What are PayPal Chargeback Scams and How to Protect Yourself

A PayPal chargeback scam is when a buyer initiates a chargeback with their credit card company or bank after receiving goods or services through PayPal. The scammer takes advantage of PayPal’s buyer protection leaving the merchant with a financial loss. Below you will learn about the most pervasive PayPal scams and how you can protect your business against them.

Table of Contents

How They Work and Ways to Identify Them: Top 5 PayPal Scams

The most common PayPal scams are phishing, fake invoice, donation scam, check overpayment, and delivery chargeback. Keep reading how each of these scams works and how you can avoid falling victim to them!

Phishing Scams & Attacks

PayPal phishing scams involve fraudsters attempting to deceive merchants into exposing their logins and or personal details. Here’s how these scams typically work:

- Impersonation: Scammers send emails or messages that appear to be from PayPal, often using official logos, colors, and formatting to mimic legitimate communication.

- Urgency and Fear Tactics: Phishing messages often create a sense of urgency, claiming there is a problem with your PayPal account. They may threaten account suspension or other consequences if immediate action is not taken.

- Fake Links: PayPal phishing emails contain links that appear to lead to the PayPal website but actually redirect to a fraudulent website designed to capture the merchant’s login information. These URLs may be subtly altered or use domain names that are similar to PayPal’s. Then when you enter your login information, it is sent directly to the scammer.

- Requests for Personal Information: Scammers often ask sellers to provide personal details, such as passwords, social security numbers, or credit card information, under the guise of resolving an account issue or verifying identity.

- Unexpected Attachments: Be cautious of PayPal email scam attachments from unknown senders or that you weren’t expecting. They may contain malware or viruses designed to compromise your device’s security and give the scammer access to your PayPal business account password.

To identify and protect your business from phishing scams on PayPal, consider the following measures:

- Verify the sender: Check the email address of the sender. Legitimate PayPal emails will come from “@paypal.com” domains. Be cautious of slight variations or email addresses that don’t match the official domain.

- Hover over links: Instead of clicking on links in emails, hover over them to view the actual URL. Ensure it matches PayPal’s official domain and doesn’t redirect to a suspicious website.

- Don’t share sensitive information: PayPal will never ask for your password, full social security number, or other sensitive details via email.

- Check for secure connections: Before entering any personal information on a website, ensure the connection is secure. Look for “https://” at the beginning of the URL and a lock icon indicating a secure connection.

- Enable two-factor authentication (2FA): Enable 2FA on your PayPal account for an added layer of security. This way, even if your login credentials are compromised, the scammer won’t be able to access your account without your verification code.

Fake Invoice Fraud

PayPal invoice scams involve scammers creating and sending fraudulent invoices to businesses. Here’s how this type of fraud typically works:

- Scammers impersonate legitimate businesses or service providers, often by using similar names, logos, or email addresses.

- They send invoices to merchants, claiming payment is due for a product or service that was never requested or received.

- The scammers often create a sense of urgency with their PayPal fake invoice scam, insisting on immediate payment to avoid consequences or disruptions to services.

- If the target pays the invoice through PayPal, the scammer receives the funds and may disappear or continue the scam with additional fraudulent invoices.

- The merchant realizes they have been scammed when they either receive no product or service or when they discover the fraudulent nature of the transaction.

While fraudsters are good at creating invoices that look genuine, if you take an extra minute or two, you can quickly realize they are fake. Key signs that you have been sent a fake invoice include incorrect emails, poor-quality images used for logos, and spelling mistakes. Also, you will never fall for this scam if you keep track of goods and services your business has actually purchased.

Donation Scams

The PayPal donation scam takes advantage of buyer protection not covering donations. Fraudsters will create a fake charity and request donations, and even if buyers do figure out the charity is a scam, they won’t be able to get a refund because PayPal explicitly states that buyer protection does not apply to donations. Do not donate to shady charities via PayPal. You should always double-check the charity is legitimate and go to their official website. To be extra safe, only donate to registered government organizations.

Check Overpayment Scam On Paypal

PayPal overpayment scams involve scammers overpaying for a good or service on purpose and then requesting a refund for the excess funds via check. Here’s how the PayPal chargeback scam typically operates:

- Initial Contact: The scammer poses as a legitimate buyer and expresses interest in purchasing an item.

- Payment Made: The scammer agrees to the seller’s listed price but “accidentally” overpays through PayPal

- Refund Request: The scammer then contacts the seller, claiming they made a mistake, and requests a refund for the excess payment.

- False Sense of Security: The scammer may convince the seller that the payment has been processed and shows as cleared in their PayPal account or provide fabricated transaction details.

- Refund Sent: Trusting the apparent overpayment, the seller refunds the excess amount to the scammer via check.

- Reversal of Original Payment: Eventually, the initial payment made by the scammer is found to be unauthorized or fraudulent, resulting in a chargeback or reversal.

- Financial Loss: The seller ends up losing not only the item or service provided but also the refunded excess funds as the original payment is reversed or deemed fraudulent.

To avoid this PayPal refund scam, simply cancel any transaction where you are overpaid and don’t even consider sending a refund. If you think someone is trying to run this scam on you, make sure you report it to PayPal so they can shut down the scammer’s account.

Delivery Scam

The PayPal delivery scam is a fraudulent scheme where scammers pose as buyers and exploit the seller protection offered by PayPal. Here’s how it typically works:

- The scammer contacts a seller and expresses interest in purchasing an item. They may negotiate the price and terms.

- The scammer insists on using PayPal for the transaction, citing buyer protection as a reassurance for the seller.

- The scammer provides a shipping address, often claiming it to be an international location or a forwarding service.

- The scammer completes the payment through PayPal, including the item’s cost and shipping fees.

- Once the payment is made, the scammer may request expedited shipping or provide additional instructions regarding the shipment.

- The seller ships the item to the provided address, usually without suspicion.

- After the item is shipped, the scammer initiates a dispute with PayPal, claiming that they never received the item or received an empty box or a significantly different item.

- Since PayPal’s seller protection policy typically requires proof of delivery to the provided address, scammers exploit this requirement to file a successful dispute.

As a result, PayPal may issue a refund to the scammer, leaving the seller at a loss with no item or payment. To identify this scam, you should look for buyers who are requesting expedited shipping or providing suspicious shipping addresses, particularly if they differ from the buyer’s PayPal address.

How to Protect Yourself from PayPal Scammers: Tips for Identifying and Avoiding Them

PayPal scammers are constantly coming up with new methods and tricks to exploit loopholes in the platform. However, if you know how to detect a scammer and the best practices to follow, you can keep your business safe!

Spot a Scammer On Paypal

How to spot a scammer on PayPal? Pay close attention to these key indicators:

- Suspicious or Unverified Contacts: Be cautious of unsolicited messages, emails, or phone calls from individuals or organizations claiming to be from PayPal. Verify their legitimacy before engaging further.

- Requests for Personal Information: PayPal will never ask for sensitive information like passwords, social security numbers, or credit card details via email or phone. Treat any such requests with suspicion.

- Poor Grammar and Spelling: Many scam emails or messages exhibit grammatical errors, typos, and awkward language. Legitimate PayPal communications are usually professional and well-written.

- Urgency and Pressure: Scammers often create a sense of urgency, insisting on immediate action or threatening consequences if you don’t comply. Beware of such tactics and take time to evaluate the situation.

- Suspicious URLs or Links: Hover over any links in emails or messages to view the actual URL before clicking. Look for misspellings, variations from the legitimate PayPal domain, or unfamiliar websites.

- Unusual Payment Requests: Be cautious of unusual payment requests, such as using unconventional payment methods or insisting on specific payment channels outside of PayPal’s official platform.

- Unverified Buyers: When engaging in transactions, research the reputation and history of the buyer. Check their feedback, ratings, or reviews on reputable platforms.

- Suspiciously High or Low Offers: Scammers may tempt you with extremely high offers to buy your items or services or, conversely, try to convince you to pay unusually low prices. Exercise caution when deals seem too good to be true.

PayPal has dedicated security measures and policies in place to protect its users, but scammers are constantly evolving their tactics. Stay informed, remain vigilant, and report any suspicious activity to PayPal’s official channels.

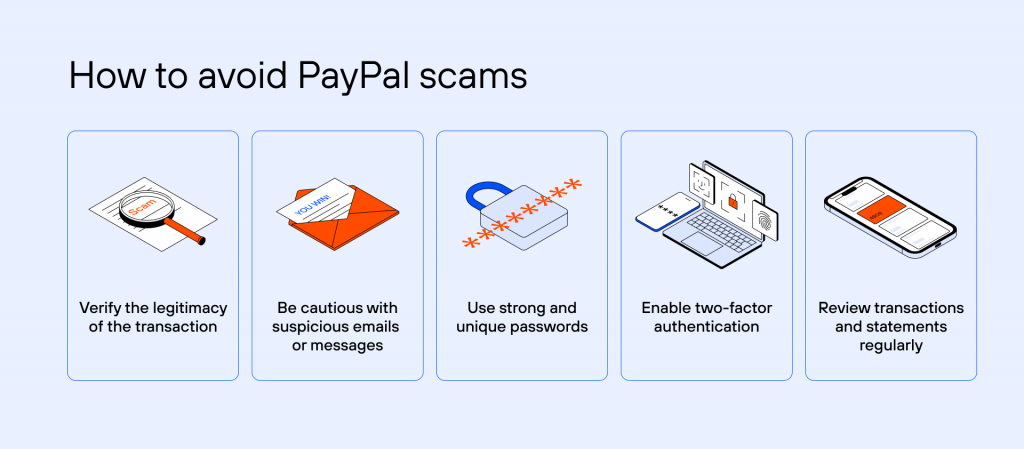

Best Practices And Tips to Avoid Being Scammed

Merchants can take several precautions to reduce the risk of being scammed on PayPal. Here is how to avoid a scam:

- Verify Buyer Accounts: Before engaging in transactions, review the buyer’s account details, including their feedback, ratings, or reviews. Be cautious when dealing with new or unverified buyers.

- Use PayPal Seller Protection: Familiarize yourself with PayPal’s Seller Protection policy, which provides coverage against unauthorized transactions, claims of non-receipt, and chargebacks under certain conditions. Understand the eligibility requirements and ensure you meet them.

- Confirm Shipping Addresses: Ship items only to the confirmed addresses provided by PayPal to avoid scam. Beware of requests to ship to alternative addresses or those that differ from the buyer’s registered address.

- Use Trackable Shipping: Whenever possible, use shipping methods that provide tracking information. This helps verify delivery and provides evidence in case of disputes.

- Communicate Clearly: Maintain clear and transparent communication with buyers throughout the transaction process. Document important conversations and agreements in writing.

- Verify Funds: Ensure that payments received are genuine and cleared in your PayPal account before fulfilling orders. Be cautious of overpayment requests or suspicious payment sources.

- Insure High-Value Shipments: For high-value items, consider purchasing shipping insurance to protect against loss or damage during transit.

- Protect Sensitive Information: Never share your PayPal login credentials, passwords, or other sensitive information with anyone. Use strong, unique passwords and enable two-factor authentication (2FA) for added security.

- Report Suspicious Activity: If you encounter any fraudulent or suspicious activity, report it to PayPal immediately. Provide detailed information and any supporting evidence to assist with their investigation.

What to Do if You’ve Been Scammed on PayPal

If your business has been scammed on PayPal, it’s important to take immediate action to mitigate the damage. Here are the steps you can take:

- Contact PayPal: Report the scam to PayPal’s customer support as soon as possible. Provide them with all relevant details, including transaction IDs, communication records with the scammer, and any supporting evidence.

- Preserve Evidence: Document all communication and transaction-related information, including emails, messages, invoices, shipping details, and any other relevant documentation. These can serve as evidence to support your case.

- Respond to PayPal Disputes or Claims: If the scammer initiates a dispute or claim against you, respond promptly and provide all relevant information and evidence to support your position. Follow PayPal’s instructions and guidelines for dispute resolution.

- Review PayPal Seller Protection: Familiarize yourself with PayPal’s scam protection policy and assess if your case meets the eligibility requirements. If eligible, submit a claim under the Seller Protection program to seek reimbursement for fraudulent transactions.

- Cooperate with PayPal’s Investigation: Work closely with PayPal’s investigation team and provide any requested information or evidence to assist in their investigation. Respond promptly to any inquiries or requests for additional details.

- Contact Law Enforcement: If the scam involves significant financial loss or if you suspect criminal activity, consider reporting the incident to your local law enforcement agency. Provide them with all relevant information and cooperate fully.

- Monitor and Secure Your Accounts: Regularly monitor your PayPal account for any suspicious activity. Change your passwords and enable additional security measures, such as two-factor authentication (2FA), to protect your account from unauthorized access.

- Inform Your Payment Processor: If you’re using a payment processor other than PayPal, notify their customer support about the scam. They may have additional measures or advice to help resolve the situation.

Stay persistent in your efforts to rectify the situation and maintain open communication with PayPal throughout the process. Taking immediate action and providing accurate information will help maximize the chances of recovering funds and preventing PayPal chargeback scams.

Understanding PayPal Refunds for Merchant Scam Victims: Your Rights and Options Explained

If your business is a victim of a scam on PayPal, you have certain rights and options to protect yourself and seek a resolution. Here are some key rights you have as a PayPal scam victim:

- Right to Report: You have the right to report the scam to PayPal’s customer support. Provide them with all relevant details, evidence, and documentation related to the fraudulent activity.

- Right to Dispute: If the scam involves chargebacks or claimed unauthorized transactions, you have the right to dispute those transactions with PayPal. Follow PayPal’s dispute resolution process, read PayPal’s refund policy, and provide supporting evidence to substantiate your claim.

- Right to Seller Protection: If you are a merchant and the scam involves a purchase made through PayPal, you may be eligible for PayPal’s Seller Protection program. Familiarize yourself with the program’s terms and conditions and submit a claim if you meet the eligibility requirements.

- Right to Cooperation: PayPal is obligated to investigate reported scams and fraudulent activities. You have the right to expect a thorough and fair investigation from PayPal’s side. Cooperate with their investigation by providing requested information and responding to inquiries promptly.

- Right to PayPal Refund: Depending on the circumstances and PayPal’s investigation findings, you may have the right to seek financial recovery for the losses incurred due to the scam. This can include reimbursement for the value of goods sold and or shipping costs.

- Right to Privacy and Security: PayPal has a responsibility to protect your personal and financial information. They should take appropriate measures to safeguard your data and ensure the security of your PayPal account.

- Right to Customer Support: As a PayPal seller, you have the right to receive prompt and helpful customer support from PayPal’s representatives. Contact their support channels for assistance in addressing the scam and resolving any related issues.

PayPal Scams FAQ: Answering Your Common Questions and Concerns

Is PayPal Safe?

PayPal is considered safe. It employs advanced security measures, including encryption and fraud detection systems, to protect user information and transactions. PayPal also has buyer and seller protection, which adds an extra layer of security. However, you still need to be wary of scams and keep all communication and transactions within the platform.

Does PayPal Have Seller Protection?

PayPal does offer seller protection. If a seller is the victim of a scam they can file a dispute within a specified timeframe. PayPal then investigates the case, and if the transaction is eligible, the merchant will receive a refund.

What Is A PayPal Business Account?

A PayPal Business Account enables businesses to receive payments from customers through PayPal, accept credit and debit card payments, create and send invoices, access additional tools for managing transactions and finances and provides a platform for selling online.

How To Report A Scam On Paypal?

To report a scam on PayPal, log into your account, go to the Resolution Center, and click on “Report a Problem.” Choose the relevant transaction and select click “Continue”. Then tap on “I Want to Report Unauthorized Activity” and follow the steps. You can also send suspicious messages to phishing@paypal.com.

How Much Is Purchase Protection On Paypal?

PayPal’s Purchase Protection typically offers coverage up to $20,000, including shipping costs per transaction. This protection helps protect buyers in case of issues such as receiving counterfeit, damaged, or different items or if the goods don’t arrive. The exact coverage amount and terms may vary, so it’s important to review PayPal’s policies for specific details.

PayPal

PayPal Blog

Blog