources, and gain complete control and insight into every case.

By clicking “Get started” you agree to our Privacy Policy

Thank you

We've sent the whitepaper to your email.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.

Thank you

We will contact you shortly. If you have any further questions, please contact us at support@chargebackhit.com.