Payment Dispute

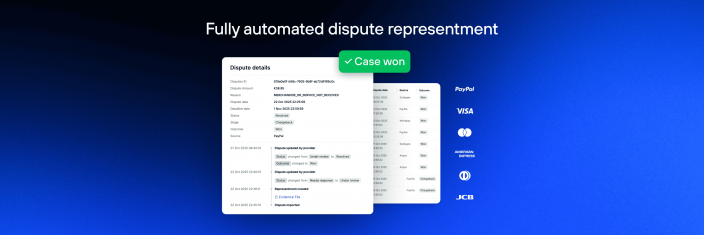

Payment disputes occur when a cardholder contacts their bank to dispute a debit from their account. Payment disputes have various reasons, ranging from fraudulent activity to issues with goods or services. When a card-issuing bank determines that a dispute meets certain criteria, it initiates a chargeback on behalf of the cardholder. Chargebacks are an integral part of the card networks (Visa, Mastercard, JCB, and American Express) system and serve to safeguard buyers from unauthorized transactions.

Cardholders can file disputes for several common reasons, including:

- Fraudulent Activity: When a buyer’s card or card details are stolen, fraudsters use the information to make unauthorized payments.

- Goods or Services Not Received: In cases where a buyer makes a purchase but does not receive the goods or services they paid for, such as when online orders go undelivered.

- Goods or Services Not as Described: If the goods or services received by the buyer are different from what was promised or of substandard quality, such as when a contractor fails to meet expectations in a construction project.

Payment disputes provide consumer protection, allowing cardholders to challenge credit or debit card transactions that they deem unauthorized or illegitimate. When a transaction is disputed, the cardholder is not required to make payment, and the funds are returned to them. However, this comes at the merchant’s expense, as revenue is deducted from their account and reimbursed to the cardholder.

Payment disputes are vital in maintaining trust and security in electronic payment systems, ensuring that buyers are protected from fraudulent or unsatisfactory transactions.

PayPal

PayPal Blog

Blog