How to Navigate PayPal Chargebacks and Protect Your Bottom Line

If you’re serious about selling globally—especially to US customers—PayPal is a must-have on your list of alternative payment methods (APM). With access to over 31 million customers across 200+ countries, PayPal opens doors that few other platforms can match.

But here’s the thing: risk monitoring in PayPal is complex and murky. Managing these disputes feels like playing defense with one hand tied behind your back. At Chargebackhit, we’ve seen merchants struggle to keep their PayPal fraud and chargeback metrics in check, often dealing with headaches like:

- Lowered payment acceptance rate

- Increased processing fees

- Excessive chargeback fees

- Potential account suspension

To save you the trouble, we’ll go over PayPal’s rules, time limits, fees, and programs. Plus, we share six battle-tested strategies from our clients to keep your PayPal chargebacks under control.

Table of Contents

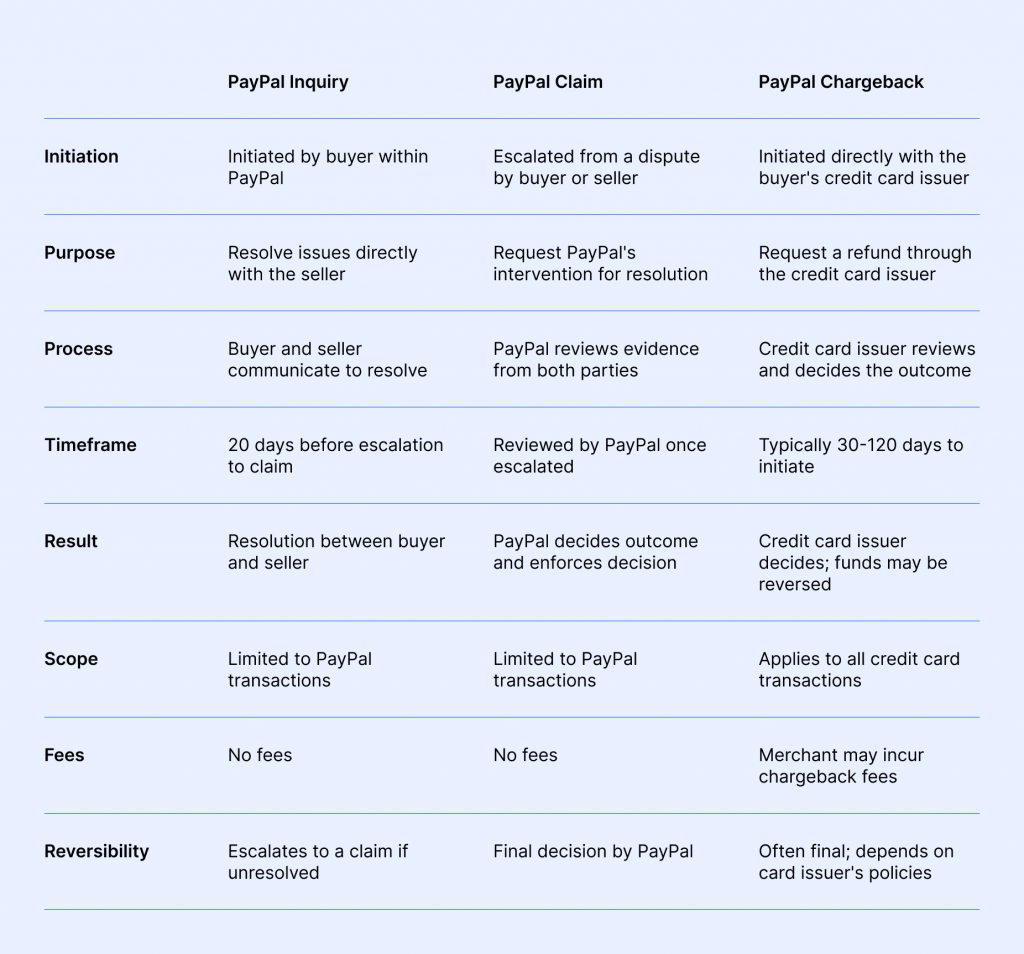

PayPal dispute system: Inquiry, Claim, External Chargeback

PayPal uses a simple two-step system for resolving seller-buyer disputes. It starts with the inquiry stage, where both sides try to work things out directly. If that doesn’t solve the problem, it moves to the claim stage, where PayPal steps in to review the issue. If things still aren’t resolved, the buyer can take it further and file an external chargeback with their credit card company.

PayPal pre-escalation disputes (Inquiry)

Pre-escalation, or inquiry customer disputes are about resolving issues directly between the merchant and the customer before things escalate to a PayPal claim. That’s the first stage of the overall resolution process when a dispute hasn’t yet become a PayPal claim.

There are only two reasons why a dispute might stay at this stage without moving immediately to a PayPal claim:

- Item not received: Your customer hasn’t received the item or service they ordered and paid for.

- Item received differs from its description: The item or service didn’t match the customer’s expectations. Whether it’s the functionality, color, texture, size, or something else, it significantly differs from what you advertised.

Buyers can raise a pre-escalation dispute through the PayPal Resolution Center. There is usually a 20-day PayPal dispute time limit between the initial request and its escalation to a claim. This gives both parties time to provide evidence to support their claims.

PayPal claims

If you and the buyer can’t resolve a dispute amicably, it escalates to a claim. This is when PayPal steps in and acts as a middleman in the buyer-seller dispute process, making a decision based on the PayPal chargeback policy and the evidence provided by both parties.

This decision is final and binding. It results in either refunding the buyer and debiting the merchant’s account or favoring the merchant and denying the refund.

Claims fall under three categories:

1. Claim escalated from a dispute: These are claims with “Item Not Received” and “Significantly Not As Described” reasons.

2. Disputes labeled “Unauthorized”: A dispute reported as unauthorized access to a customer’s account with non-customer executed transactions is automatically escalated to a claim.

3. Internal claims labeled “Billing Error” or “Other”: These claims include duplicate payments sent by mistake or the wrong debt amount entered by a buyer.

PayPal claims the time limit is ten days. At this stage, merchants can’t communicate directly with the customer, and PayPal fully manages the process. If the buyer’s claim is approved, you have ten days to respond and provide substantial evidence to support your case.

Note: Dispute ratio only includes the first type of claim.

External chargebacks on PayPal

An external goods and services chargeback occurs when a customer initiates a request to reverse the payment not via PayPal but via their card issuer.

How does PayPal chargeback process work?

Step 1. Buyer initiates a credit card chargeback through their card issuer.

Step 2. The card issuer sends a notification to the merchant and takes money out of PayPal.

Step 3. PayPal sends an email to the merchant and asks for any information that can help challenge the chargeback dispute.

PayPal doesn’t handle chargebacks—it only collects transaction evidence and helps you work with the buyer’s credit card company or bank to resolve chargeback disputes as soon as possible.

Note: PayPal can cover your loss on a chargeback if you’re eligible for PayPal Seller Protection, which we cover later.

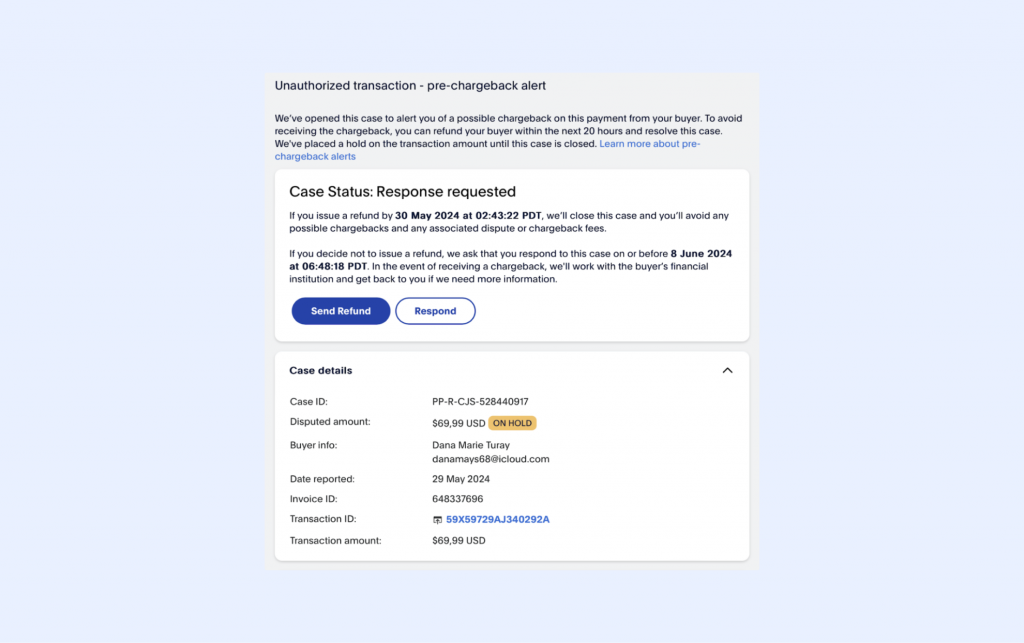

What is a Pre-Chargeback Alert?

PayPal’s Pre-Chargeback Alert feature gives merchants a heads-up about a potential dispute, letting you deal with it before it escalates to a chargeback. Around 75% of PayPal disputes come directly from cardholders reaching out to PayPal, and these are exactly the kind of disputes you’ll see in the Pre-Chargeback Alerts.

Now, here’s a key nuance: another 25% of the claims that the cardholder files directly with their credit card company aren’t shown in PayPal Pre-chargeback Alerts. This mens merchants can’t address them through PayPal’s system alone. Yet, handling this portion of disputes is critical to fully covering all the claims and keeping your chargeback ratios within acceptable limits.

The only way to manage these 25% disputes is by integrating them via a platform like Chargebackhit which has a way to extract these alerts and match them to PayPal orders. By doing so, merchants can address 100% of pre-chargeback disputes by getting early dispute alerts for both PayPal and credit card claims.

How PayPal distributes chargeback rates

PayPal’s distribution logic for external chargebacks is a bit of a dark forest. Given the many payment methods PayPal accepts, including e-checks, bank transfers, card payments, and Buy Now Pay Later (BNPL), understanding how exactly PayPal calculates chargeback rates is tricky.

From our experience, when calculating the external chargeback rate, the denominator includes 50% of the actual sales, while the numerator accounts for all the chargebacks. The reason is simple: within PayPal, you can’t separate card sales from other payment methods. PayPal also uses multiple MIDs to spread out transactions, and how they do it is pretty much a mystery.

This setup can cause some MIDs to show higher chargeback rates on PayPal, even if the overall rate is within acceptable limits. Unfortunately, these MID-specific rates can be unpredictable and nearly impossible to track.

Here’s the formula to calculate PayPal chargeback rate:

Chargeback rate = total count of chargebacks / total count of sales

Note: Use your current month’s data to calculate this formula.

Also, make sure to differentiate between “total card sales count” and “total sales count.” “Total card sales count” is only the transactions made with customers’ debit or credit cards. “Total sales count” is all types of sales, including PayPal sales and other payment methods. For example, if a customer uses PayPal to buy something after adding funds to your wallet, it’s not a card sale.

The chargeback rate must be below 0.4% to avoid getting into the card monitoring programs.

What are PayPal chargeback fees?

PayPal charges a settlement fee for every debit and credit transaction chargeback that’s not processed through a buyer’s PayPal account or PayPal Guest Checkout services. The Standard PayPal Chargeback Fee is $20 dollars for a transaction in USD. If you accept multiple currencies, you must pay an additional conversion fee.

For example, if a buyer in Canada disputes a transaction made in Canadian Dollars (CAD) and you’ve already converted CAD to USD, you’ll have to pay an extra currency conversion fee on top of PayPal’s $20 chargeback fee. PayPal’s currency conversion fee is around 3-4% of the original transaction amount. For high-value transactions, the additional fees can be much higher.

What are PayPal dispute fees?

PayPal may charge a Dispute Fee when a buyer initiates a dispute or chargeback for a transaction made through their PayPal account or PayPal Guest Checkout services. How a dispute or a chargeback is initiated doesn’t matter, be it directly via PayPal Resolution Center or the buyer’s credit card issuer.

Unlike PayPal chargeback fees, PayPal dispute fees are categorized into two: The Standard Dispute Fee ($15) and The High-volume Dispute Fee ($30). The category you fall into depends on your current Dispute ratio—the ratio of “Item Not Received” and “Significantly Not As Described” claims to your total PayPal sales from the previous three months.

If your Dispute ratio is below 1.5% and you had less than 100 transactions in the last three months, you’ll pay the Standard Dispute Fee. Otherwise, you’ll pay the High-volume Dispute Fee.

Note: If a dispute was amicably resolved between you and the customer, aka it didn’t escalate from an inquiry to a claim, you won’t be charged the Standard Dispute Fee. The fee is also not charged for “unbranded” transactions made via PayPal Pro or Advanced debit and credit cards.

What are the PayPal chargeback time limits?

PayPal chargeback time limits vary by card brand and chargeback reason. On average, a buyer has 120 days to file a chargeback. Once you receive a chargeback, you have ten days to solve the issue.

If you don’t respond within this timeframe, the chargeback is considered final. If you choose to dispute the chargeback, be prepared that the resolution process can take weeks or even months.

PayPal’s seller protection programs

As a merchant, you may be eligible for PayPal’s seller protection programs, which, when applicable, will allow you to keep the total purchase amount.

PayPal Chargeback Protection

If you have a business account and have enabled Advanced Credit and Debit Card checkout, you can apply for PayPal Chargeback Protection. This service minimizes the risk of credit and debit card fraud, protecting merchants from “Unauthorized” or “Item Not Received” transactions. Once a merchant provides proof of shipment/delivery, the PayPal chargeback fee will be waived, lifting the hold on the disputed amount.

Note: Only “Unauthorized” and “Item Not Received” transactions can be subject to PayPal Chargeback Protection. If you have other disputes such as “Duplicate Charge,” “Significantly Not As Described,” or “Broken Item,” the resolution process is standard—via the PayPal Resolution Center.

You can cancel Chargeback Protection anytime with no cancellation fees.

PayPal Seller Protection

PayPal Seller Protection is a no-cost service that covers the full purchase amount on all eligible transactions if they meet the requirements. Just like in Chargeback Protection, two types of complaints are eligible for Seller Protection: “Unauthorized” or “Item Not Received” transactions.

To avoid paying related PayPal chargeback fees, you must provide valid proof of delivery or shipment. It’s important to note that this service doesn’t cover payments for vehicles, cash, businesses, or real estate.

PayPal Fraud Protection Advanced

Fraud Protection Advanced is a PayPal fraud scoring tool that helps merchants spot potentially fraudulent transactions in real-time by contrasting customer behavior against PayPal’s transactions track record.

The ultimate goal of PayPal Fraud Protection Advanced is to detect suspicious transactions and flag them to preemptively fight fraud. Fraudulent chargebacks, where customers dispute legitimate purchases to get refunds while still keeping the items, are the main focus of this feature. The tool is flexible and customizable, which helps you adapt to a changing fraud landscape.

The tool is available to all PayPal users and covers debit and credit card payments, as well as Google Pay, Apple Pay, and Samsung Pay. PayPal charges a monthly fee and a per-transaction fee for this service.

Relevant read: Types of PayPal chargeback scams, and how to protect yourself

How to prevent PayPal chargebacks and fraud: 6 recommendations for merchants

There are some simple actions you can take that proved highly effective in reducing PayPal fraud and chargebacks among our clients.

Block unauthorized transactions from the geographies with high fraud rates

Certain countries and Tier 3 regions, such as Latin America, Africa, and Southeast Asia, have higher levels of fraud. If your reports indicate that certain countries are responsible for many fraudulent transactions, blocking traffic from these regions can be a smart decision.

Resolve pre-escalation disputes within 20 hours after receiving the alert

Immediately communicate with the customer to deflect fraudulent disputes with pre-dispute compelling evidence or, if the request is found valid, issue refunds before it becomes a formal claim.

Use a client risk scoring system to determine if a customer can use PayPal for payment.

Develop a model that assesses the likelihood of fraud based on user behavior, geographical location, transaction history, and other factors. If the risk is high, we recommend disabling the PayPal button for that customer.

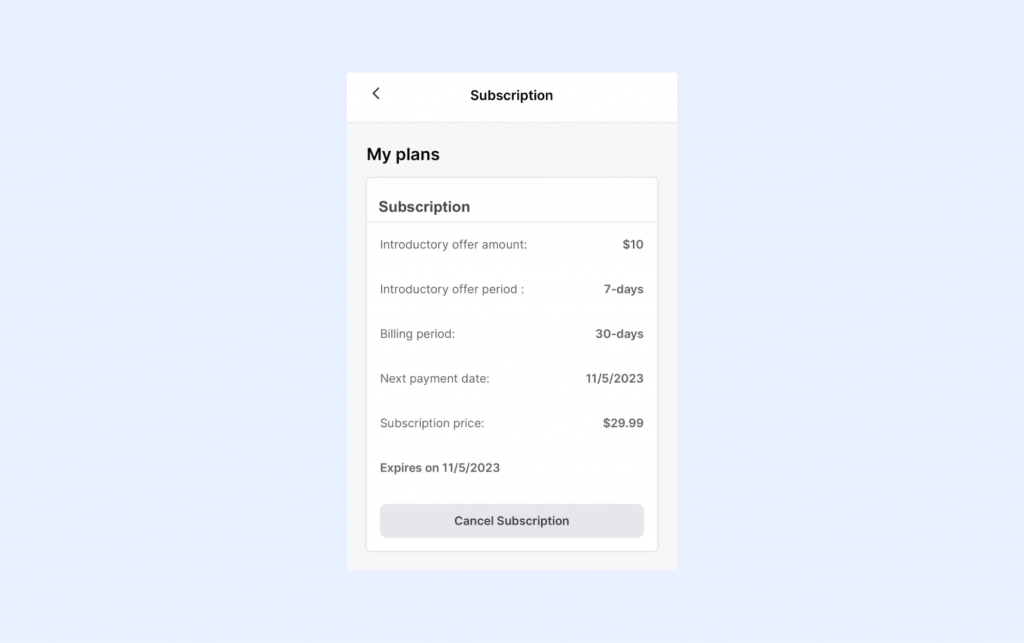

Implement a clear “unsubscribe” flow

If you operate a subscription model, make sure your “unsubscribe” flow is as clear as day:

1. Make the “Unsubscribe” button visible on all user communication channels, including emails and account settings pages;

2. Once a user cancels a subscription, send an immediate confirmation email with the effective date of cancellation and refund information.

3. Develop a self-service portal where users can manage their subscriptions, view billing history, and process refunds without needing to contact support.

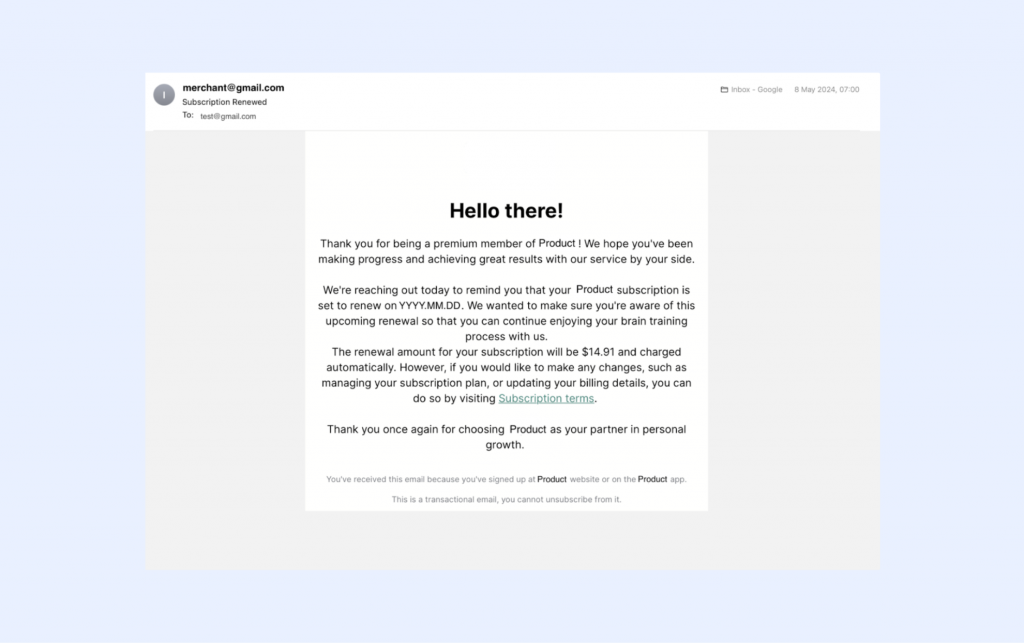

Notify customers before re-billing them

Many subscription businesses don’t notify customers about the upcoming re-bill for automatic subscriptions and payments. These charges catch customers off guard, resulting in increased refund requests and chargebacks.

You can easily avoid this by setting up an automatic email notification 7-10 days before the subscription renewal.

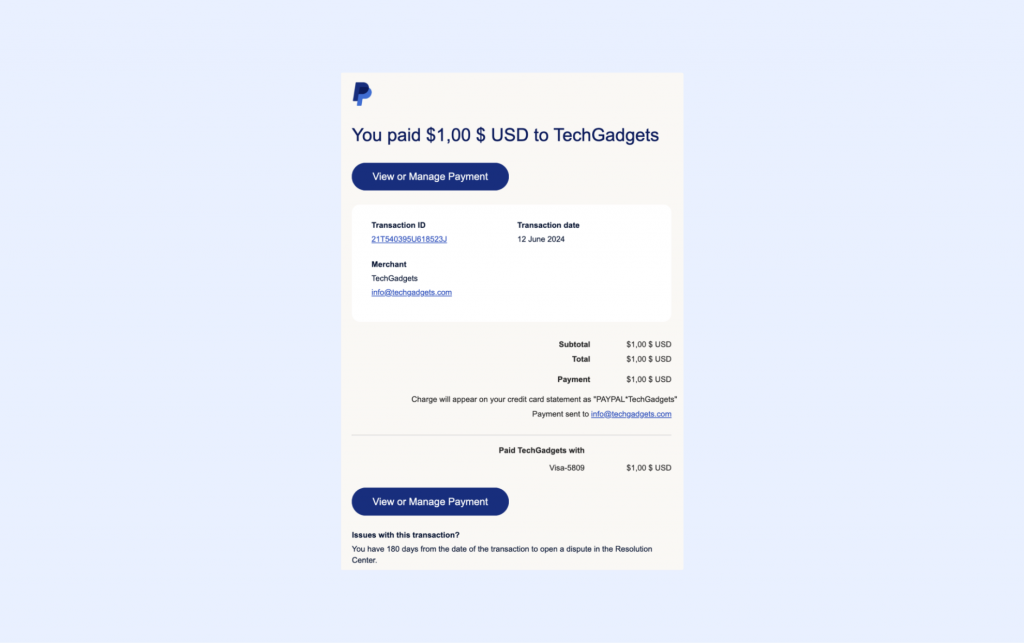

Make your business name recognizable across all documents and payment descriptors

Seeing different business names pop up across your documents and platforms after a transaction confuses customers. Not recognizing the purchase, they start requesting chargebacks en masse. You can avoid this easily by ensuring your website, doing business as (DBA), and statement descriptor names match.

Example: If your legal entity name is “Tech Solutions LLC,” it should match your DBA name “TechGadgets,” your descriptor “PayPal*TechGadgets,” and your website www.techgadgets.com.

FAQ

How to prevent a chargeback on PayPal?

To prevent a PayPal chargeback, ensure clear communication with customers, provide accurate product descriptions, use delivery tracking, and maintain detailed records of transactions. Additionally, ensure you know all the intricacies of PayPal chargeback policies.

How do you win a PayPal chargeback?

Submit your case through PayPal’s Resolution Center and provide all the requested evidence within the set PayPal chargeback time limits.

How long does PayPal chargeback take?

PayPal generally disputes a chargeback within a 30-day period. However, the credit card issuer may take up to 75 days to resolve a chargeback.

How much is a PayPal chargeback fee?

The Standard PayPal chargeback fee is $20 for each dispute.

PayPal

PayPal Blog

Blog