Stripe Increases Dispute Fees to $30 Per Chargeback

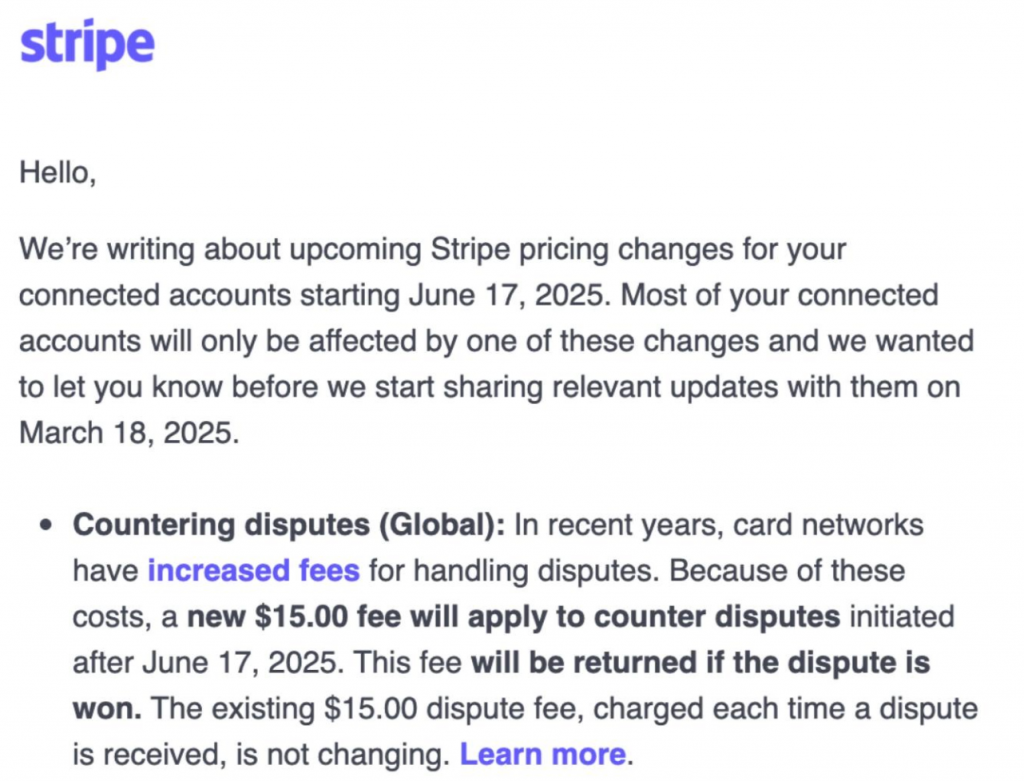

In a move that’s likely to stir up some reactions, Stripe has announced an update to its dispute fee structure. Starting June 17, 2025, an additional $15 fee will be charged to merchants who challenge and lose disputes.

This is on top of the existing $15 dispute fee, meaning that if a merchant loses a dispute, they’ll now be charged a total of $30. The silver lining is that this new fee is refundable if the merchant wins the dispute.

Table of Contents

The new structure of Stripe dispute fees

Currently, Stripe charges a $15 fee for each dispute initiated. If a merchant successfully contests a dispute, the fee is refunded. Starting June 17, 2025, the dispute fee structure will change as follows:

- Additional dispute fee: An extra $15 fee will be introduced for disputes that are countered (challenged) and subsequently lost.

- Total fees for lost disputes: Lost disputes will now incur a total fee of $30, combining the existing and new fees.

- Refund policy: The existing $15 fee will remain refundable if a dispute is won; however, the new $15 fee for lost disputes will not be refunded.

Impact on merchants’ bottom line

For businesses with low average transaction values, the new fee structure may discourage merchants from challenging disputes due to the lower return on investment (ROI).

Let’s look at an example: A merchant with a $20 average transaction value and a 50% win rate on disputes would face a significant increase in costs under the new fee structure. Under the current system, the merchant pays $15 per dispute, leading to a total cost of $15,000 for 1,000 chargebacks (500 won, 500 lost).

However, with the new system, lost disputes will incur an additional $15 fee, driving the total cost up to $22,500. This means the merchant would face an additional net cost of $7,500. As a result, the new fee structure could become a heavy financial burden, particularly for merchants with lower win rates.

How to avoid extra dispute fees

With the new fees in place, each chargeback becomes more expensive. To minimize these costs, you should carefully evaluate your dispute management strategies to ensure you:

- Prevent disputes from happening in the first place, and

- Only challenge chargebacks that have a high probability of success.

Dispute Prevention is key

With Stripe’s updated fee structure, dispute prevention is more important than ever. It’s essential to minimize chargebacks before they happen, and fortunately, there are tools available to help:

- Visa’s Order Insight and CE 3.0 offer similar functionality, reducing the chance of disputes turning into chargebacks.

- Ethoca’s Consumer Clarity and First Party Trust: help merchants by providing issuers with additional transaction details and historical data when a dispute is initiated. This can help resolve issues before they escalate.

Fight disputes under two conditions

- Fight if you have Compelling Evidence 3.0: Only fight if you have strong proof that the dispute is unwarranted. If you don’t, fighting could end up costing more than it’s worth.

- Evaluate the disputed amount: If the disputed amount is high enough to justify the risk, it may be worth challenging. But always factor in your win rate and operational costs. Use this formula:

Expected gain = (Dispute amount × win rate) − $30. If the result is positive, it’s worth disputing.

Also, monitor your chargeback ratio: if it’s under control, it’s easier to justify the added risk of disputing transactions.

Overall, with chargebacks becoming more costly, being proactive is your best defense. The real winners in this new landscape will be the merchants who invest in dispute prevention and chargeback recovery tools.

PayPal

PayPal Blog

Blog